beauty and personal care

views from affluent & hIGH net worth individuals in US, UK, FRANCE and china

Beauty Segments - Luxury Purchases - Beauty Habits - Spending Trends - Key Purchasing Factors - Beauty Inspirations - Cosmetic Surgery - Quotes from affluent/HNWIs

Release date: July 2024

introduction

Discover the latest trends in beauty and personal care with our exclusive study, focusing on cosmetics and fragrances. Completed in July 2024, this comprehensive survey was conducted among Affluent and high-net-worth clienteles in four countries (UK, US, France and China).

Gain insights into how Affluent/HNW engage with the beauty sector, including their preferences for cosmetic surgery and procedures. Uncover the most common purchasing methods and average spending on luxury beauty products. Our in-depth analysis also reveals the most critical factors influencing luxury purchases and the primary sources of beauty inspiration.

the sample

The sample was balanced 52:48 female: male. In age terms, 41% were aged 18-34, 24% between 35 and 44, and the remaining 35% over the age of 45. When converted to $, the sample had a median household income of over $425k and investible assets of just under $1m.

Dive into this detailed report to understand the evolving landscape of beauty and personal care among the world’s most affluent individuals. This is part of our ongoing series of short category reports which are intended to provide an up-to-date snapshot on some of the key trends in luxury and wealth.

KEY TAKEAWAYS

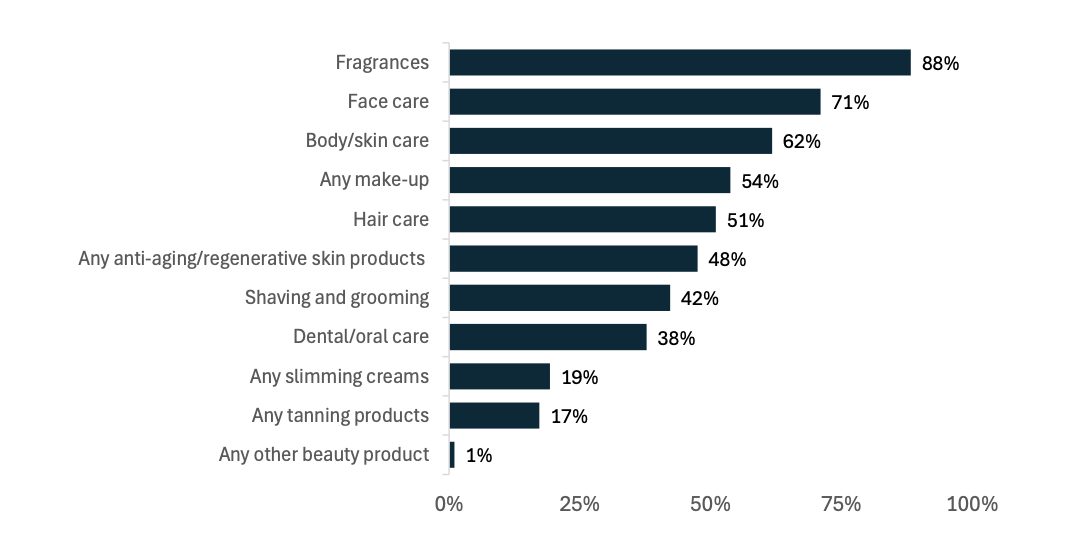

88% bought a luxury fragrance within the past year, with similar popularity by gender. Face care follows close behind, with purchases driven by women (86% vs 54% of men).

