Sustainable Luxury Brand Index 2021

views from affluent & hnw individuals in asia, europe and north-america

introduction

Welcome to this inaugural edition of Altiant’s annual Sustainable Luxury Brand Index. The purpose of this report is to drive the agenda on sustainability and corporate responsibility in the world of luxury and wealth management by offering an independent view of sustainability-related behaviours and sentiments from validated global affluent and High Net Worth Individuals (HNWI).

Over the past decade, sustainability has become more visible as a global issue, with international events such as floods and wildfires causing both governments and civilians to reassess their impact on the world.

The ongoing Covid-19 pandemic has arguably accelerated this focus on sustainability, potentially leading to significant shifts in future lifestyles. For example, the rise of rental and re-use channels in fashion and automotive categories has shown how behaviours are changing. The adoption of the circular economy principles resonates with many luxury brands, and the onus is now on them to embrace sustainability with vigour and authenticity.

Many consumers appear to expect companies to act with sustainable principles in mind as a baseline, with any activities being authentic and credible and not ‘greenwashing’. Those which ignore or undervalue the importance of sustainability and environmentalism could see themselves slipping behind their competitors. Brands need to show their commitment and go above and beyond the basics by investing in circular design and anticipating second lives for their products, and improving their logistics chains to match the growing standards expected by the luxury consumer.

Communicating about sustainability is not an easy task, and claims are not always received as intended. As you will see in the data below, sustainable actions resonate differently with many wealthy individuals; in some cases, it directly encourages them to pay more for products.

ABOUT THE POPULATION

Data in this report is taken from Altiant’s luxury tracker, the Global Luxury and Asset Management (GLAM), using survey responses from its proprietary panel, LuxuryOpinions. The report uses only those questions looking specifically at sustainability, with the tracker also covering many other subjects such as finance and travel (see more here). Across 2020, 1,814 interviews were conducted for GLAM, with just over n=450 in each of the four quarters (Q1 456/Q2 452/Q3 452/Q4 454).

NOTES

Sustainability here reads as ‘Policies that promote Environmental protection, Social Responsibility & Ethical behaviour.’

We welcome the free and fair use of our data to meet your individual and business objectives, only asking that you clearly link your readers to the source of the data whenever applicable. In the event you have any questions about the data, please contact us at contact@altiant.com.

