ALTIANT Global Luxury AND ASSET MANAGEMENT (GLAM) MONITOR

Q4 2025 RELEASE

I

Q4 2025 RELEASE I

Quarterly GLAM Monitor: Q4 2025

Release date: January 2026

Lars Long - Founder & CEO, Altiant

Welcome to the newest edition of Altiant’s Global Luxury and Asset Management (GLAM) Monitor. The monitor focuses on the behaviours and sentiments of our panel of validated global affluent/High Net Worth Individuals.

For GLAM, we have now conducted over 14,000 interviews to construct a comprehensive and evolving view of luxury sentiment and behaviour. The seven years of study so far clearly show the significant change and disruption which the world has seen in that period. We hope that the future findings continue to assist your business strategies and decisions in the years ahead.

2025 was a year in a rush, with rapidly developing opportunities and threats for the luxury industry. While some brands found the going tough, others thrived. Global issues such as the energy and climate crises, international conflicts, tariffs/trade wars and inflation continue to impact affluent sentiment. AI has also become firmly established, with many people now using it daily, either consciously or not.

All of the data is available within Tableau so that you can reformulate the results according to your own preferences. Age, gender, region and household income filters will enable you to interact with the data and cut it in different ways to identify key variances and trends.

We welcome the free and fair use of our data to meet your individual and business objectives, only asking that you clearly link your readers to the source of the data whenever applicable. As we publish additional iterations, trends will continue to strengthen, enabling you to further enhance your understanding of global luxury consumers. In the event you have any questions about the data, please contact us at glam@altiant.com

Altiant Founder and CEO, Lars Long

INTRODUCTION TO THE RESEARCH

All data presented in this GLAM monitor has been sourced from Altiant’s manually validated in-house panel of Affluent and High Net Worth Individuals (HNWIs), Luxury Opinions©. This iteration reports on Q4 2025 but will also include trended data from the trackers’ previous quarters. For any additional questions about this research, please contact glam@altiant.com.

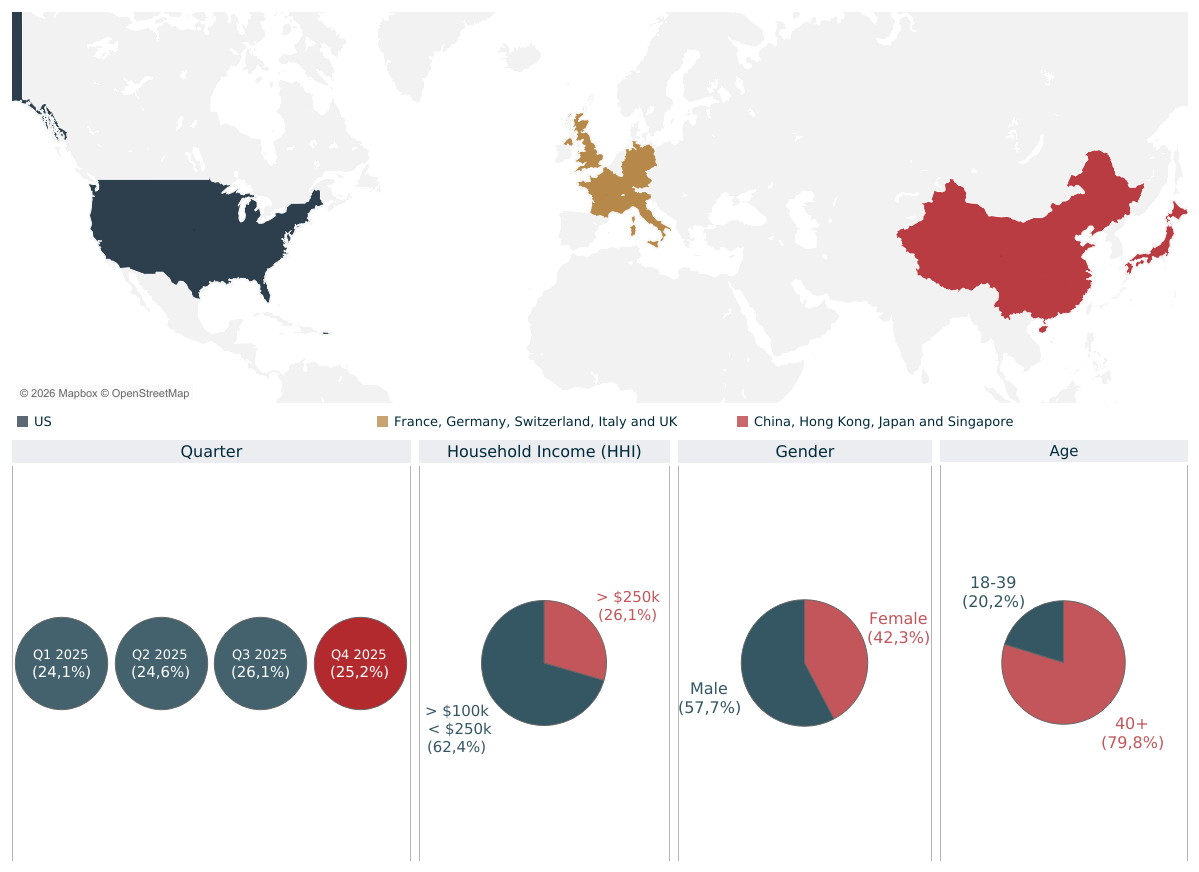

METHODOLOGY

We continue to survey different members of our global panel whenever possible, trying to survey all respondents once a year at most. 477 affluent/HNWIs were surveyed between October and December 2025, with 162 in Europe, 168 in North America and 147 in Asia Pacific. 19% of this quarter’s sample was aged 18-39, with 81% aged over 40. The sample was split 53:47 male:female in terms of gender. Since starting the tracker in Q3 2018, we have now conducted more than 14,000 interviews in total, 34% of which were among aged 18-39s (66% over-40) and with a gender split of 51:49.

MEDIAN HOUSEHOLD INCOME AND INVESTIBLE ASSETS

Normalised to $US, the median household income (HHI) in this quarter was $300k, while the median investible assets (IA) stood at just over $1m (exchange rates as per 15th January 2026). This brought the median HHI across all 5+ years’ of study so far to $270k, while the IA median stands at $892,500.

wealth acquisition: the new categories

In Q3 2024 we introduced a new question asking for the respondents’ best description about how they had acquired their wealth so far. The five categories are:

· Legacy wealth: Wealthy upbringing/financial support and with an inheritance

· Head start: Wealthy upbringing/financial support with no inheritance

· Upwardly mobile: Middle-class or poor upbringing with financial support and an inheritance

· Inheritor: Middle-class or poor upbringing with an inheritance but no financial support

· Self-made: Middle-class or poor upbringing without an inheritance or financial support

Across the five quarters so far, 11% have defined themselves as coming from Legacy wealth, while 15% fell into the Head start category, the latter rising to 25% in China. Another 21% said they were Upwardly mobile, while only 7%defined themselves as an Inheritor. By far the largest share fell into the Self-made category (46%), albeit standing at only 12% among the Chinese response. The results for Q4 were broadly in line with the previous quarters for this question.

GLAM 5-YEAR

In July 2025, we released a GLAM Monitor Report, which collects five years of continuous and detailed data collection, marking a sustained contribution to thought leadership in luxury and asset management research. DISCOVER THE REPORT AND MAIN INSIGHT

STUDIED POPULATIOn

KEY QUARTERLY CHANGES

Travel spending P12m remains buoyant and the highest of all categories studied, increasing to $12,250 from $11,000 in the previous quarter.

Holidays with friends P12m stood at 41%, rising to 47% among under-40s, the highest result across the four quarters of study for this metric.

The share of affluent/HNWIs who said that they had purchased luxury goods/services in a physical store reached 85% in Q4 2025, the highest point in the tracker since Q1 2020.

In Q2, perceived stability in the global financial system dropped to 14%, the lowest point of the tracker so far, before recovering slightly to 20% in Q3 but dropping off again to 16% in Q4.

Almost one quarter (23%) say that they have cut the amount of free time they spend online over the past year (vs 17% who are doing so more), rising to 30% among affluent Europeans.

LUXURY PURCHASES

LUXURY BEHAVIOUR

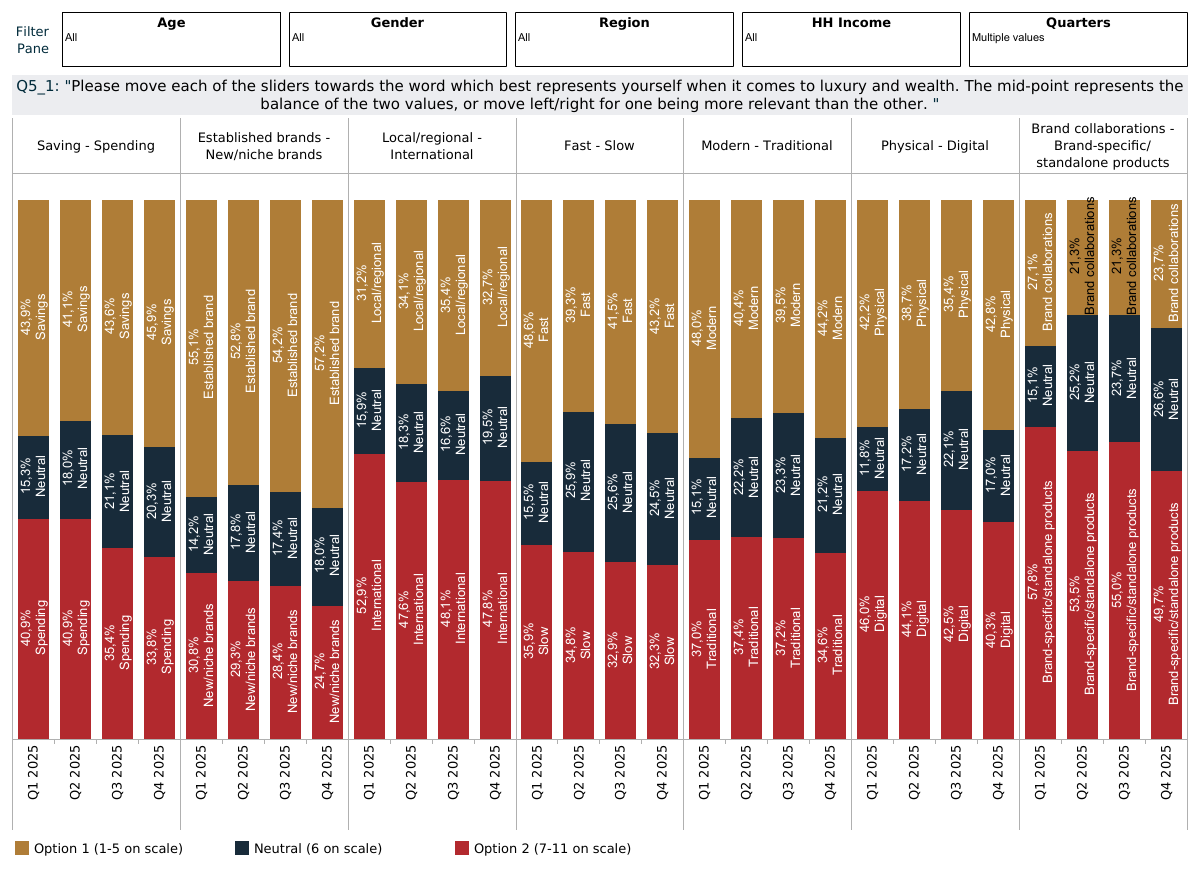

“Which of the following words best represents yourself when it comes to luxury and wealth?”

Base: 1,891 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThis question was introduced for 2025, with respondents using an 11-point slider to indicate which words from the following pairs best sums them up. The numbers below represent a net of the three slider points closest towards each word (bottom 3/top 3). While most of the pairs are reasonably balanced between the two extremes, there is a clear preference towards established brands (30%) and those which focus on brand-specific/standalone products (25%) rather than collaborations.