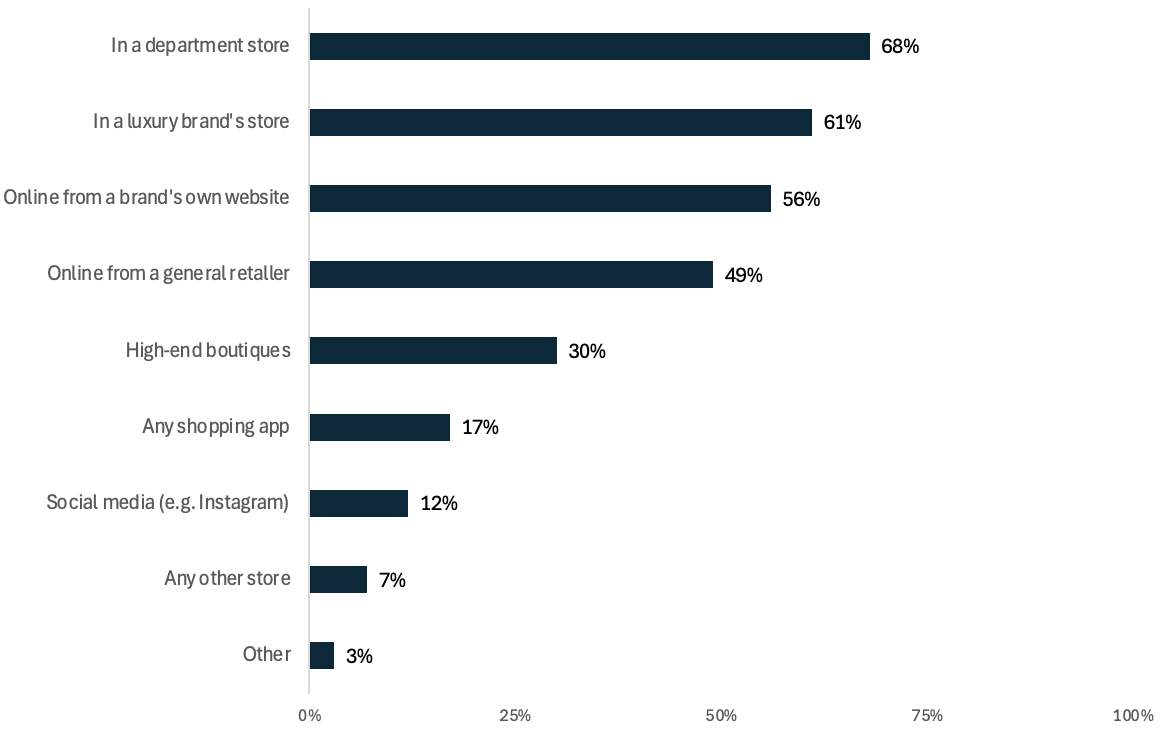

Two thirds (68%) have made luxury beauty purchases in department stores.

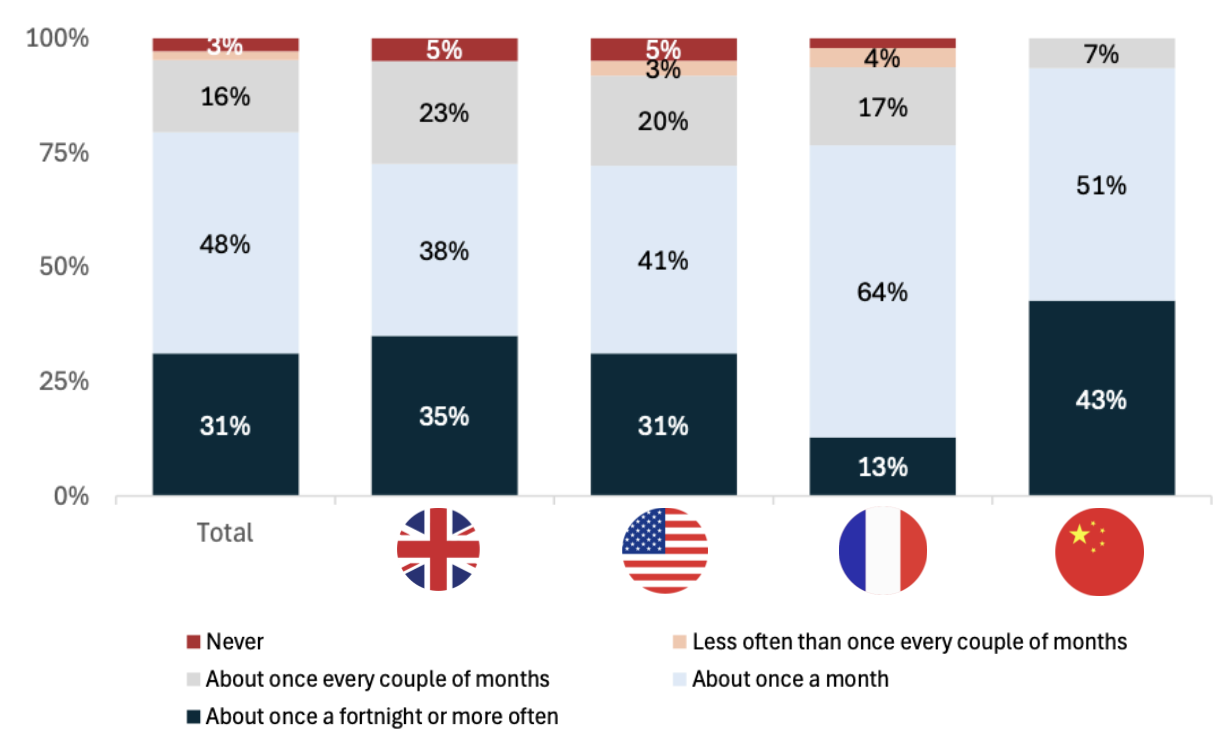

Almost one-third (31%) of affluent/HNW females visit a beauty salon at least once a fortnight.