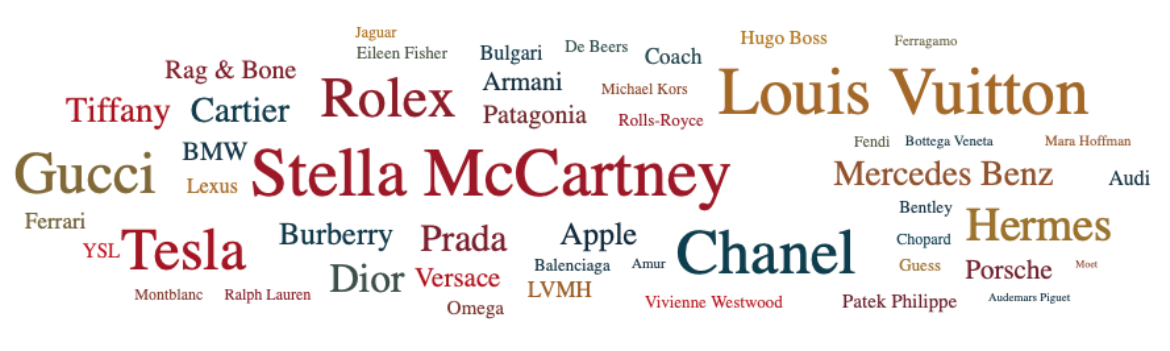

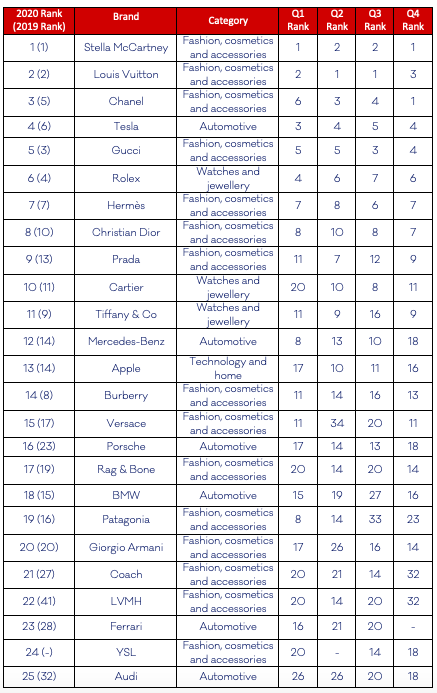

Sustainable Luxury Brand Champions

“Are there any luxury brands in any industry which you think are good examples of sustainable luxury? If so, which companies?”

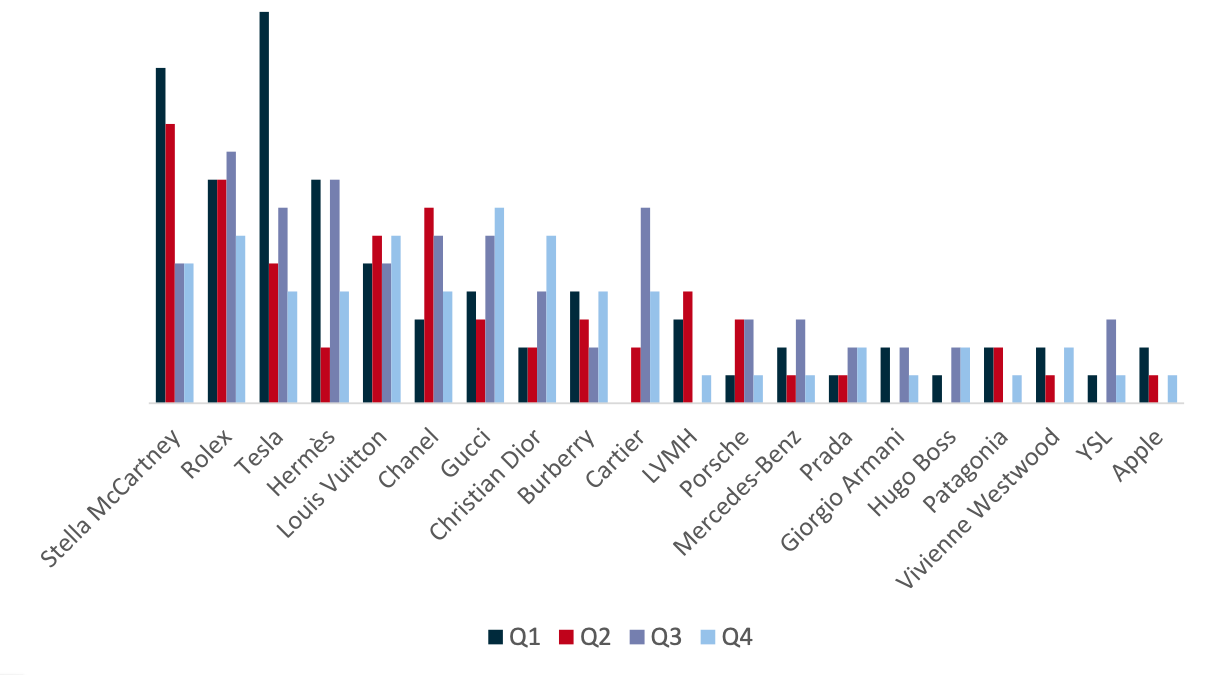

Figure 1: Top 50 by Brand in 2020

Base: 1,543 affluent/HNWIs who mentioned a brand name Source: LuxuryOpinions/Altiant GLAM

Note: Brands are ranked equally in each quarter when they have the same number of mentions. Brands have been categorised according to our opinion of their primary area of business.

Stella McCartney and Louis Vuitton retained their positions at the top of the list of unprompted brand mentions. Both notably increased their number of mentions in 2020, reinforcing their positions as perceived champions of sustainable luxury. Stella McCartney has recently launched a whole new fashion range using the 'leather' alternative Mylo, which should help it to retain its status as a sustainability pioneer. Interestingly, Louis Vuitton’s owner, LVMH, was also explicitly cited as a company by many more respondents last year, a possible reflection of its widespread efforts in tackling Covid-19.