Saving vs Spending: 21% vs 14%

Established brands vs Niche brands: 32% vs 10%

Local/regional brands vs International brands: 19% vs 25%

Fast vs Slow: 22% vs 13%

Modern vs Traditional: 23% vs 15%

Physical vs Digital: 18% vs 20%

Brand collaborations vs Standalone products: 8% vs 24%

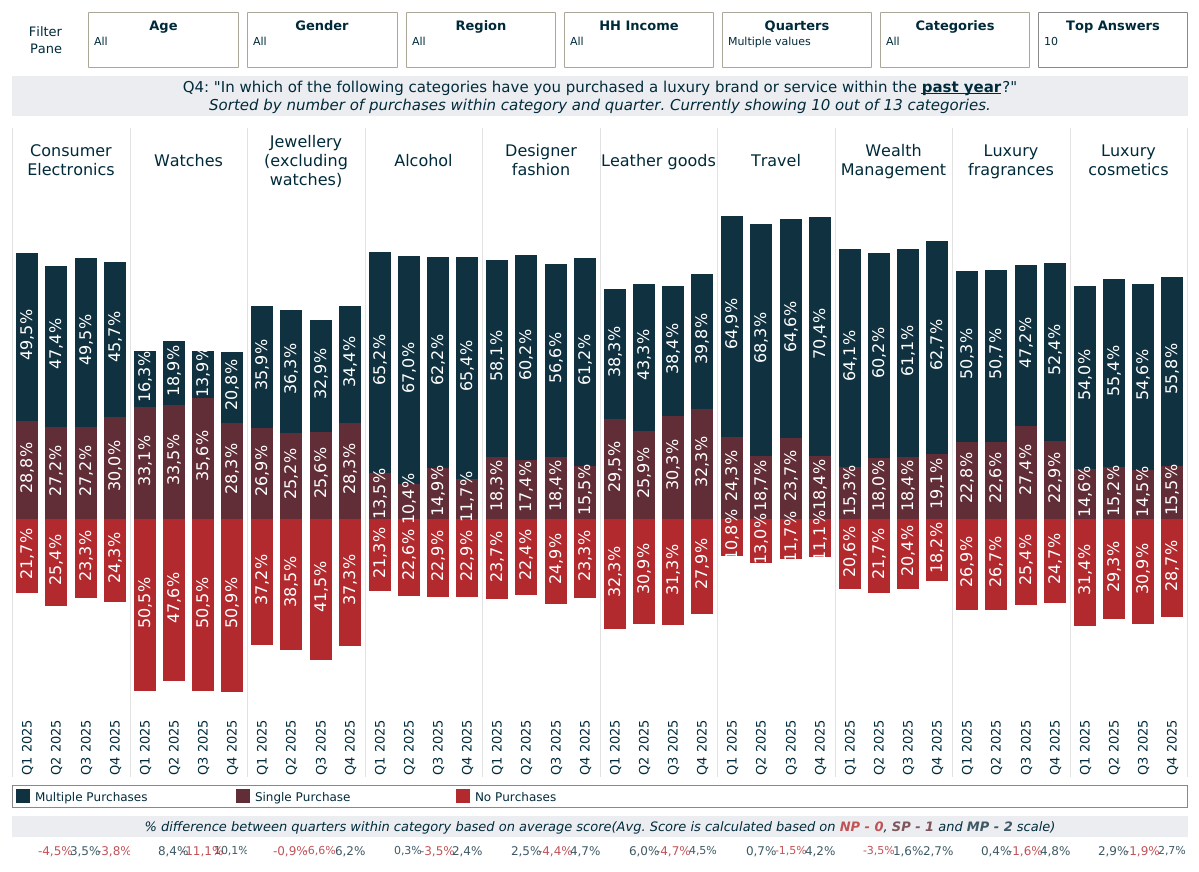

PAST LUXURY PURCHASES (Past 12 Months)

“In which of the following categories have you purchased a luxury brand or service within the past year?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThe travel industry has fully bounced back after the pandemic and travellers have mostly returned to their previous habits. The share of wealthy individuals saying that they had taken a luxury holiday reached a new tracker-peak of 90% in Q4 2024 and has stayed around this point since (89% in Q4 2025), with 70% taking multiple trips within the past year. Tourism remains firmly at the top of the list for share of category purchases and a little way ahead of the nearest cluster of other categories.

Various others such as wealth management services, designer fashion, alcohol, electronics and cosmetics/fragrances have also remained popular and purchased by 70-80% within the past year. Purchases of leather goods and cosmetics/fragrances see a clear skew towards women, while men are more likely to buy watches and use wealth management services. Luxury automotive (42%), high-end audio (41%) and art and collectibles (39%)remain the least likely categories to have been purchased within the past year.

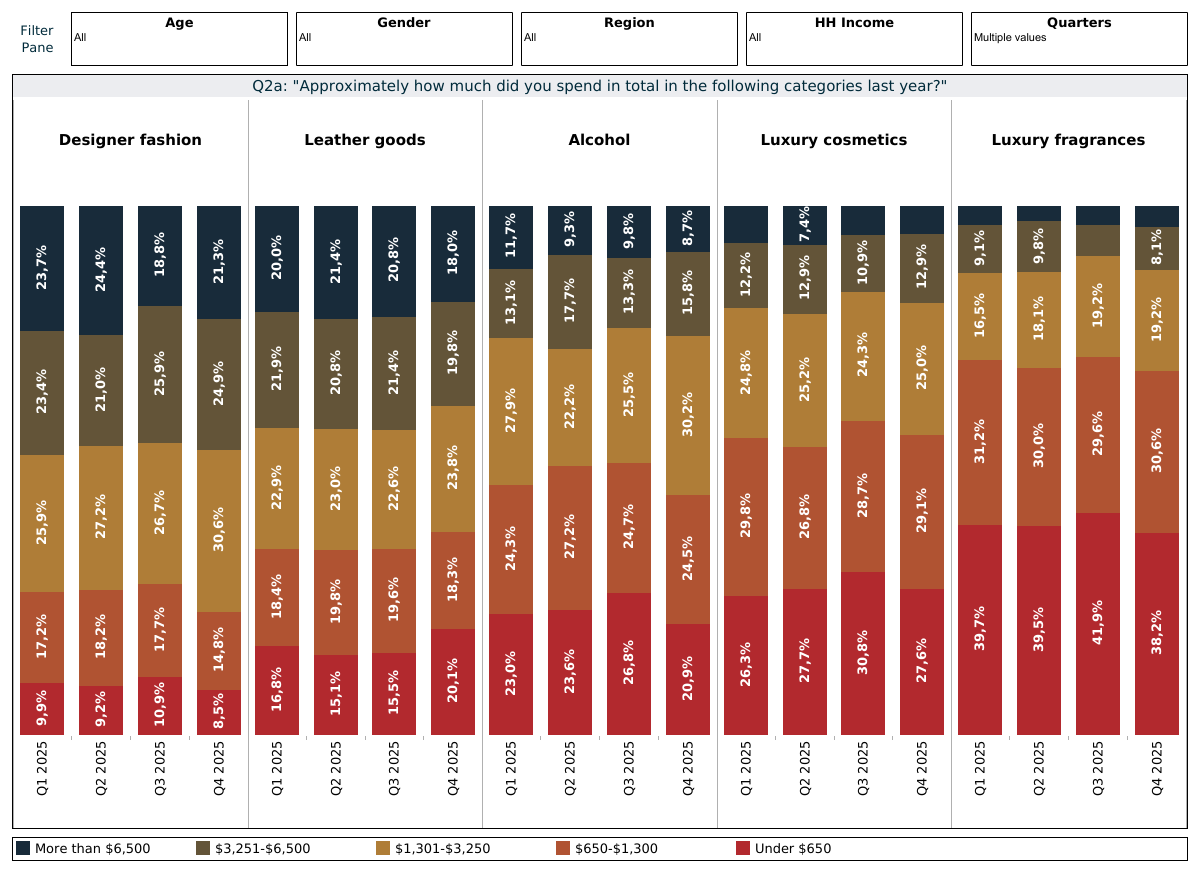

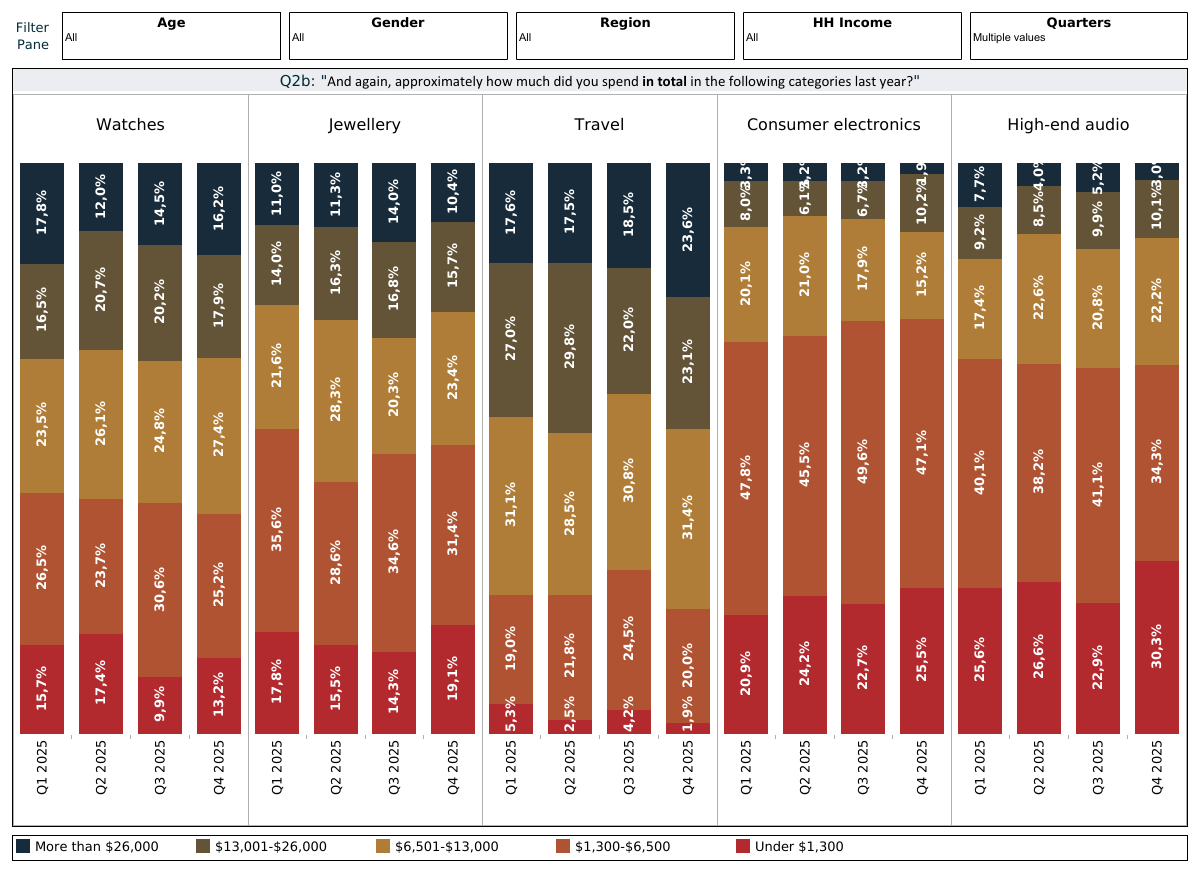

“Approximately how much did you spend in total in the following categories last year?”

Base: global affluent/HNWIs who made purchase(s) in the relevant categories | Source: LuxuryOpinions®/AltiantAmong the typically lower-priced categories, fragrances again came out the lowest with a median normalised spend of just over $900, a little behind cosmetics ($1,150). Both leather goods and designer fashion had a median spend in the $2,000-3,000 range. Travel had the highest median spending category and is the only one to exceed $10,000: spending stood at $12,250, up from $11,000 in the previous quarter. Watches followed a short way behind ($9,250), with jewellery spending at $6,500 and high-end audio and electronics just over $4,000.

Luxury Purchase Intent (Next 12 Months)

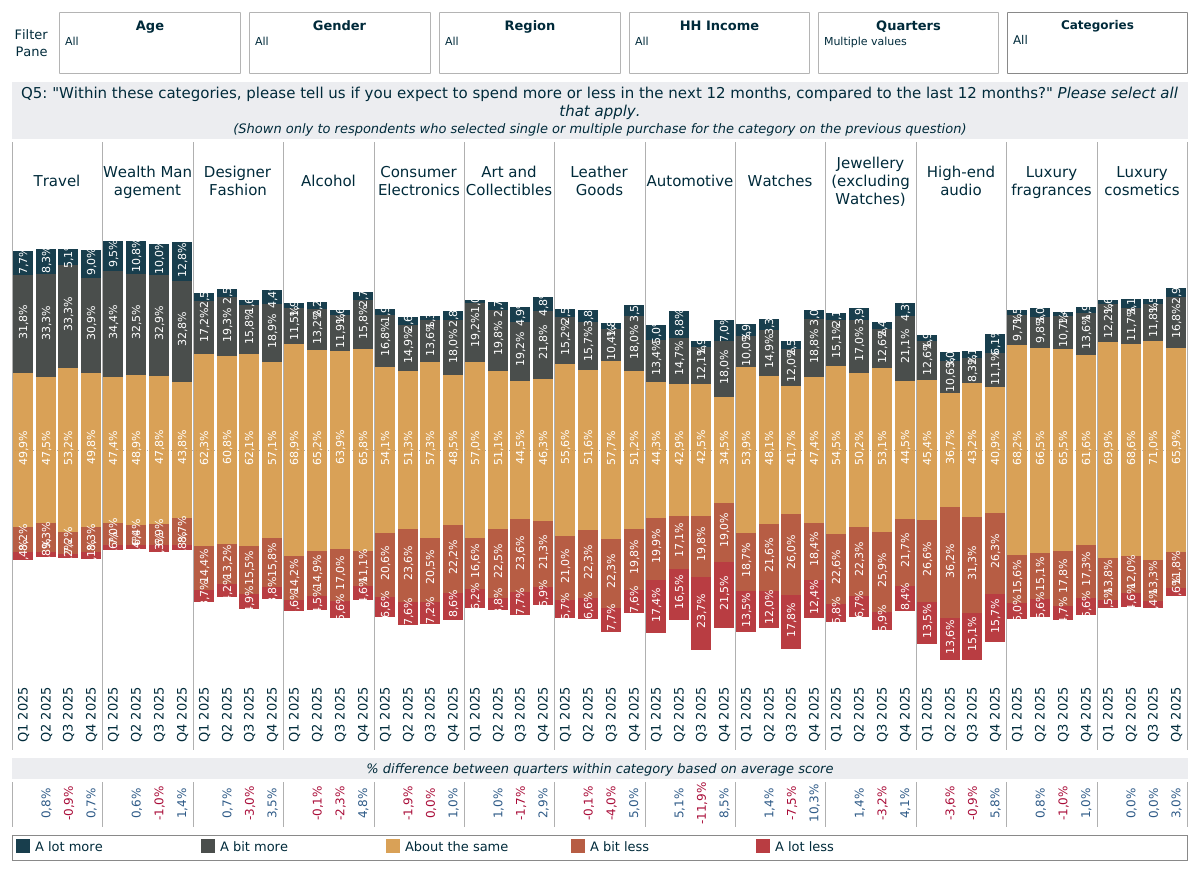

“Do you expect to spend more or less in the next 12 months, compared to the last 12 months?” - Active buyers, past 12m

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantPurchasing trends remained somewhat consistent across 2024 but saw a clear and significant shift in 2025 with a cautious mentality prevailing. Many brands have reported difficult sales periods recently, with purchasing intentions in several categories suggesting further challenges ahead.