41% of affluent/HNW females say that they spend more than the equivalent of $650 on luxury cosmetics within a typical three-month period (vs 21% of males).

89% say that when buying luxury cosmetics and fragrances, the use of premium ingredients is either very important or essential to them. Advanced formulas and technology and natural/organic ingredients are the other most important factors.

BEAUTY SEGMENTS

Affluent/HNWIs are strongly engaged with the beauty category

Cosmetics and fragrances are highly popular with the global affluent/HNW population, with all respondents buying at least one type of luxury product within the category. Overall, fragrances such as aftershave or perfume are the most widely purchased product type, 88% buying a luxury fragrance within the past year.

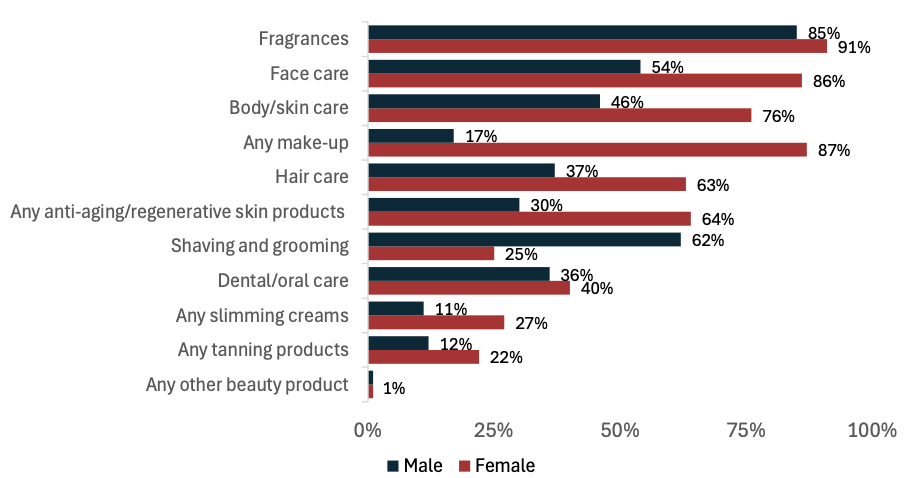

Facial care products such as luxury cleansers/toners, serums and moisturisers follow a short way back, purchased by 71% and rising to 90% in China. In a similar field, anti-aging products (which are often facial) were purchased by almost half. While purchases of these products are heavily skewed towards females (86% and 64% respectively), many men also bought them: more than half purchased luxury facial care products and 30% did so for anti-aging, showing the growing popularity of cosmetics for men. Body/skin care is also more likely to be purchased by affluent HNW females, albeit with a significant share of males again doing so (76% vs 46%).

Similarly, make-up and hair care purchases are also heavily driven by women (87% and 63% respectively). However, recent years have seen growing numbers of brands producing male-oriented hair products and cosmetics such as foundations and nail varnishes. 17% of affluent/HNW males purchased a luxury make-up product, a figure which is likely to continue edging upwards in the coming years. Conversely, shaving purchases were heavily driven by men (62% vs 25% of women).

“Within the past year, which of the following items have you purchased a luxury product of?”

Figure 1: Luxury Purchases in the Past Year

Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

Figure 2: Luxury Purchases in the Past Year, by gender

Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

LUXURY PURCHASES

Department stores lead the way for purchases

For all of the defined locations, women are more likely than men to have made purchases, reflecting their higher category engagement. Overall, department stores (68%) are the most popular place for luxury beauty purchases, rising to three-quarters among Brits and females. Brits are otherwise less likely than average to buy luxury cosmetics from many of the other locations, showing the importance of department stores for the category’s success within the UK.

Department stores are also only one of two locations (the other being high-end boutiques) which see a higher share of purchases coming from over-45s than under-45s (70% vs 66%). Almost two-thirds (61%) purchased from luxury brands’ own stores, with Chinese respondents the most likely to do so (75%). Affluent/HNW Chinese also show a particular fondness for high-end boutiques – 49% vs 30% overall.

The third most popular location overall – buying online from brands’ own websites (56%) – sees another country leading the way. This time, the US is the most likely of the four countries at 68%, falling back to just 45% in France. The French response typically falls around or slightly behind the average for most of the locations. At just under half (49%), online general retailers are the other most popular purchasing venue. Other online apps/platforms such as social media are rather peripheral, with only around one in ten using these avenues for luxury cosmetic purchases.

“Where did you purchase these luxury cosmetic products from?”