Chanel and Tesla were two other strong performers last year, seeing their mentions rise and nudging them upwards in the 2020 ranking. Chanel’s strong results are driven in particular by a spike in mentions in quarters 2-4. As Covid-19 hit, Chanel was one of the most proactive companies in donating money to non-profit organisations for medical equipment, something which appears to have resonated with many.

Gucci and Rolex saw marginal increases in mentions but dropped slightly in the 2020 ranking as a result. There is then a considerable gap to the next most cited brand, Hermès, which saw a significant increase but could only retain its position in 7th. Hermès’ recent launch of a new mushroom-based ‘leather’ bag could see it rise even higher in next year’s rankings. Christian Dior, Porsche, YSL and Prada also saw significant gains, the latter entering the top 10 as a result.

On the other hand, Burberry, BMW, Omega and Chopard were among the brands which saw the biggest fall in unprompted mentions in 2020 vs the previous year. Many other brands, such as Hennessy and Marc Jacobs, secured a handful of mentions in 2019 but failed to secure any in 2020. In total, more than 250 luxury brands were identified by our global respondents in 2020. Please get in touch if you would like to see the complete list: contact@altiant.com.

Almost half of the brands in the top 50 sit in the designer fashion or accessory market. With fashion one of the most polluting industries in the world, the onus is on fashion brands to continue to forge ahead with improving their green credentials. Meanwhile, watch/jewellery and automotive brands each comprised almost a quarter of the top 50 in 2020.

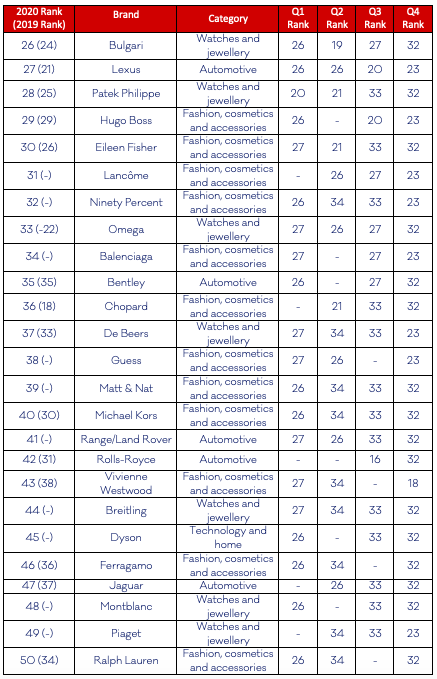

“Are there any luxury brands in any industry which you think are good examples of sustainable luxury? If so, which companies?”

Figure 2: The Top 50 in 2020 by Category

Base: 1,543 affluent/HNWIs who mentioned a brand name Source: LuxuryOpinions/Altiant GLAM

In regional terms, Tesla is a particularly strong performer in North America, securing more than half of its overall mentions here. The overall figures for Stella McCartney, Rag & Bone and Tiffany are also strongly driven by the North American response. On the other hand, Americans were responsible for less than a quarter of Louis Vuitton’s overall mentions, suggesting that its sustainable credentials are not as resonant in this market. Chanel and Hermès are two other brands which under-index on this metric among affluent Americans vs the overall figure.

“Are there any luxury brands in any industry which you think are good examples of sustainable luxury? If so, which companies?”

Figure 3: The Top 20 in 2020 by Region (North America)

Base: 582 affluent/HNW Americans who mentioned a brand name Source: LuxuryOpinions/Altiant GLAM

Within Europe, Rolex is a particularly strong performer and almost on par with Stella McCartney for the most brand mentions in 2020. Tesla, Hermès and Burberry also score particularly well among the European response. Although it remains one of the top five, Louis Vuitton again falls some way behind the leading brand mentions among European affluent/HNWIs.

“Are there any luxury brands in any industry which you think are good examples of sustainable luxury? If so, which companies?”