After spiking in Q3, the share of respondents planning to cut back on spending remained broadly at the same level, or even grew further in several areas, in Q4. Watches (44% to 31%) and alcohol (23% to 16%) were the standout categories for seeing a reduction in negative sentiment in Q4 vs Q3.

High-end audio (42%) and automotive (41%) remain the categories with the highest share of category buyers expecting to cut back in 2026. Various other categories such as leather goods (27%), art and collectibles (27%) and jewellery (30%) also saw around a third of their current buyers planning to spend less over the next year.

Overall, travel and wealth management are the best performers here, with only around 10% expecting to cut back. Indeed, 40% and 46% respectively expect to increase their spending in these categories in the year ahead. Many affluent/HNWIs appear to want to plan financially for unforeseen events, political change or to hedge against inflation.

“You mentioned that you have not purchased luxury items from the following categories within the last year/Do you think you will make purchases in any of these categories within the next year?”

Alcohol, high-end audio, art and collectibles and luxury fragrances/cosmetics remain the least likely categories to entice new customers, all having a high share of non-users not expecting to begin doing so in 2026. Travel is the category which may be able to attract renewed travellers, with half expecting to take at least one trip again in the next 12 months.

PURCHASE CHANNELS

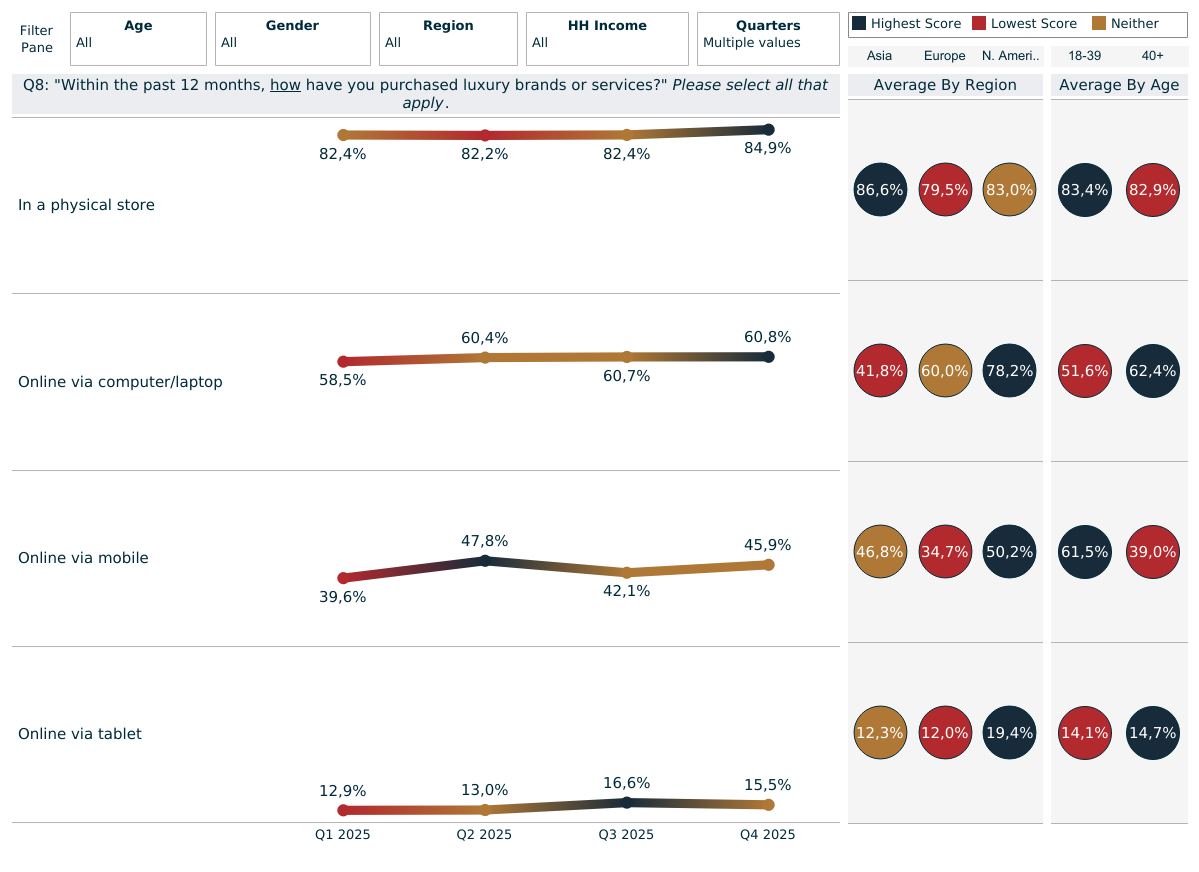

“Within the past 12 months, how have you purchased luxury brands or services?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantPrior to Covid-19, the share of consumers buying luxury goods/services in a physical store hovered around the 85% mark. This fell as low as 67% in Q2 2021 and while there were some fluctuations across 2022 and early 2023, it stabilised around the 80% mark across 2024/25. However, this reached 85% in Q4 2025, the highest point in the tracker since Q1 2020.

The past two years have also seen a notable uplift in online luxury shopping, although this too saw some fluctuation over the past year. As of Q4 2025, 61% said that they had purchased luxury goods or services via their computer/laptop, flat vs Q3, and rising to 81% of Americans. Purchases via mobile phones continue to fluctuate and nudged upwards to 46%in Q4 while those via tablets fell slightly to 16%. Men and over-40s comfortably remain the least likely to have shopped via devices.

SOCIAL MEDIA INTERACTIONS

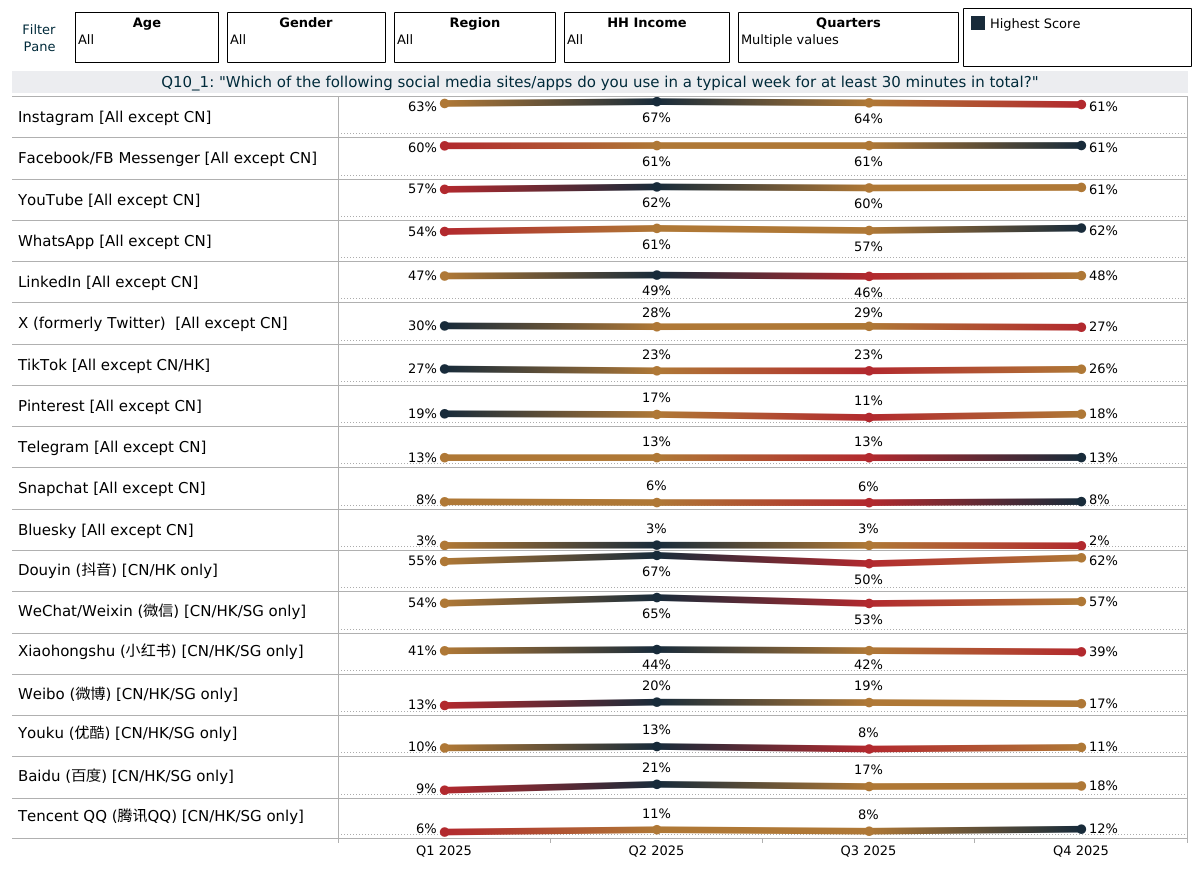

“Which of the following social media sites/apps do you use in a typical week for at least 30 minutes in total?

Base: 1,891 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThis question was introduced from Q1 2025 to provide a greater level of detail about social media usage. The unique nature of Chinese social media means that its specific sites were only shown to respondents in China, with all other markets seeing the same options. Respondents from Hong Kong were shown both the Western/international sites as well as the Chinese ones. Within China, Douyin is highly popular and used by 76% of the Q4 sample. Nearly all Chinese respondents said that they used Weixin (93%), while two thirds (64%) use Xiaohongshu and a third (31%) use Weibo.

Among the non-Chinese markets, Instagram, Facebook and YouTube (all 61%) were the most popular, followed by the professional networking site LinkedIn (48%). The direct messaging app, WhatsApp, also remains popular with 62%using it for at least 30 minutes in a typical week. Women are much more likely to use the former two sites, with men more likely to use LinkedIn. Despite recent controversies, X/Twitter remains reasonably popular and used by 27%, while only 2% are currently using Bluesky. TikTok is now used by just over one quarter of this affluent cohort (26%).