Figure 3: Purchasing habits

Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

BEAUTY HABITS

Beauty salons such as nail bars continue to thrive

Beauty salons remain a popular part of many shopping districts, with 97% of females using them. Nail bars are one of the most popular outlet types, with the segment enjoying a further boost in visibility during the 2024 Paris Olympics as many athletes wore eye-catching nail designs. Almost one-third of our affluent/HNW response say that they use them at least once a fortnight, rising to 43% in China but falling back to just 13% in France.

Instead, French females are more likely to do so a little less frequently at around once a month; 64% vs 48% overall. Chinese females are again more likely than average to visit salons on a monthly basis. Indeed, only 7% use them less often than this and none say that they never use them. Around one-quarter of affluent/HNW Brits, Americans and French say that they use them about once every couple of months or less often.

“How often did you typically visit a beauty salon (e.g. nail bar) within the past year?”

Figure 4: Frequency of Beauty Salon Visits in the Past Year

Base: 209 UK/US/France/China affluent/HNWI females Source: LuxuryOpinions®/Altiant

SPENDING TRENDS

Affluent/HNW spending in likely to be highest in China

Within a typical three-month period, almost one-third (31%) say that they spend more than the equivalent of $650 on luxury cosmetics. This figure is heavily driven upwards by China, where 58% do so. Women are also twice as likely as men to spend heavily on cosmetics (42% vs 21%), while there is no major variance based on age.

In each of the four countries, around one-third say that they spend between $326 and $650 on luxury cosmetics. A similar share say that they spend between $126 and $325 in France, UK and US, while this figure drops to just 7% in China, with many affluent/HNWIs here falling into the higher spending tiers. One-in-ten say that they spend under $125 across a typical three-month period, while only 4% do not spend anything.

“How much do you spend on luxury cosmetics within a typical three-month period?”

Figure 5: Quarterly Spending on Luxury Cosmetics

* All countries’ spending normalised to USD $ -Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

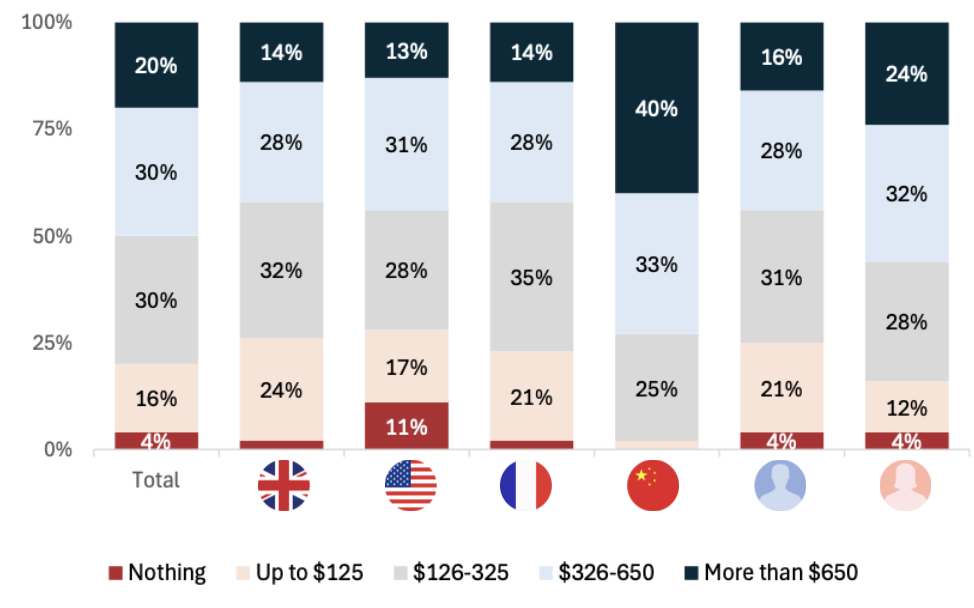

The situation is similar when it comes to spending on luxury fragrances, with China again far above the other three markets. Overall, spending on fragrances is a little lower than cosmetics: 20% spend over $650 in a typical three-month period, rising to 40% in China. In all four countries, around 30% spend in both the $126-325 and $326-650 price tiers. As with cosmetics, just over one in ten (16%) spend under $125 over this period, while 4% spend nothing at all.

“How much do you spend on luxury fragrances within a typical three-month period?”