Figure 4: The Top 20 in 2020 by Region (Europe)

Base: 426 affluent/HNW Europeans who mentioned a brand name Source: LuxuryOpinions/Altiant GLAM

Louis Vuitton and Chanel are comfortably the most likely brands to be cited as sustainable champions by wealthy Asians. As mentioned above, Louis Vuitton falls a little way behind the leaders in Europe and North America. Instead, its overall mentions are heavily driven by Asian respondents (60%). Similarly, Chanel and Hermès owe more than half of their overall brand mentions to the Asian market. Meanwhile, other leading sustainable brands in the other regions such as Stella McCartney and Tesla fall a bit further back in the Asian response.

“Are there any luxury brands in any industry which you think are good examples of sustainable luxury? If so, which companies?”

Figure 5: The Top 20 in 2020 by Region (Asia)

Base: 535 affluent/HNW Asians who mentioned a brand name Source: LuxuryOpinions/Altiant GLAM

In terms of gender, women are more likely than men to link many luxury brands to sustainable credentials. The top three brands overall – Stella McCartney, Louis Vuitton and Chanel – are particularly strongly associated to sustainability by women. Indeed, women are more likely than men to see many luxury fashion brands as being good examples of sustainable luxury. On the other hand, men are more likely to link sustainability to automotive (Tesla, Mercedes-Benz), watch (Rolex) and technology (Apple) brands.

“Are there any luxury brands in any industry which you think are good examples of sustainable luxury? If so, which companies?”

Figure 6: The Top 20 in 2020 by Gender

Note: There was a small gender disparity in the data (n=704 male/n=839 female) which will have some influence on results.

Base: 1,543 affluent/HNWIs who mentioned a brand name Source: LuxuryOpinions/Altiant GLAM

Stella McCartney’s overall position as the most cited luxury brand for sustainability is also based on it resonating with both 18-41s and over-41s alike. Its closest two competitors – Louis Vuitton and Chanel – are in fact cited comfortably more widely by 18-41s, but fall down overall by resonating less with the older cohort.

Tesla and Gucci both saw an increase in mentions in 2020 by appealing to both the older and younger cohort. Automotive and hard luxury brands (eg Mercedes-Benz, Rolex) tend to be cited most widely by over-41s, whereas many fashion brands such as Dior and Prada show a clear skew towards the younger age group.

“Are there any luxury brands in any industry which you think are good examples of sustainable luxury? If so, which companies?”

Figure 7: The Top 20 in 2020 by Age

Note: The age break was cut at 41 years to minimise data disparity and its impact on results (n=750 18-41s/n=793 of 42+s).

Base: 1,543 affluent/HNWIs who mentioned a brand name Source: LuxuryOpinions/Altiant GLAM

THE IMPORTANCE OF SUSTAINABILITY

“How important is it to you that luxury brands commit to adopting policies that promote environmental protection, social responsibility and ethical behaviour ('sustainable luxury')?”

