LUXURY AUTOMOTIVE

VIEWS From THE WealthY CONSUMER

Release date: June 2022

The SAMPLE

This report updates purchasing trends and sentiments on luxury cars. The survey was completed by 100 respondents in each of the UK, US and China in April 2022, and was balanced 46:54 in terms of male:female and 55:45 for under-45s vs over-45s. When converted to USD, the sample had a high median HHI of almost $475,000.

BRAND AWARENESS & OWNERSHIP

Rolls-Royce is the most cited luxury automotive brand

Unlike other markets such as jewellery and watches, there is not one automotive brand which comfortably stands out for top-of-mind awareness. Rolls-Royce is the most cited brand overall (18%) but is closely followed by Bentley (14%) and Mercedes-Benz (12%). Various others also secured a reasonable number of mentions, while some other globally renowned brands such as Land/Range Rover did not gain enough mentions to make the list. Despite its high profile, Tesla only garnered 6% of total mentions, and only one single response in China.

Fig. 1 - “What is the first luxury brand which comes to mind when you think of a luxury car?” [most selected]

Base: 300 UK, US, China affluent/HNWIs Source: LuxuryOpinions/Altiant

Three quarters own one or two cars

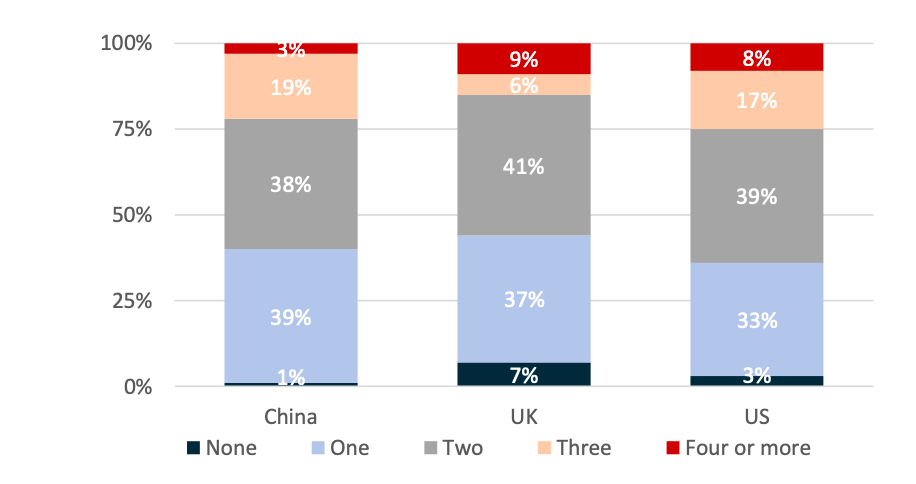

Fig. 2 “How many cars do you currently own?”

Base: 300 UK/US/China affluent and HNWIs Source: LuxuryOpinions/Altiant

Overall, driving remains something which the significant majority of our sample do, and 96% own at least one car. While around a third of each country’s respondents only own one car, many affluent/HNWIs have more than one. Around 40% of each country’s respondents own two cars, while Americans and the Chinese are most likely to have three or more.

In terms of car ownership, there is a logical correlation with awareness (see Fig. 1), with brands such as BMW, Mercedes-Benz and Porsche being the most owned. Brands such as Rolls-Royce and Bentley appear to be aspirational and enjoy high levels of awareness despite being currently owned by relatively few.

Americans and Chinese are the most likely to keep their cars for longer

Fig. 3 “How often do you change your car/the car which you drive most often?”

Very few drivers change their main car in under a year, or indeed under two years, with the Chinese the least likely to do so (8%). Instead, around half of drivers in each country say that they change their car every 2-4 years. At the top end, a third (34%) of Chinese and American (32%) drivers keep their car for four or more years, falling to just 20% of Brits. Women and over-45s are also a little more likely than men and under-45s to keep their car for longer than four years.

Base: 300 UK/US/China affluent and HNWIs. Source: LuxuryOpinions/Altiant

FUTURE INTENTIONS

Tesla is the brand which the wealthy are most likely to buy next

Fig. 4 “Which car brand do you think you will buy next?” [most selected]

Base: 300 UK/US/China affluent and HNWIs Source: LuxuryOpinions/Altiant

Despite only 6% listing Tesla as the luxury car brand which comes to mind first, it narrowly leads the list for planned car purchases. 12% of the sample think that their next car will be a Tesla, followed closely by Mercedes-Benz, Porsche and BMW. Conversely, the two brands with the highest top-of-mind awareness are only potential buys for a minority, a likely result on their relatively higher cost.

Affluent/HNWIs expect to drive a little more overall

Fig. 5 “Over the next 12 months, do you intend to drive more or less than you did over the past 12 months?”