Figure. 6: Quarterly Spending on Luxury Fragrances

* All countries’ spending normalised to USD $ -Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

KEY PURCHASING FACTORS

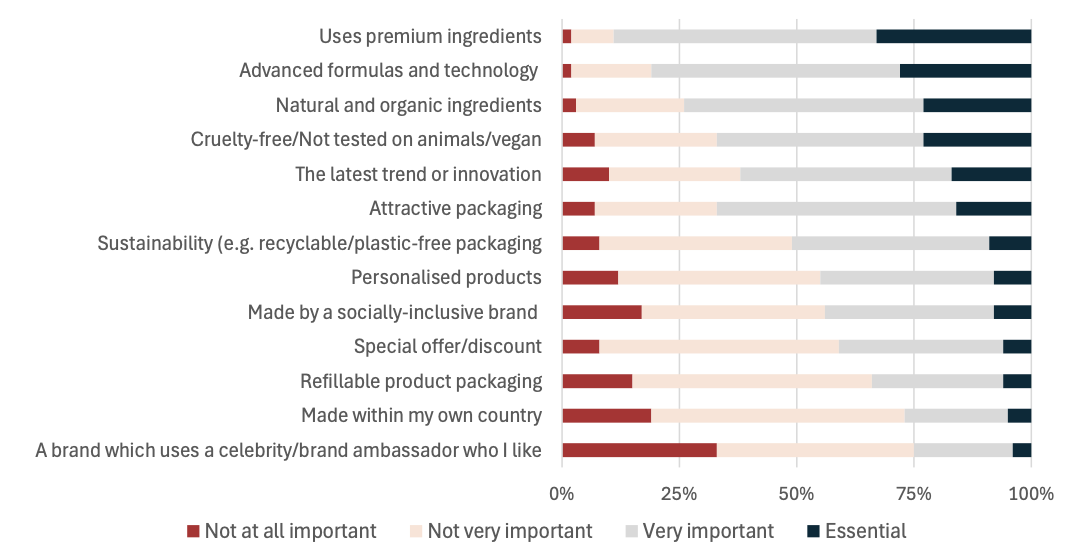

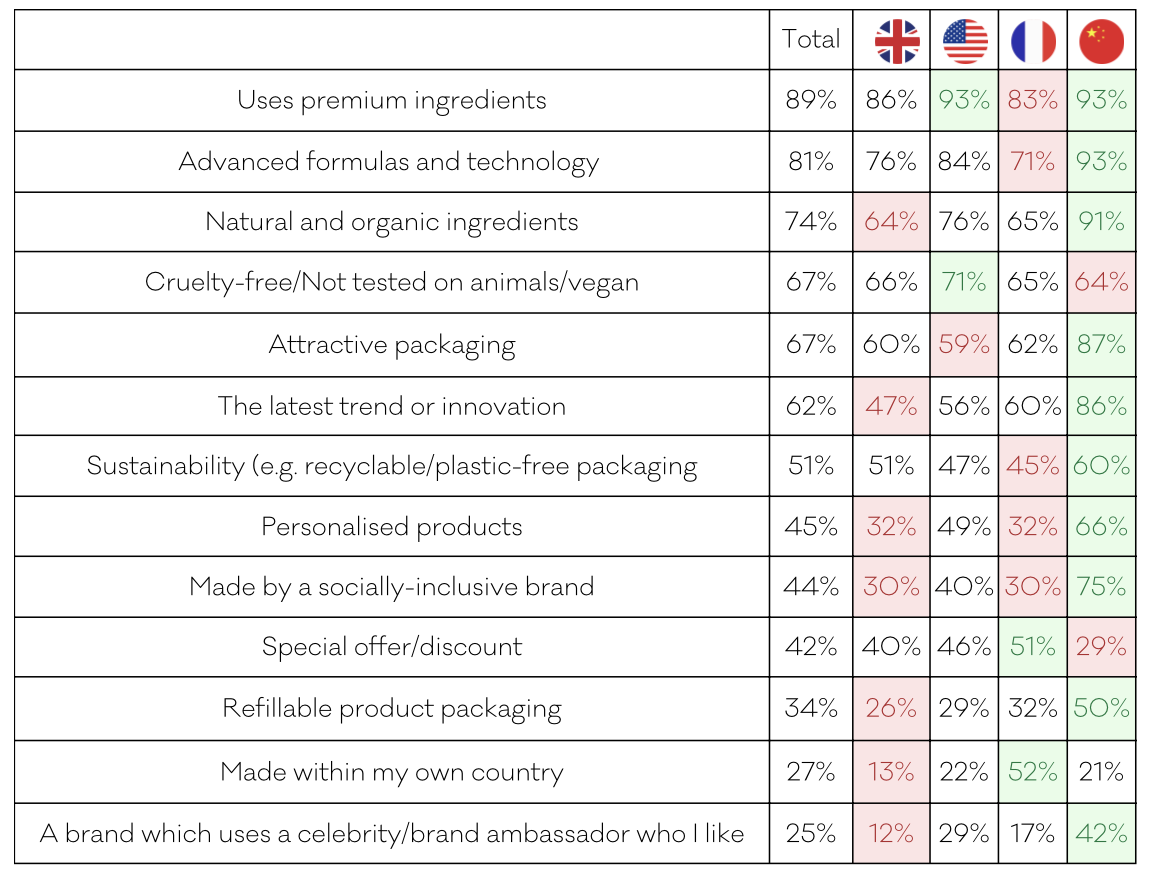

Premium ingredients are the most important factor for luxury purchases

When buying luxury cosmetics and fragrances, the use of premium ingredients is the most important factor overall: 89% say that this is either very important or essential to them. Natural/organic ingredients follows close behind in third place, with three-quarters answering in the top-2 boxes.

In between these two factors, 81% say that the use of advanced formulas and technology is very important/essential, with women and under-35s more likely to prioritise this element. Indeed, these two groups along with those from China are the most likely groups to deem most of these factors as very important or essential purchase considerations.

Cruelty-free/not tested on animals is another priority for many luxury beauty buyers, with two-thirds stating this is very important/essential to their decision (rising to 75% of women). Attractive packaging, the latest trend/innovation and sustainability credentials are the three other factors with more than half of their scores falling into the top-2 boxes.

“How important are the following factors when buying luxury fragrance and cosmetic products?”

Figure 7: Important Factors in Purchasing

Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

“How important are the following factors when buying luxury fragrance and cosmetic products?” [top 2 boxes net – very important/essential]

Figure 8: Important Factors in Purchasing

Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

Perhaps as expected given their wealth, special offers/discounts are somewhat less important for affluent shoppers. Just over two-in-five (42%) score this factor within the top-2 boxes. It is one of the few factors which resonates much less than average among the Chinese response, with only 29% deeming it an influential factor. The only other factor which scores notably less than average in China is for products made within their own country, showing their widespread preference for international brands.

Overall, Brits appear the most resistant to being influenced by the different factors and are not the highest scoring country on any metrics. Conversely, they are the lowest for several, falling far behind the pack for the latest trend or innovation, products made within the UK and those which use celebrities/brand ambassadors.