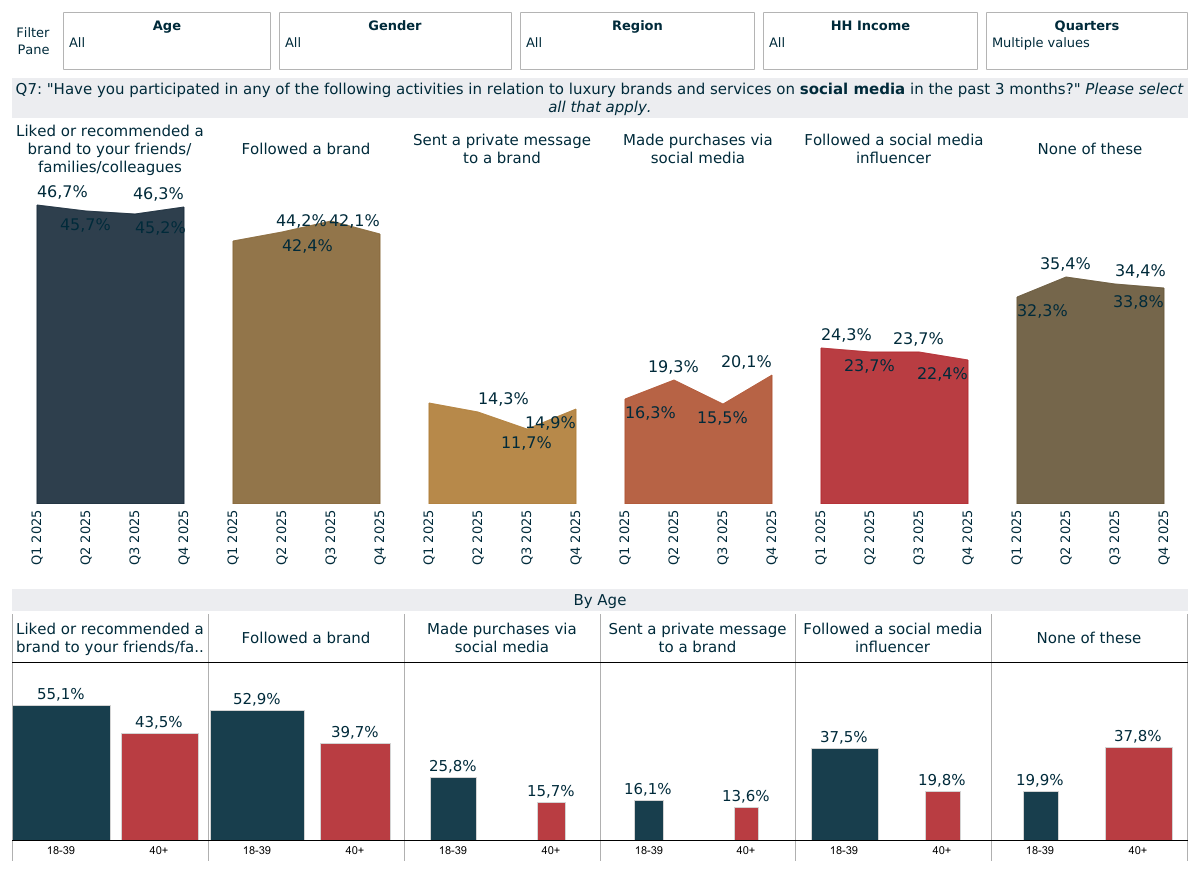

“Have you participated in any of the following activities in relation to luxury brands and services on social media in the past 3 months?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantIn line with online retail prospering, social media is now key for most luxury brands. Some 42% of the Q4 sample said that they had followed a brand, while 46% had liked or recommended one to family, friends or colleagues within the past three months, both figures broadly in line with the previous quarters. In both cases, women and under-40s continue to be the most likely to do so. Elsewhere, under one in five made purchases via social media (20%) or sent a private message to a brand (15%), with under-40s again most likely to do so.

Many are dedicating parts of their marketing budgets to social media influencers. With almost one quarter (22%) of wealthy individuals saying that they had followed influencers within the past three months, this can be a lucrative option if well-chosen partners are utilised. Over-40s, men and Europeans are the least likely groups to do so at under one in five. Finally, 34% reported that they made none of these social media interactions within the past three months.

LUXURY & SUSTAINABILITY

Attitudinal Statements

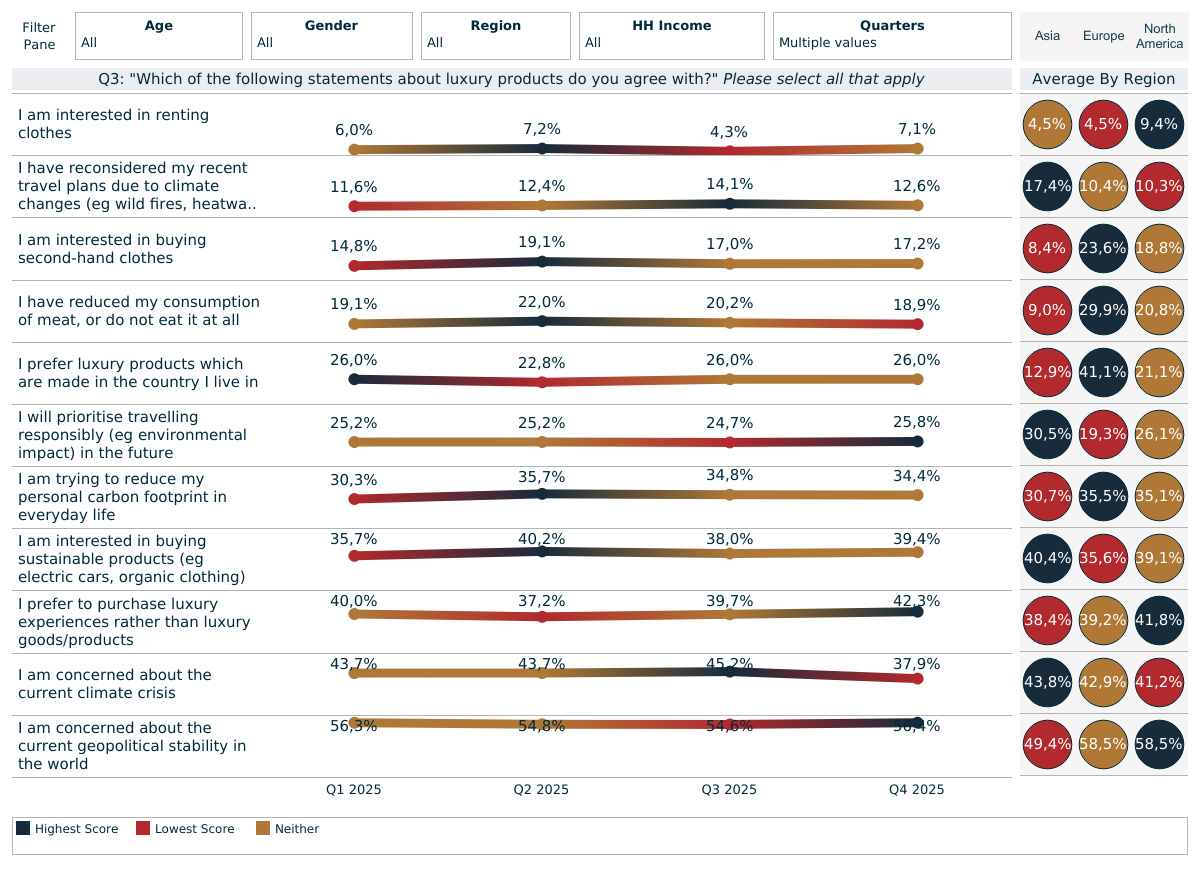

“Which of the following statements about luxury do you agree with?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantRecent years have led to many affluent/HNWIs reassessing their purchases of luxury goods, often instead preferring to spend their money on luxury experiences: two in five (42%) say that they now prefer luxury experiences over goods/products. As seen in Section 1, tourism is buoyant and sustainable/ethical trips will remain prevalent: 26% say that they will prioritise responsible travel in the future. Meanwhile, 13% say that they have reconsidered their recent travel plans due to climate changes such as heatwaves and wildfires.

Similarly, many people are opting to rent items rather than buy them, particularly in categories such as fashion and jewellery. Sustainability and tapping into the circular economy are at the heart of this growth, although that still only 7%are interested in renting clothes indicates that this is likely to be gradual. Meanwhile, 17% say are interested in buying second-hand clothes, though this figure continues to lag in Asia where only 5% are receptive.

Wealthy individuals are also increasingly gravitating towards brands which have a genuine sustainable ethos and positioning. Two in five (39%) are interested in buying sustainable products such as electric cars or organic clothing. A similar/slightly higher share are also now concerned about the climate crisis (38%) and geopolitical stability in the world (56%), while 34% are trying to reduce their personal carbon footprint in everyday life. Finally, 19% have reduced or eliminated their consumption of meat, rising to 28% in Europe but standing at just 10% in Asia.

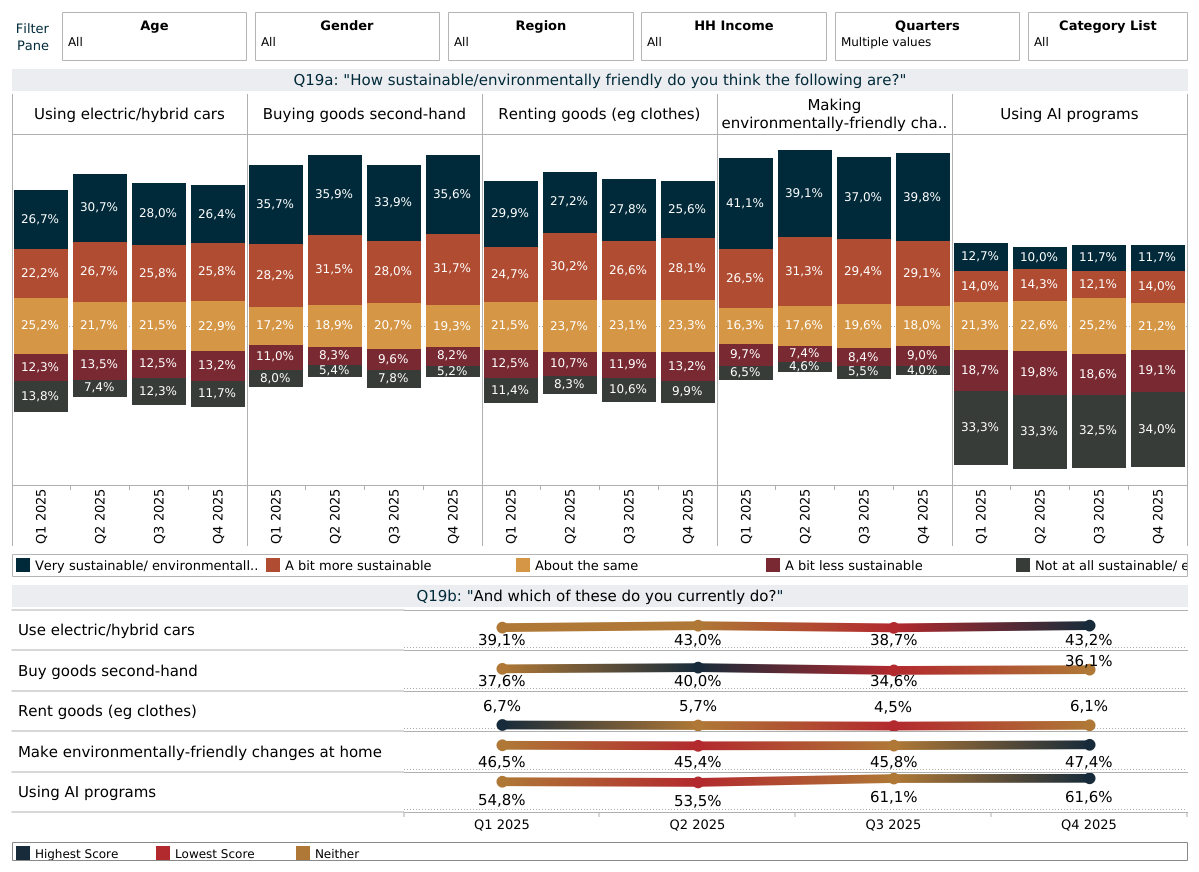

“How sustainable/environmentally friendly do you think the following are? / And which of these do you currently do?

Base: 8,108 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThe ongoing climate crisis means that many wealthy individuals are now scrutinising their own actions and how they are contributing to, or alleviating, this issue. Perceived green credentials can be highly influential, and the growth of the rental and second-hand market has been built around the circular economy.

While some studies have questioned the legitimacy of these claims, consumer perception is key. This appears to be broadly positive as over half (54%) think that renting goods is either somewhat or very environmentally-friendly, rising to 67% for buying goods second hand. Some 36% say that they are already doing the latter, though only 6% are currently renting.

Another significant behavioural change is the increasing need to find alternative fuels for driving. The growth of electric and hybrid cars has been broadly positive, albeit with some ongoing concerns about the convenience of charging and battery reliability (‘range anxiety’). Nevertheless, 26% think that these cars are very environmentally-friendly, with another 25% thinking they are somewhat so. Two in five (43%) have already made the switch to electric or hybrid cars, although some countries are reporting flat or waning driver interest and a reversion back to ICE vehicles.

There are also growing energy demands coming from the use of AI programs, a new metric introduced to the tracker from Q3 2024. As of Q4 2025, only 26% think that these are sustainable or environmentally friendly, with 52% believing they are not very/at all green. Over-40s and Europeans are the most likely to have a negative impression of AI from a sustainability perspective. Nevertheless, 62% of the Q4 sample say that they are already using such programs (up from 54% in Q2), rising to 71% among millennials and 70% among American respondents.

Many wealthy individuals are also making sustainable changes at home, for example by investing in solar panels or heat pumps. Two thirds (69%) believe that these actions are very or somewhat environmentally friendly, with broadly high response across the demographics. Almost half (47%) of the Q4 sample have already taken some of these steps, only falling behind in Asia (37%).