Base: 300 UK/US/China affluent and HNWIs. Source: LuxuryOpinions/Altiant

One of the behavioural changes arising from the pandemic was that many people spent more of their time at home or in their local area. Lockdowns and an increasing propensity for working from home meant that car travel for many was reduced in 2021. As the world edges back towards normal, many have resumed their pre-pandemic habits and almost half (47%) of affluent/HNWIs expect to drive more in the year ahead. This is a little higher for under-45s than over-45s (52% vs 42%).

Rising fuel prices are often acknowledged by the wealthy (see Fig. 12), but these are less likely to cause a notable change in behaviour. Only around one in ten plan to cut back further on their car usage in the year ahead. The remaining 40-50% in each country do not expect to change how much they drive in the year ahead as they did over the past 12 months.

Chinese most likely to be big spenders on their next car

For this question, the banding across the three different currencies were approximately equal to enable a degree of comparison. Overall, the Chinese are the most likely of the three countries to spend in the top tier of more than RMB 825k/£100k/$125k, with a quarter doing so vs around 15% in the UK and US.

The Chinese are also considerably more likely than Brits and Americans to spend in the next price tier down, 38% doing so vs only 11% in the UK and 19% in the US. These relatively low numbers in the top tiers help to explain why so few affluent/HNWIs plan to buy ultra-luxury brands such as Rolls-Royce and Bentley as their next car. Brits and Americans are much more likely to spend between £25-80K/$35-100k, with just over half doing so in both countries. Perhaps as expected, very few affluent/HNWIs plan to buy from the bottom price tier, with none at all doing so in China.

Fig. 6-8 “How much do you plan to spend on your next car?”

Base: 100 China affluent and HNWIs. Source: LuxuryOpinions/Altiant

Base: 100 UK affluent and HNWIs. Source: LuxuryOpinions/Altiant

Base: 100 US affluent and HNWIs. Source: LuxuryOpinions/Altiant

Cash/card/bank transfer is the most popular way to buy a car

In all three countries, cash/card/bank transfer is the most popular way to buy a car. This rises from half in the UK and US to just over three quarters in China. At 27%, Americans are the most likely to use a loan/finance/hire purchase for their next car, and they are also equally the most likely (along with Brits) to lease a car at 21%. Meanwhile, Brits are the most likely of the three countries to buy using personal contract purchase, although only 13% would do so.

Fig. 9 “How would you purchase your next car?”

Base: 258 UK/US/China affluent and HNWI who plan to buy a car. Source: LuxuryOpinions/Altiant

The majority would use the internet to research their next purchase

In all three countries, the significant majority of potential car buyers would use the internet to research and buy their next car. Overall, only 5% say that they would be unlikely to do so. Almost two thirds of Brits and Americans say that they would be very likely to use the internet, but this appears to be something which will be applicable to most affluent/HNWIs globally.

Fig. 10 “How likely are you to use the internet to research and buy your next luxury car?”

Base: 258 UK/US/China affluent and HNWI who plan to buy a car. Source: LuxuryOpinions/Altiant

ELECTRIC & HYBRID VEHICLES

Chinese are most likely to already own an EV, and to plan to get one

Uptake of electric/hybrid cars is highest among Chinese and under-45s, with a third saying that they already own at least one of these vehicles. This is slightly lower in the UK/US and among over-45s, but still stands at a quarter of these groups. The Chinese (41%) and under-45s (32%) are also the most likely to be new owners and say that they will definitely get one of these vehicles within the next two years, compared to around one in five in the UK and US.

Instead, Brits and Americans are a little more conservative about their potential ownership, with two in five thinking it is possible that they will do so. Encouragingly for the market, only 14% of affluent/HNWIs currently have no interest in buying an electric/hybrid car within the next two years, rising to 18% of over-45s.

Fig. 11 “Which of the following options is the most relevant to you in relation to electric/hybrid cars?”

Base: 300 UK/US/China affluent and HNWIs. Source: LuxuryOpinions/Altiant

Environmental reasons are the primary motive for changing fuel source

Overall, almost three quarters (72%) of affluent/HNWIs say that protecting the environment is a reason why they would buy an electric/hybrid car. This garners a high response across the different demographics, albeit falling back a little in the US (67%). Environmental advantages are therefore likely to be an effective message for brands to use to attract new customers.

Despite their wealth, affluent/HNWIs are also cognizant of rising gas/petrol prices and looking to save money where possible. 45% of current or potential electric/hybrid owners say that saving on fuel would be a reason for switching to an electric/hybrid vehicle. While this drops to only 28% of Chinese, it rises to 61% in the US, suggesting that rising fuel prices is a more emotive issue to American drivers. Convenience-related attributes such as the ability to charge at home is a factor for 38% of drivers, while a number of others such as affordability, performance and driveability also apply to around a quarter of the sample.