BEAUTY INSPIRATIONS

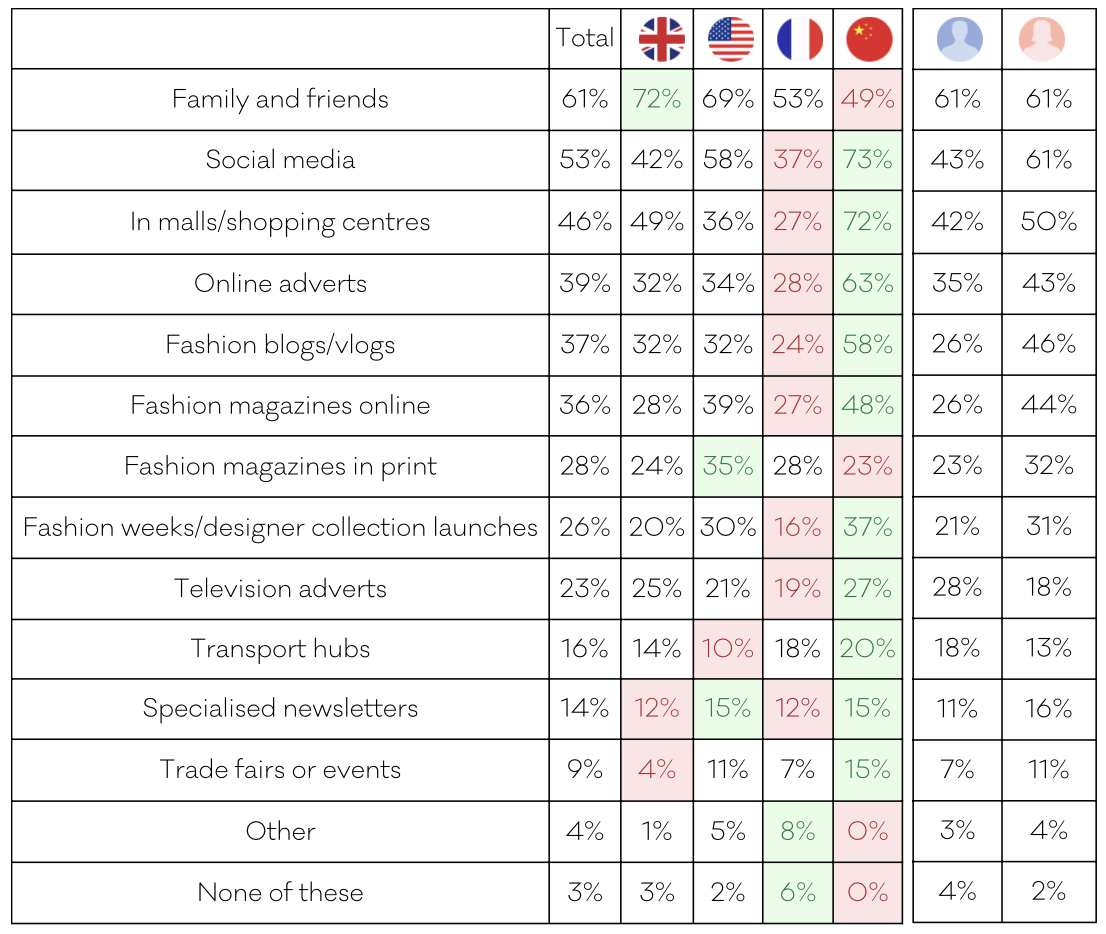

Family and friends are key for beauty inspiration

Across the total sample, affluent/HNWIs are most likely to cite family/friends as their main source of inspiration for beauty and cosmetics. However, this total score hides a notable amount of regional variance, with British and Americans particularly likely to cite this, but French and Chinese much less likely to do so. The French are the least likely of the four markets to be inspired by most of these factors, while the Chinese are most likely, often significantly so.

Social media comes in in second place overall, with sites such as YouTube, Instagram and TikTok proving popular for make-up tutorials and unboxing/product reviews. This is especially true for under-35s: indeed, at 66% this age group is most likely to get its inspiration from social media (falling to 43% among over-35s).

Online adverts (39%), blogs/vlogs (37%) and digital fashion magazines (36%) can also inspire many affluent/HNWIs while they are online. Nevertheless, there is also space