The Importance of Sustainability

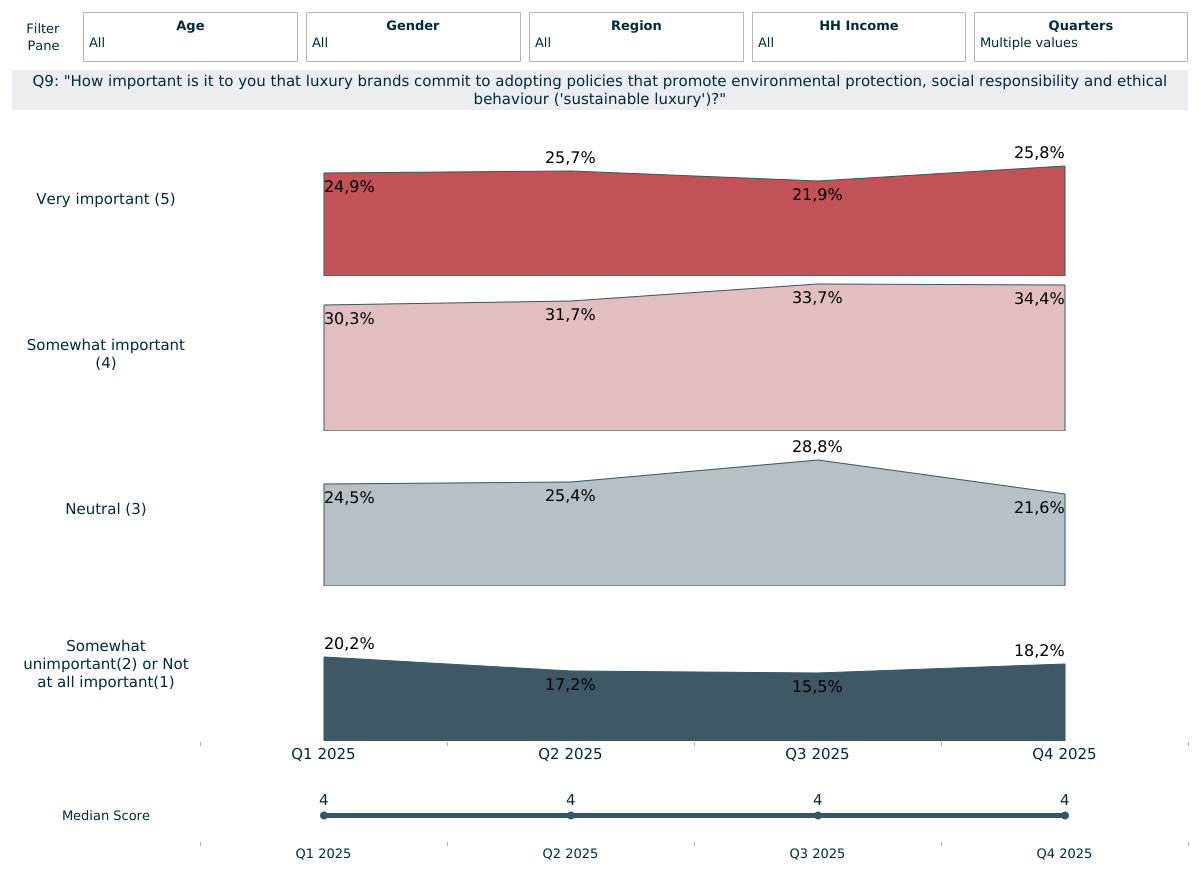

“How important is it to you that luxury brands commit to adopting policies that promote environmental protection, social responsibility and ethical behaviour (sustainable luxury)?”

Base: 8,108 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThe ongoing climate crisis remains one of the most pressing issues globally. This has led to many becoming increasingly demanding of brands to acknowledge and act alongside them in alleviating climate concerns. Individuals are also becoming more aware of ‘greenwashing’ and discerning about brands which make sustainable claims. Three in five (60%) say that it is very or somewhat important to them for brands to do this. Only 18% now say that it is not very, or not at all important for brands to focus on sustainability, showing the importance of this issue for consumers.

Trading up for Sustainability

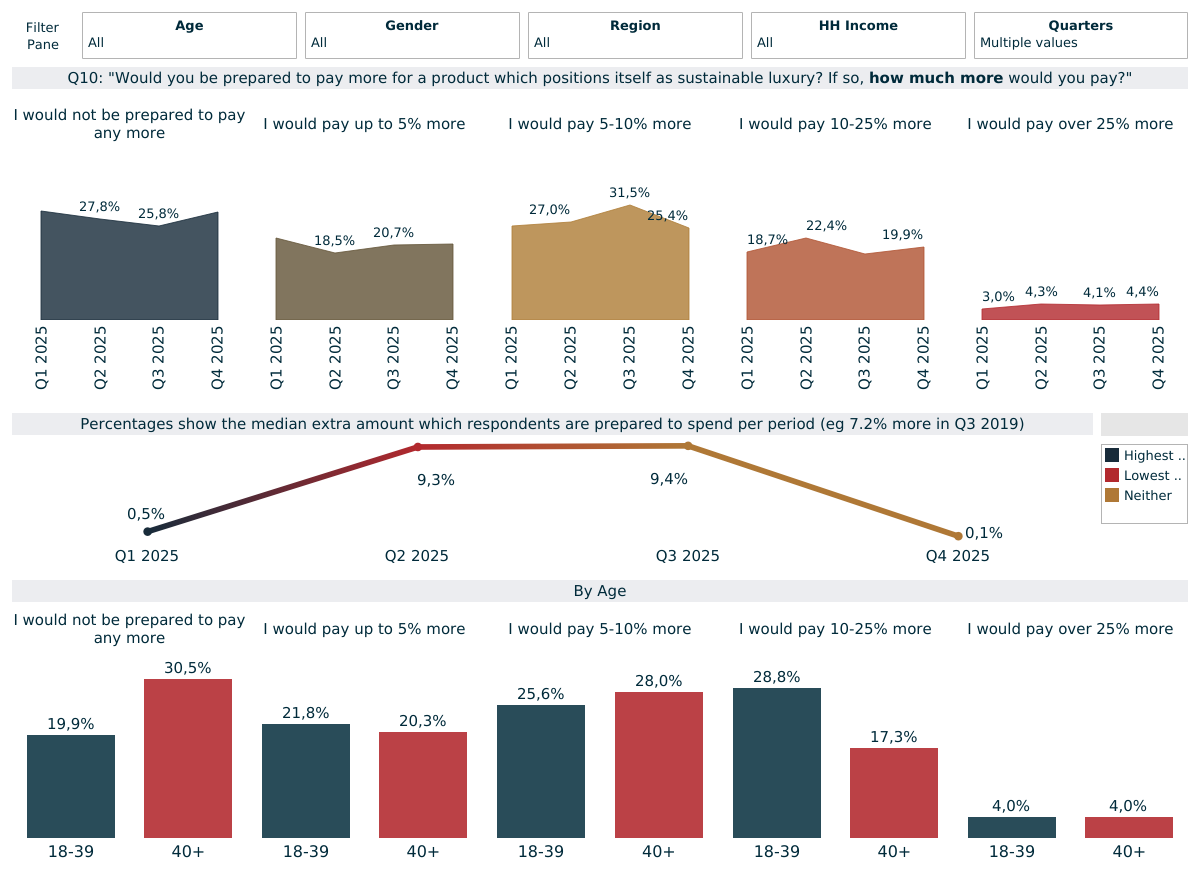

“Would you be prepared to pay more for a product which positions itself as sustainable luxury?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantDespite some muted responses to brands’ sustainability efforts, many affluent consumers are seemingly prepared to back up their views about environmental protection and sustainability with their money. Only 30% of the Q4 sample are entirely unprepared to spend any more for sustainable/ethical luxury products, while 46% are prepared to spend up to 10% more, which could represent a sweet spot for brands to justify a small price premium.

The remaining 24% are prepared to spend more than 10% extra for sustainable/ethical luxury products, with 4% even being prepared to spend more than 25% extra. Trading up for sustainable goods resonates with under-40s more than over-40s overall, especially for the 10-25% extra spending bracket.

Sustainable Luxury Champions

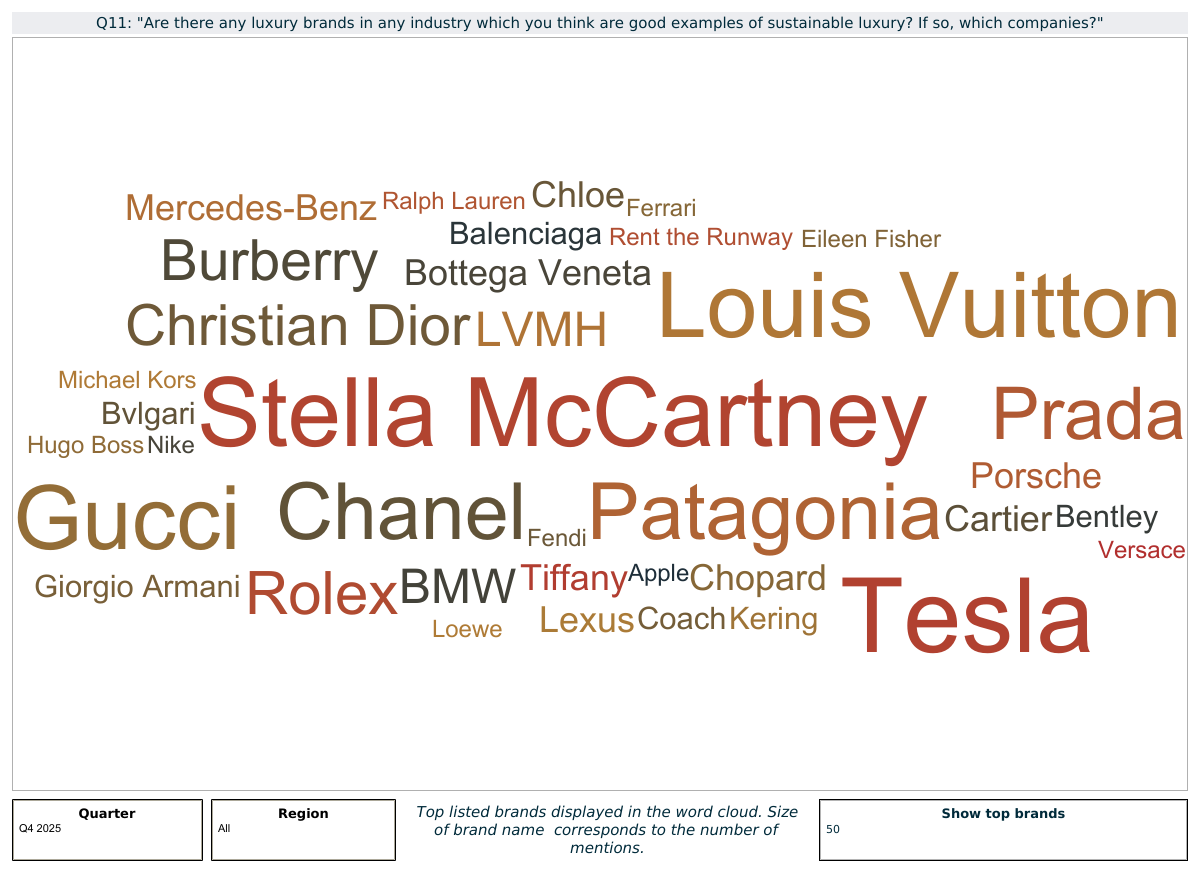

“Are there any luxury brands in any industry which you think are good examples of sustainable luxury? If so, which companies?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantOver the course of our tracker so far, a handful of luxury brands have consistently stood out to wealthy individuals as sustainable luxury operators. The likes of Louis Vuitton, Stella McCartney, Gucci and Tesla garner a high share of the response each quarter, with these brands also being among the most cited in Q4. Meanwhile, many wealthy individuals do not state any specific sustainable brands or, even worse, actively mistrust some green claims, something which brands continue to have to work on resolving.