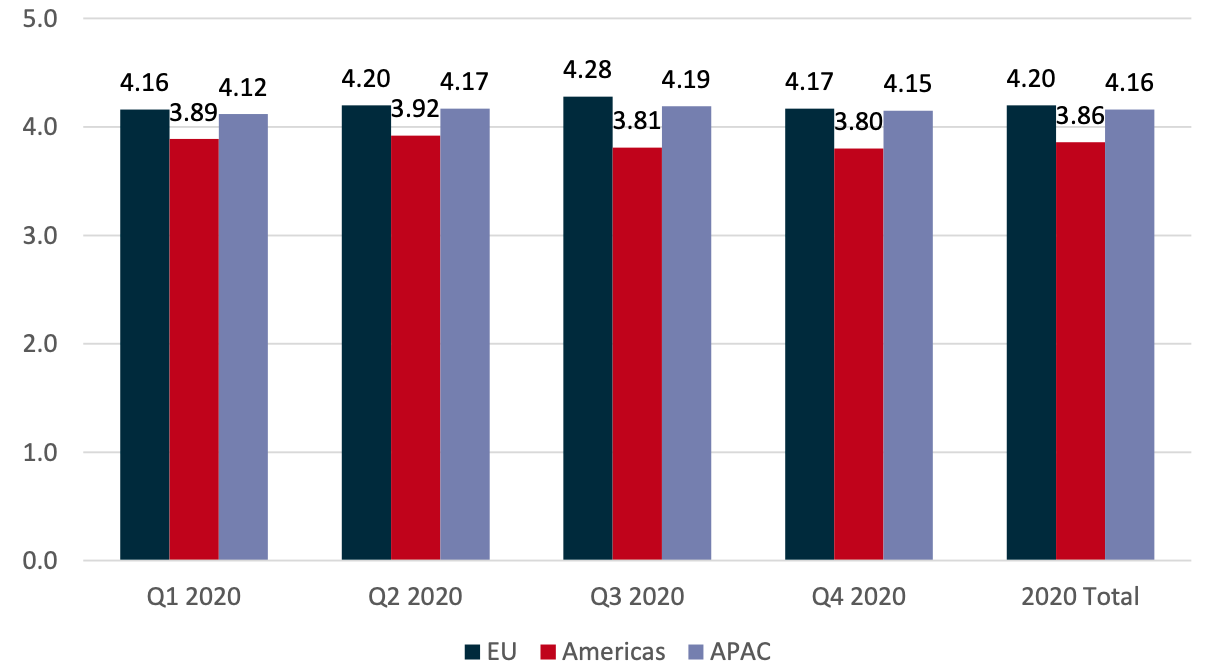

Figure 8: Importance of Sustainability by Quarter (Median)

Note: 1 = Totally unimportant, 5 = Very important

Base: 1,814 affluent/HNWIs Source: LuxuryOpinions/Altiant GLAM

Wealthy individuals continue to see sustainable luxury as very important, with the global median score standing at 4.12 (out of 5) across the whole year. Americans are a little less likely than Europeans and Asians to rate sustainable luxury as very important. There was minimal change on this metric by quarter, although Q3 saw a small peak in Europe before falling back again in Q4.

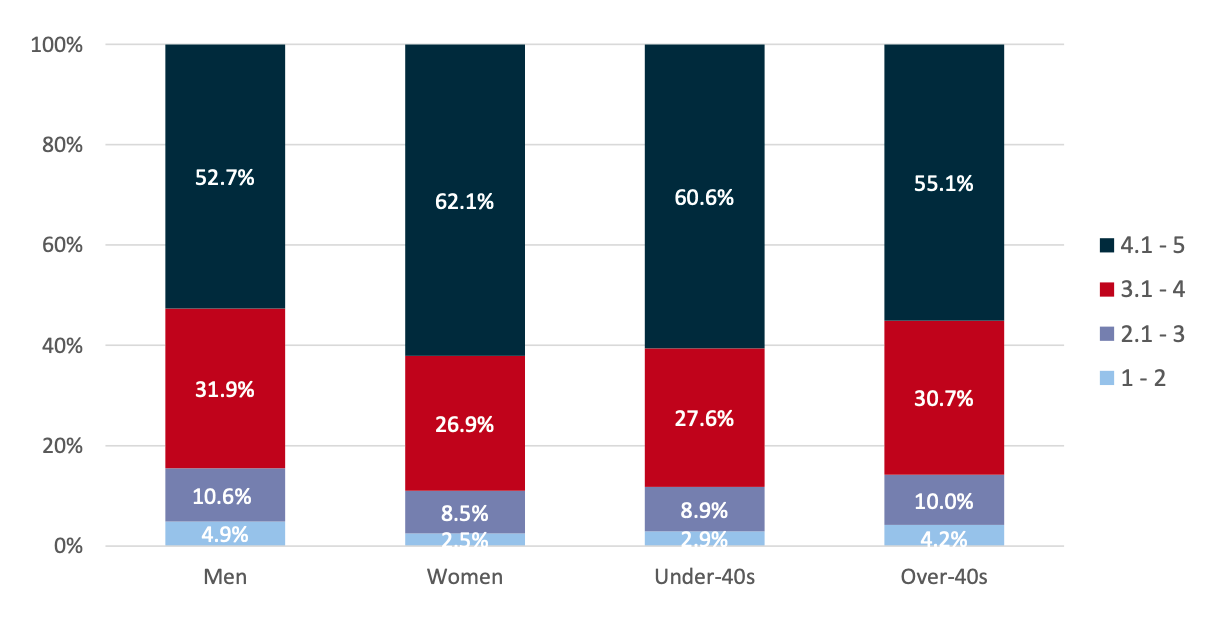

Women and under-40s are significantly more likely than men and over-40s to say that sustainable luxury is very important to them (4-5 on the scale). Nevertheless, more than half of men and over-40s still fall into this high importance cohort. Only between 10-15% in each of the four groups say that sustainable luxury is unimportant to them, showing how it has become a notable consideration for many wealthy consumers.