for more traditional mediums such as mall advertising (46%) and printed media (28%). Many brands continue to utilise television adverts, although these are becoming a little more peripheral and only inspire one-quarter of the sample.

“Where do you get inspiration for beauty and cosmetics?”

Figure 9: Sources of Inspiration

Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

COSMETIC SURGERY

Widespread openness to having cosmetic surgery in the future

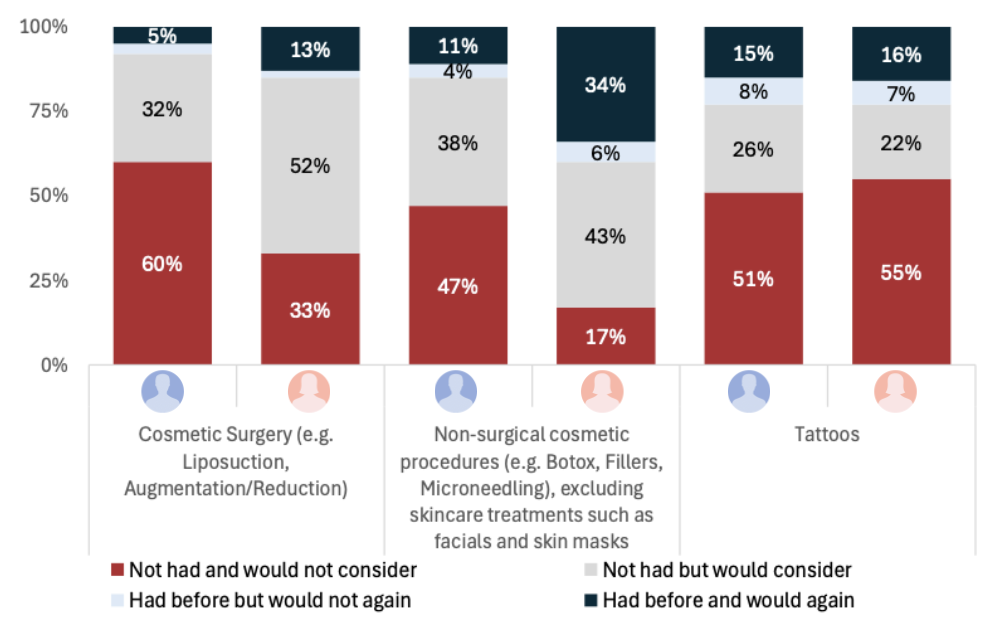

While relatively few affluent/HNWIs have previously had cosmetic surgery and procedures, there is widespread interest in having them. Specifically to cosmetic procedures, 11% have had them so far and rising to 19% in France, with most willing to do so again. A significant 43% say that they have not had one of these surgeries to date but would be willing to do so. This rises to 46% among over-45s, 51% in the US and 52% among females. The remaining 46% of the sample are opposed to ever having any personal cosmetic surgery, peaking in China (52%) and among males (59%).