Fig. 12 “What are the main reason(s) for you buying, or potentially buying an electric/hybrid car?”

Base: 250 UK/US/China affluent and HNWIs who own, or might own, an electric/hybrid vehicle. Source: LuxuryOpinions/Altiant

Perceived unreliability and charging logistics are the two main drawbacks

Among the 72% of affluent/HNWI drivers who have not already switched to electric or hybrid cars, there are two clear stand-out reasons: perceived range/unreliability for long-distance driving (62%) and unavailability of charging points (52%). Battery reliability is steadily improving as the technology evolves, while many governments are now looking to enhance the national infrastructure in attempts to wean drivers of petrol/gas vehicles. Indeed, the Chinese electric carmaker, Nio, operates workshops in countries such as Norway where drivers exchange their car batteries for charged ones in less than five minutes.

Fig. 13 “What are the main reasons why you have not purchased an electric/hybrid car before?” [by country]

Base: 209 UK/US/China affluent and HNWIs who do not currently own an electric/hybrid vehicle. Source: LuxuryOpinions/Altiant

Most of these factors show a stark variance between China and the UK/US, suggesting differing perceptions and/or levels of understanding in these countries. Concerns about range is a particularly strong barrier in China (71%) but falls back in the US (51%), whereas the opposite is true for a paucity of charging points which deters 59% of Americans and 45% of Chinese. The Chinese are also by far the least likely to see these vehicles as expensive to buy, but instead the most likely to think that battery replacement is expensive and that they are less fun to drive.

The British response falls between the two other countries on most metrics, but there are signs of an elevated deterrent when it comes to long-distance driving and vehicle cost. Among the ‘other’ factors cited by respondents were not liking the look of these cars, a perceived limited choice and availability, and being happy with their current car.

Under-45s deterred by perceived unreliability and driveability

Across the total sample, under-45s may also be deterred from buying into electric/hybrid vehicles by a higher perception for unreliability on long-distance trips and for fun of driving. Pleasure and fun are often prominently communicated in driving adverts and overcoming this hurdle could be key for electric/hybrid brands in winning over younger individuals. Meanwhile, older drivers are more likely to be deterred by more rational considerations such as charging point availability and the costs associated with these vehicles.

Fig. 14 “What are the main reasons why you have not purchased an electric/hybrid car before?” [by age]

Base: 209 UK/US/China affluent and HNWIs who do not currently own an electric/hybrid vehicle Source: LuxuryOpinions/Altiant

PREFERENCES IN CAR FEATURES

Most car features show a clear split in preference

For this question, we asked our respondents whether they had a preference between two broadly opposing features of cars. All of the options received a stated inclination by the majority, with fewer than a third saying they had no preference in each case. This shows how emotive cars can be for drivers and how they usually have clear preferences with regards to different features.

The least divisive factor relates to modern vs traditional features, with 68% preferring the former and only 16% the latter. A preference for modernity increases to 72% among under-45s and 77% among the Chinese but falls back to 59% of Brits. Another factor with a clear preference is that of leather seats vs sustainable alternatives to leather for seating. A number of brands are now exploring more environmentally-friendly materials but for now, most drivers still favour leather. Chinese drivers are again the most likely to do so (66%), with Brits the least likely (54%).

Three other factors receive more than half of respondents stating a preference: 58% prefer larger cars vs smaller ones (14%), 55% prefer comfort over style (32%), and 52% favour electric/hybrid power over petrol/gas (25%). In all three cases, affluent/HNW Chinese are the most likely to state these preferences, with under-45s also more likely than over-45s to favour larger cars and electric/hybrid vehicles. The other two features: speed vs fuel efficiency and smaller vs larger brands see a fairly equal split between the two variables.

Fig. 15 “From each of the following options, select which you have more of a preference for when it comes to luxury cars.”

Base: 289 UK/US/China affluent and HNWIs who own car(s). Source: LuxuryOpinions/Altiant

ABOUT ALTIANT

Altiant is a specialised fieldwork company which enables large scale, global research among affluent consumers/High Net Worth Individuals (HNWIs) in 15+ countries worldwide.

For more information on this study or any other research requirements, please contact us at reports@altiant.com.

By servicing dozens of the world’s top luxury and wealth brands, Altiant helps renowned brands and their research agencies to answer critical questions among this very hard-to-reach demographic. We ensure that all of our survey respondents are genuinely affluent by having their identities verified and wealth levels validated.

Altiant is a corporate member of ESOMAR, the World’s leading association for standards & Ethics within market research. Altiant adheres to, and abids by their strict guidelines governing the best practice in the industry.

To view the data set in full, or speak to us about any of your luxury research requirements, please email us at contact@altiant.com

Contributors

Chris Wisson, Knowledge Director

Ivan Murtov, Senior Project Manager

Contact

reports@altiant.com

media@altiant.com

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.