“How important is it to you that luxury brands commit to adopting policies that promote environmental protection, social responsibility and ethical behaviour ('sustainable luxury')?”

Figure 9: Importance of Sustainability by Gender and Age (Median)

Base: 1,814 affluent/HNWIs Source: LuxuryOpinions/Altiant GLAM

PRICE TO PAY FOR SUSTAINABLE LUXURY

“Would you be prepared to pay more for a product which positions itself as sustainable luxury? If so, how much more would you pay?”

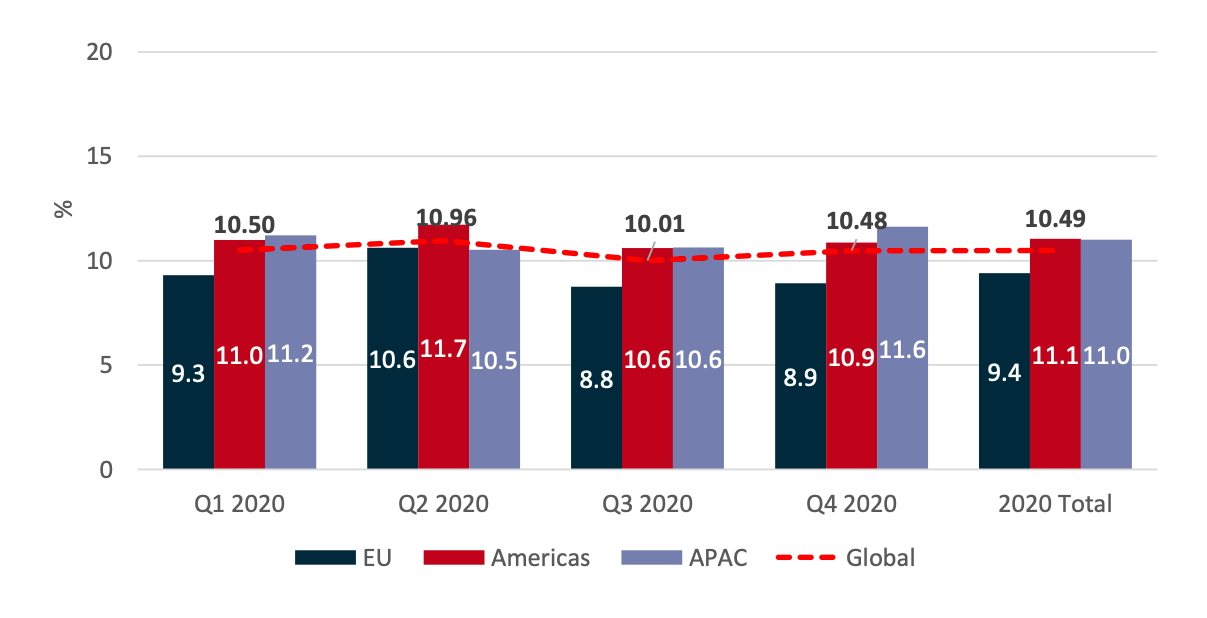

Figure 10: Willingness to pay more for sustainable luxury by Quarter (Mean)

Base: 1,814 affluent/HNWIs Source: LuxuryOpinions/Altiant GLAM

Across the whole of 2020, just under one in five affluent/HNWIs say that they would not pay any more for sustainable luxury products. Meanwhile, a third say they are prepared to spend more than 10% extra for such products, with 7% willing to spend more than 25% extra. When converted to a mean, the global result has remained between 10-11% across all four quarters, with relatively minimal fluctuation. Europeans are the least willing to pay significantly more in each of the quarters, suggesting that more considerable price mark-ups for sustainability might fare a little less well in this region.