Non-surgical procedures such as Botox or fillers are more popular, with 28% having already had them and with most willing to do so again. While only 19% of affluent/HNW Brits have had these, the number rises to one-third in the US and 37% in China. Women are also considerably more likely to have had these treatments (40%), although 15% of men have also done so. As with cosmetic surgery, two-in-five have never had them but are open to doing so. However, this time only 31% are not interested in having these treatments at any time in the future.

Finally, tattoos are reasonably commonplace among the sample. Almost one-quarter have previously had at least one, with another quarter open to having them in the future. Affluent/HNW French and Chinese are comfortably the least likely to have had been tattooed at only 16%, half the level of Brits and Americans. Overall, just over half say that they would never have one, peaking at 60% in France and 62% among over-35s.

“Which of the following is the most applicable to you regarding cosmetic surgery and tattoos?”

Figure 10: Perspectives on Cosmetic Surgery and Tattoos

Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

QUOTES FROM AFFLUENT/HNWIs

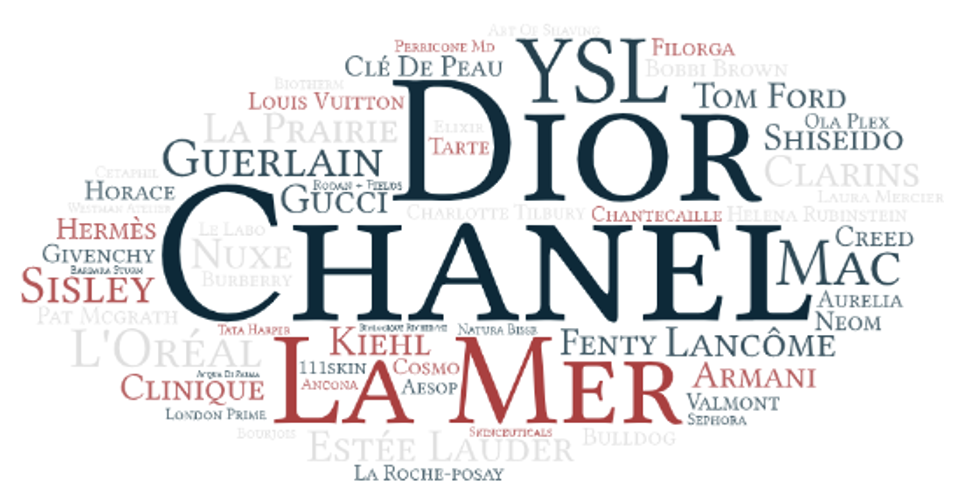

Chanel and Dior lead the way for spontaneous awareness

When asked which brands first come to mind when thinking about luxury cosmetics, 75 different brands were cited by the sample. Overall, Chanel and Dior were cited most often, with La Mer, YSL and Estée Lauder trailing further back. Chinese respondents were much more likely to cite a number of brands, including La Mer, Helena Rubinstein and Estée Lauder.

“What are the first brands which come to mind when you think of luxury cosmetics?”

Figure 11: Luxury cosmetics’ brands

Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

Chanel and Dior were even more dominant for luxury fragrances, with the former particularly popular among the Chinese response. A handful of other brands – Hermès, YSL, Tom Ford, Gucci, Creed and Guerlain – all garnered a similar number of mentions overall, albeit considerably fewer than the two leaders. There was also some regional variance here, for example Guerlain and YSL were most cited in France, while Creed received nearly all of its mentions from the UK and US.

“What are the first brands which come to mind when you think of luxury fragrances?”

Figure 12: Luxury fragrances’ brands

Base: 400 UK/US/France/China affluent/HNWIs Source: LuxuryOpinions®/Altiant

We also asked our respondents if they were loyal to any particular beauty brands. A selection of answers to this question are shown below:

This is part of our ongoing series of short category reports which are intended to provide an up-to-date snapshot on some of the key trends in luxury and wealth.

Contributors

Chris Wisson, Knowledge Director

Chiara Casale, Marketing & Partnership Manager

Violeta Manolova, Project Manager

Contact

reports@altiant.com

ABOUT ALTIANT

Altiant is a specialised fieldwork company which enables large scale, global research among affluent consumers/High Net Worth Individuals (HNWIs) in 15+ countries worldwide.

By servicing dozens of the world’s top luxury and wealth brands, Altiant helps renowned brands and their research agencies to answer critical questions among this very hard-to-reach demographic. We ensure that all of our survey respondents are genuinely affluent by having their identities verified and wealth levels validated.

Altiant is a corporate member of ESOMAR, the World’s leading association for standards & Ethics within market research. Altiant adheres to, and abids by their strict guidelines governing the best practice in the industry.

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.