FOCUS ON FINANCE

Global Financial System Stability

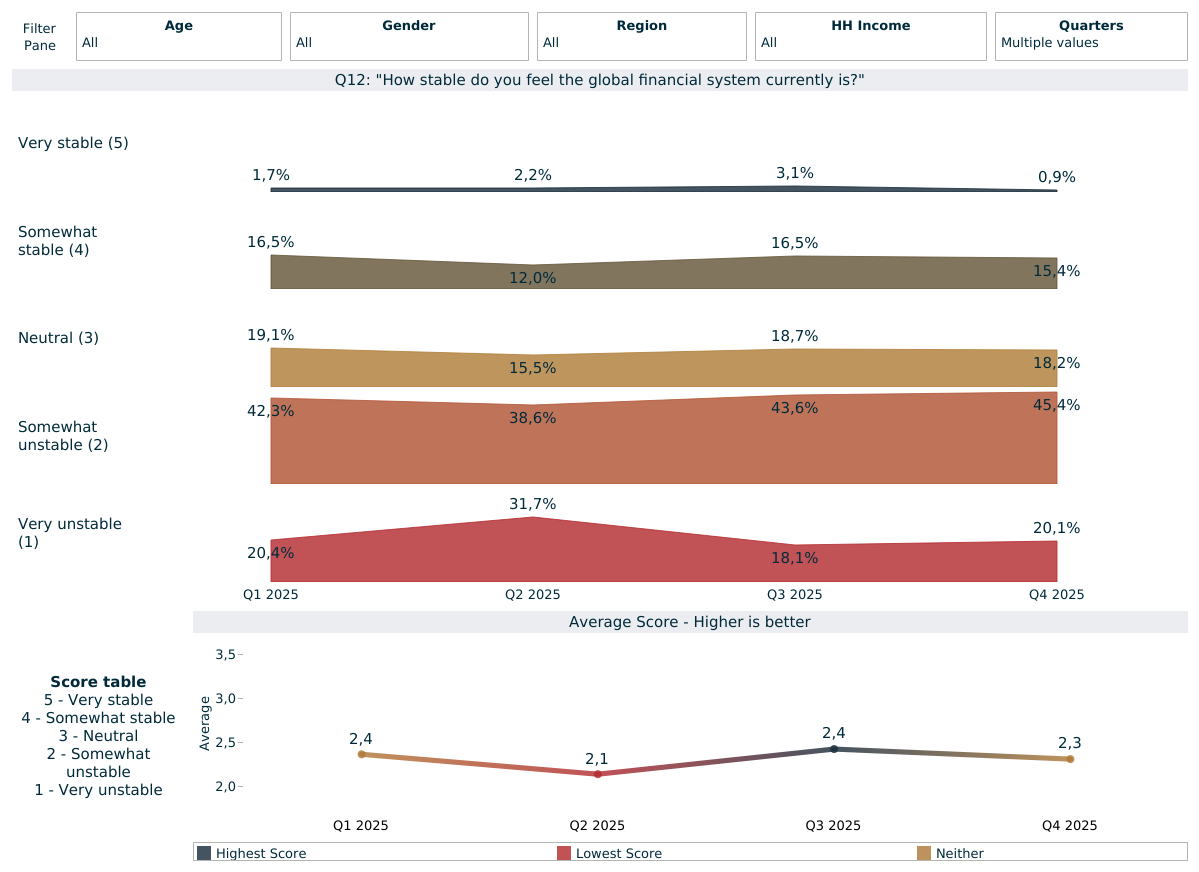

“How stable do you feel the global financial system currently is?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantA variety of recent events have had a major impact upon consumer confidence in the global financial system. Perceived stability in the financial system plummeted at the outset of the pandemic before recovering unevenly in the intervening years. In Q2, perceived stability dropped to 14%, the lowest point of the tracker so far, before recovering slightly to 20% in Q3 but dropping off again to 16% in Q4. Concurrently, the share of those who think that system is very or somewhat unstable rose to 70% in Q2, fell to 62% in Q3 before nudging upwards again to 64% in Q4. Only 18% now hold a neutral/uncertain position.

Stock Market Knowledge

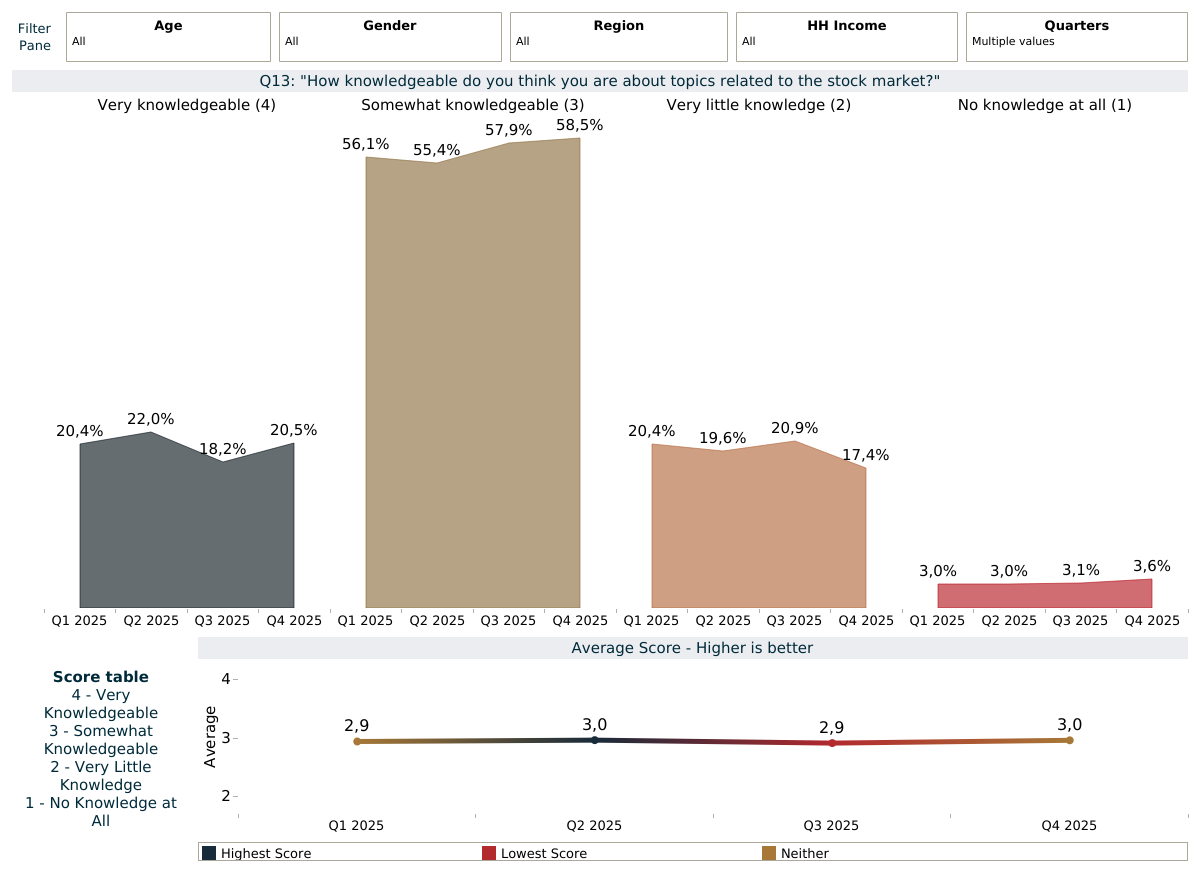

“How knowledgeable do you think you are about topics related to the stock market?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantSelf-claimed stock market knowledge has historically shown little quarterly variation, hovering around the 75-80% mark. In Q4, this remained true as 79% said that they are either very or somewhat knowledgeable, and with only 21% falling into the top box. Women and Europeans continue to be the least likely groups to state that they are knowledgeable. 17%feel that they have very little stock market knowledge, while only 4% say they have no knowledge at all. Women remain much more likely to profess having little or no knowledge in this area (27% vs 16%).

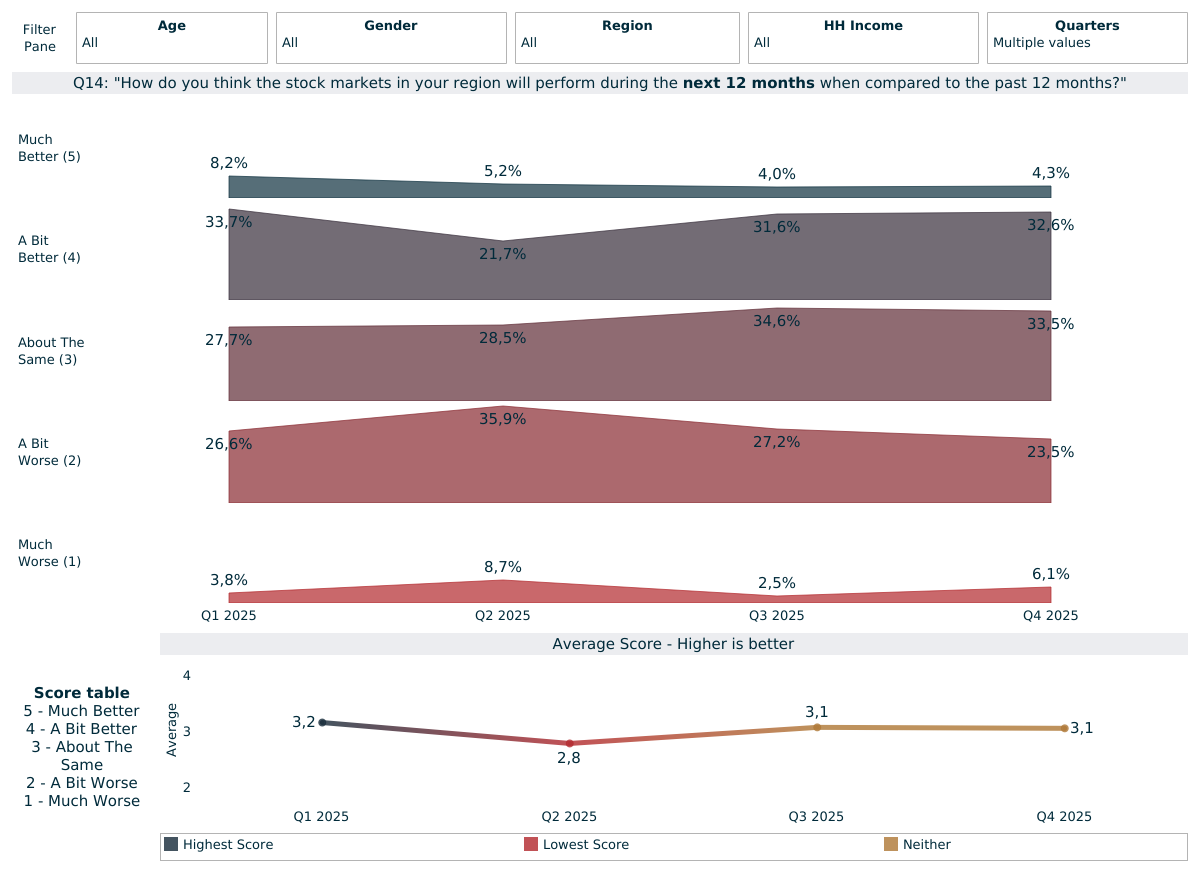

Regional Stock Market Confidence

“How do you think the stock markets in your region will perform during the next 12 months when compared to the past 12 months?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantStock market confidence dropped as low as 30% in Q2 2022, before recovering in an uneven manner since. However, this again dropped dramatically to a new tracker low in Q2 2025, with just 27% expecting an improved performance in the year ahead (down from 42% in Q1). While this recovered a little in Q3 (28%) and even more in Q4 (37%), it remains relatively low when looking across the tracker as a whole. One third (33%) now think that their stock performance will remain about the same, while 30% anticipate are expectant of a downturn.

INVESTMENT PLANS

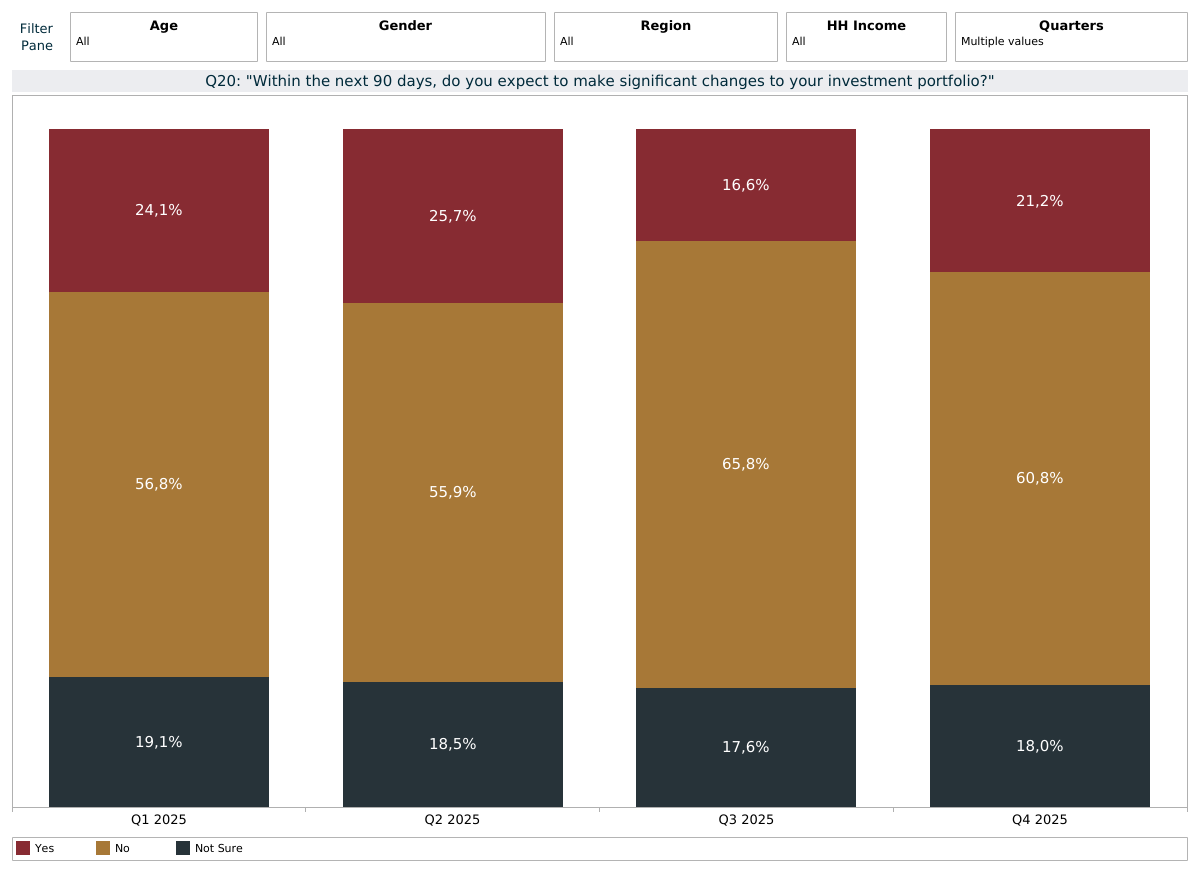

“Within the next 90 days, do you expect to make significant changes to your investment portfolio?”