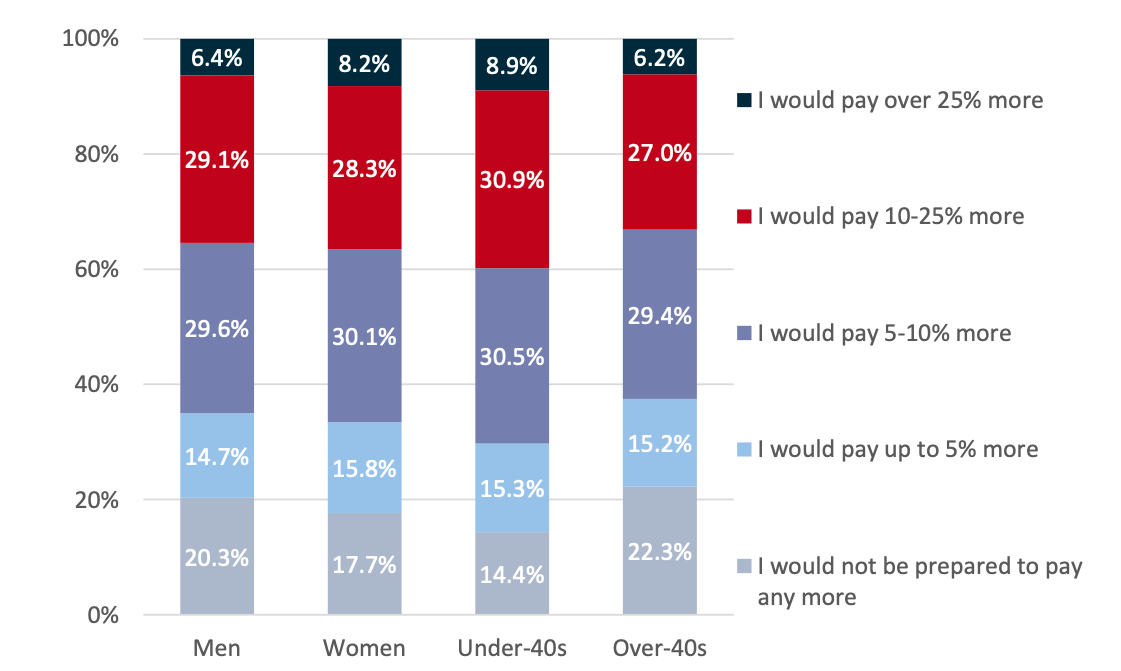

Across the whole of 2020, women and under-40s are the most willing to spend a significant premium for sustainable luxury goods, with almost one in ten prepared to spend over 25% more. In all four groups, around three in ten would pay 10-25% extra, with a similar share willing to go up by 5-10%. Only one in five or fewer respondents in each of the four groups are unprepared to spend any more for sustainably-made luxury products. This indicates that there is widespread willingness to spend at least a little more for sustainable goods, but also that these consumers may scrutinise brands which make such claims.

“Would you be prepared to pay more for a product which positions itself as sustainable luxury? If so, how much more would you pay?”

Figure 11: Willingness to pay more for sustainable luxury by Gender and Age

Base: 1,814 affluent/HNWIs Source: LuxuryOpinions/Altiant GLAM

To view the data set in full, or speak to us about any of your luxury research requirements, please email us at contact@altiant.com.

Contributors

Chris Wisson, Knowledge Director

Plamen Iliev, Senior Project Manager

Contact

reports@altiant.com

ABOUT ALTIANT

Altiant is a specialised fieldwork company which enables large scale, global research among affluent consumers/High Net Worth Individuals (HNWIs) in 15+ countries worldwide.

By servicing dozens of the world’s top luxury and wealth brands, Altiant helps renowned brands and their research agencies to answer critical questions among this very hard-to-reach demographic. We ensure that all of our survey respondents are genuinely affluent by having their identities verified and wealth levels validated.

Altiant is a corporate member of ESOMAR, the World’s leading association for standards & Ethics within market research. Altiant adheres to, and abids by their strict guidelines governing the best practice in the industry.

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.