Base: 8,108 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThere has been relatively little movement on this question over the past three years, with only around one quarter planning to make significant imminent changes to their portfolios, while half did not. However, caution now appears to be the priority as just under two thirds (61%) do not anticipate making such changes and only 21% do. One in five (18%) remain unsure. The ongoing market turbulence and uncertainty, largely emanating from the US, is likely to be a key reason for the shift in these results over the past year.

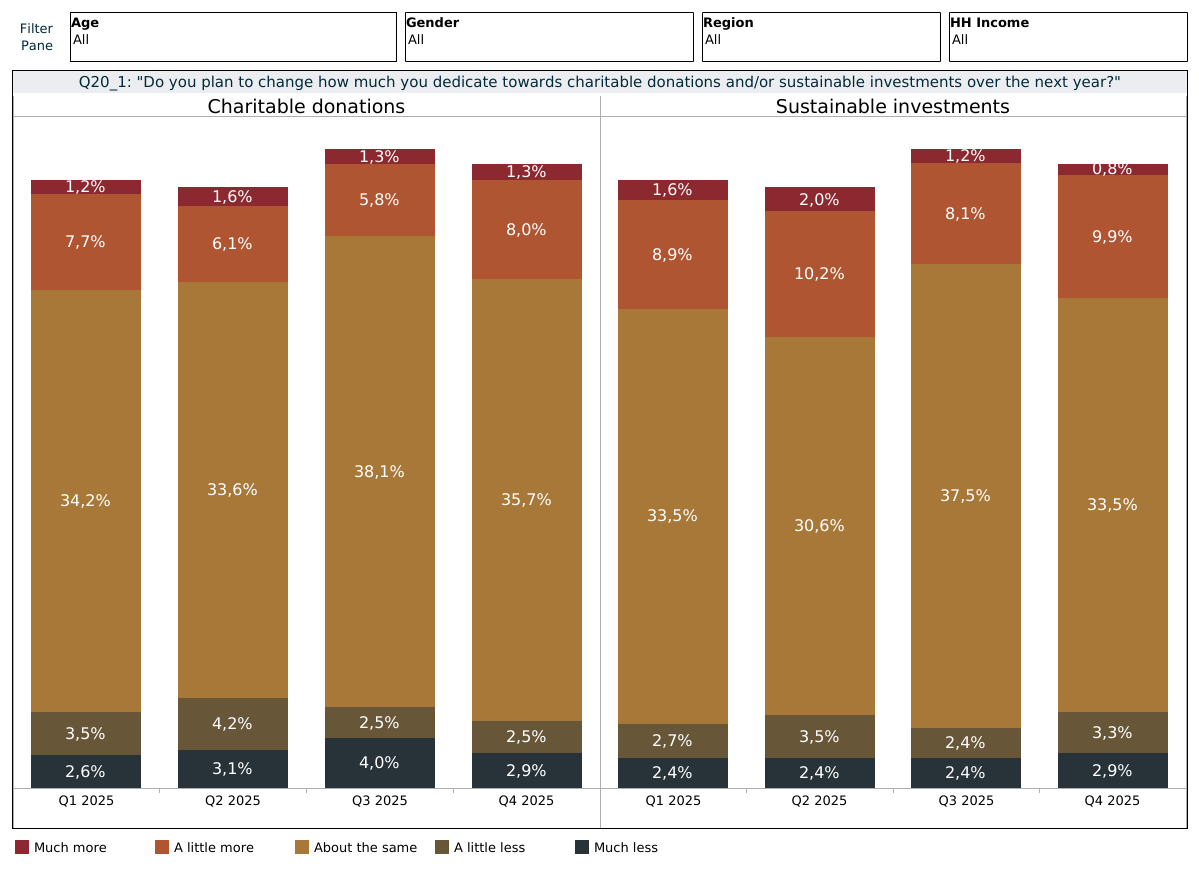

“Do you plan to change how much you dedicate towards charitable donations and/or sustainable investments over the next year?”

Base: 4,287 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantOnly 18% say that they will be making more charitable donations in the year ahead. Almost three quarters (71%) expect to donate about the same amount as before, while only 11% anticipate cutting back. A similar pattern emerges for planned sustainable investments, with 21% expecting to increase these, 67% planning to maintain and only 12%cutting back.

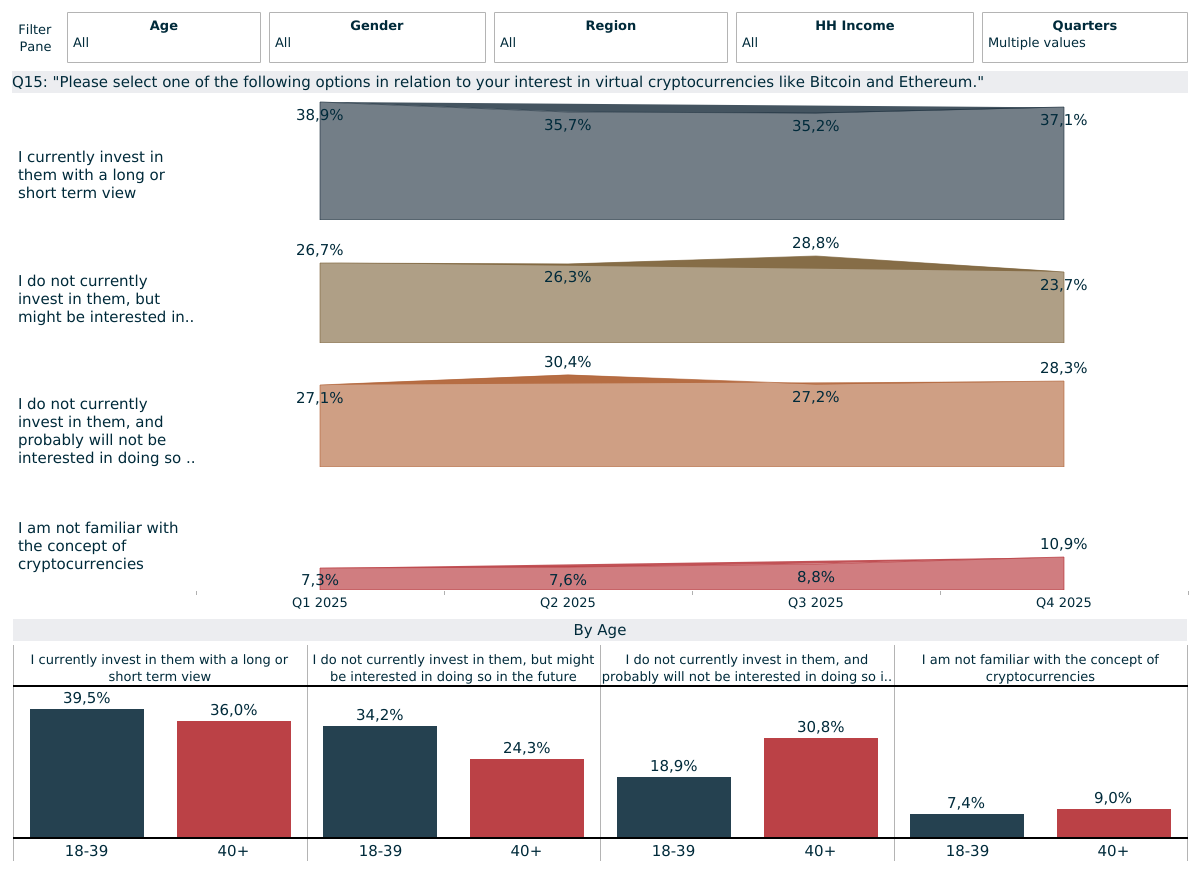

Investing in Cryptocurrencies

“Please select one of the following options in relation to your interest in virtual cryptocurrencies like Bitcoin and Ethereum.”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantCryptocurrency continues to attract a high level of media interest amid ongoing controversies. Only 11% of the global affluent are now entirely unfamiliar with them. Following a significant drop in 2022, Bitcoin values reached a new all-time high in August 2025 of $124,000 before falling away thereafter and ending the full year around 6% down.

In Q4 2025, 28% of global affluent/HNWIs were long-term investors, driven by Americans and men, while 9% invested with a short-term view. Bitcoin remains the most popular digital currency by some distance. Despite the aforementioned growing value of coins such as Bitcoin, the actual share of investors remains broadly flat vs previous quarters. While some investors only do so for single coins, typically Bitcoin, many also dabble in others such as Ethereum.

Despite rising values, the continued unpredictability and volatility of crypto appears to have hardened the opposition among many non-investors: the share of current non-investors but who might be interested in doing so fell back steadily in 2023 and remained at around a quarter since (24% in Q4). Another 28% now say that they do not currently invest in crypto and do not think they will do so in the future.

FOCUS ON TRAVEL AND LEISURE TIME

Holiday habits and intention

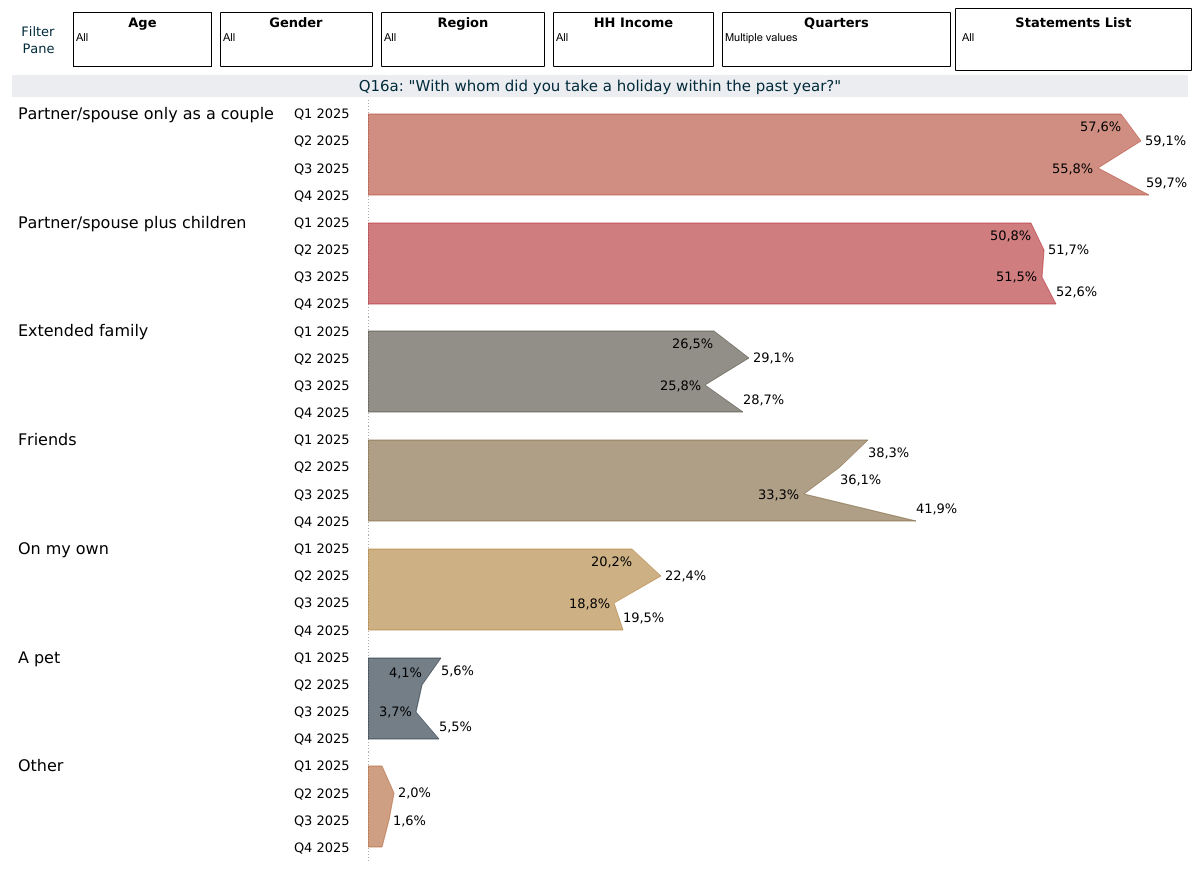

“With whom did you take holiday within the past year?

Base: 1,891 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantAnother new question introduced in Q1 2025 aimed to understand who travellers were taking their holidays with. As per the results in Q4, couple trips remain the most popular overall, with 60% doing so, closely followed by couples plus children (53%). Holidays with friends were also commonplace at 41%, rising to 47% among under-40s. Multi-generational/extended family trips (29%) and solo travel (20%) also provide the industry with significant opportunities to tap into.

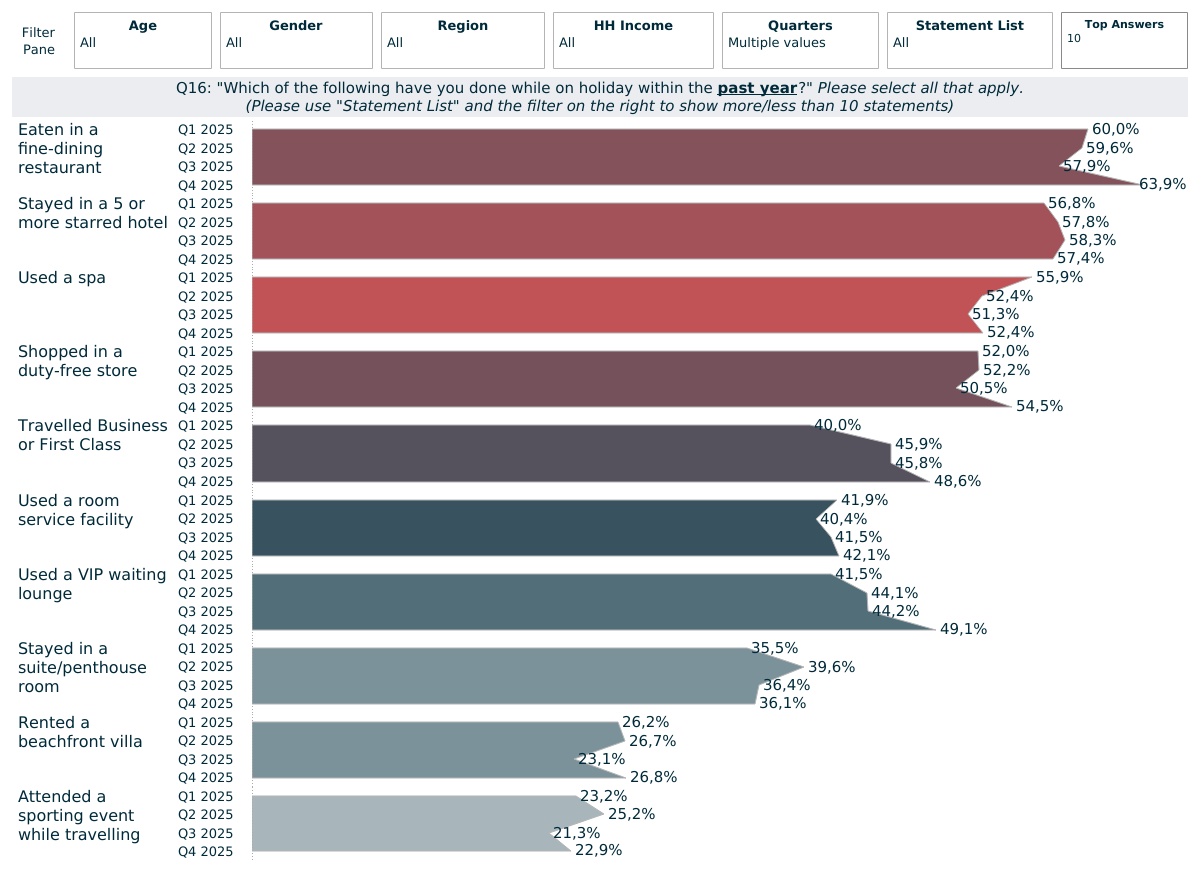

“Which of the following have you done while on holiday within the past year?”

[Note: in Q4 2021 this question was from a three-year time period to one-year]

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantLuxury is important right from the start of respondents’ holidays, including at the airport: 55% shopped in a duty-free store, 49% used a VIP waiting lounge and 49% travelled by business/first-class within the past year. Alcohol, perfume and cosmetic purchases were commonplace among those who shopped in a duty-free store. 5* or more hotelsremain highly popular, used by 57%, while 36% stayed in a suite/penthouse room and 27% rented a beachfront villa. Fine dining (64%) and room services/concierges (42%) also continue to attract many of these travellers.

Spas were used by more than half (52%) within the past 12 months, with under-40s remaining the most likely users (58%). Wellness tourism continues to flourish as more luxury hotels acknowledge the appeal of relaxation facilities; indeed, 23% say that they had been to a wellness retreat over the past year.

Many wealthy individuals are also extending business trips for a holiday (workations/’bleisure’). Almost one quarter (21%) say that they have done this over the past year, while a similar share had a private transport experience such as a helicopter ride (21%) or used a private chauffeur (23%). Americans are the most likely to have treated themselves on their luxury holidays in most of these listed activities, with very little overall change vs Q3.

Two new codes were introduced in Q3 2024 to account for increasingly visible travel trends: taking a medium/long distance luxury train trip (such as the Orient Express) and attending a sporting event while on holiday. One in ten (9%) said that they had taken one of these train trips within the past year, while 23% had attended sporting events, the latter rising to one third of wealthy Americans.

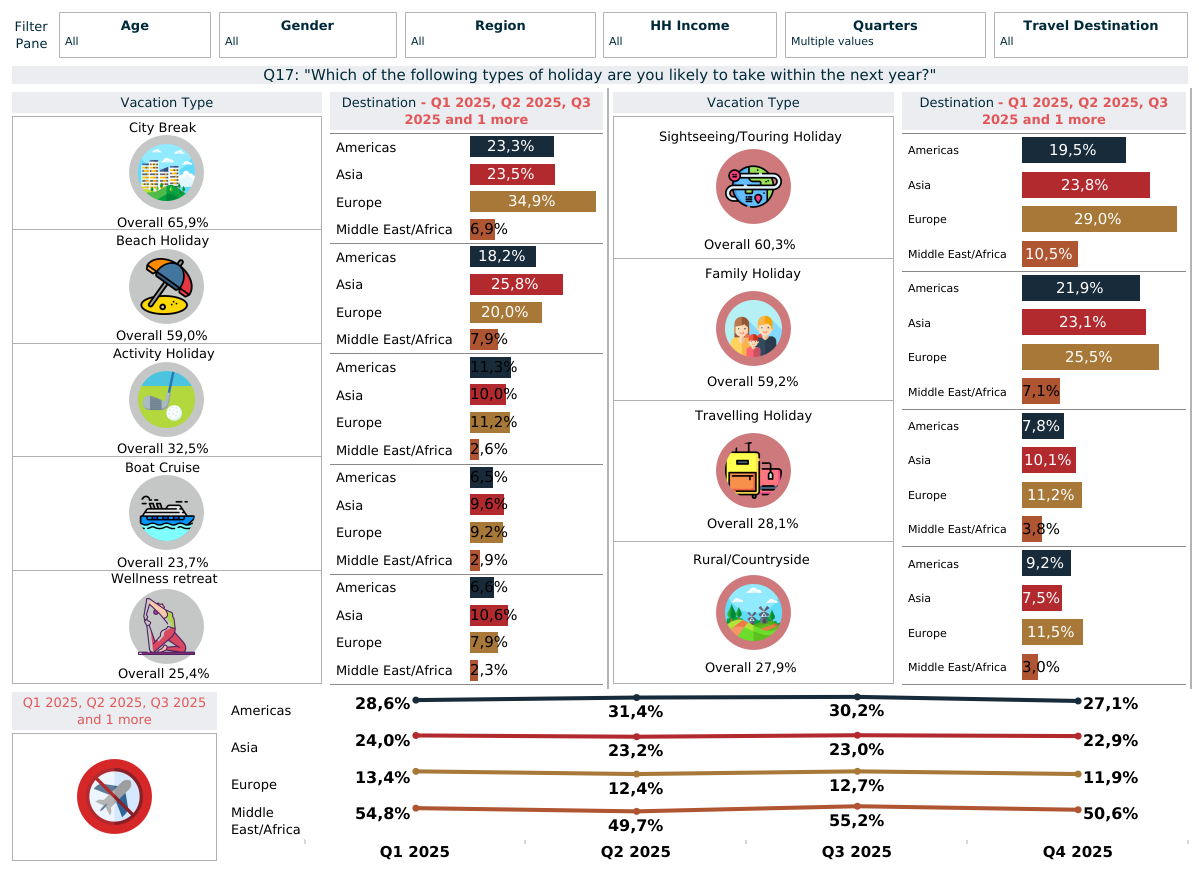

“Which of the following types of holiday are you likely to take within the next year?”

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantWhile many individuals continue to favour domestic trips, or going to countries closer to home, international holidays have firmly recovered from the post-Covid dip (see Section 1). Different holiday types see wide variance in popularity across the regions, with many now looking for hidden gems and lesser-known destinations off the beaten track.

Overall, city breaks are set to be the most popular type of holiday in 2026 (69%), rising to three quarters of under-40s. This is closely followed by sightseeing or tourist breaks (64%), beach holidays (61%) and family trips (60%). Multi-generational trips remain popular along with rural/countryside holidays such as glamping (30%), reflecting many wealthy travellers’ ongoing desire for privacy. Wellness retreats are also likely to retain their popularity as the wealthy look to improve their physical and mental health: 29% plan to visit one of these in the year ahead.

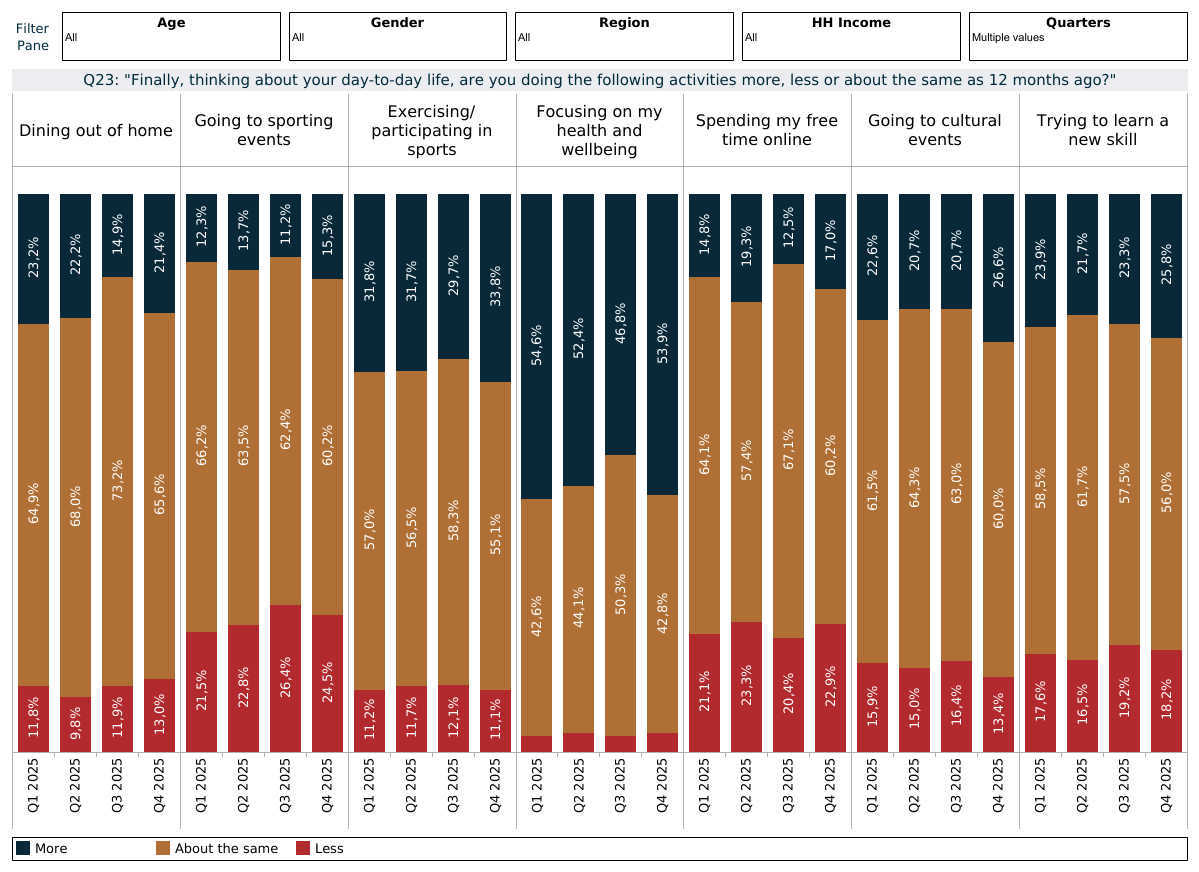

“Thinking about your day-to-day life, are you doing the following activities more, less or about the same as 12 months ago?

Base: 14,062 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThis last question was introduced at the start of 2025 to provide a better overview of respondents’ leisure time when they are not on holiday. There are signs of a growing return to in-person experiences, and a reduction of screen time. While 60% say that they are spending about the same amount of time online, 23% have reduced this vs 17% who are doing so more often. Europeans are the most likely to be cutting back on their screen time (30%), vs only 16% of Asian respondents.

Health is becoming an increasingly key component in their lives, with 43% focusing on their health and wellbeingabout as much as last year, while 54% are giving it greater importance. Specifically to sports and exercise participation, 55% are maintaining their levels of activity, while 34% are doing so more often. Finally, rising costs have not yet been a significant deterrence for dining out of home, going to sporting and cultural events. Just under two thirds are doing so about the same as a year ago, with around one in five doing so more often.

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.