FINE JEWELLERY

VIEWS From THE WealthY CONSUMER

Survey Background

This snapshot report is part of Altiant’s Category Surveys, short questionnaires submitted to our in-house panel of Affluent and High Net Worth Individuals, LuxuryOpinions®. This version explores the Luxury Jewellery Market. The aim was to assess our panel’s sentiments and interactions with the luxury jewellery market and its associated brands.

The quantitative online survey for this report was carried out during December 2018-January 2019, and interviewed 1,138 members from various countries across our online affluent community (32% Asia/35% Europe/33% North America). 40% of this sample was aged 18-39, while 60% was aged 40+. The gender split was 53:47% male:female. Normalised to $US, the median household income across this total sample was $248,000.

Please note that any overarching references to affluent/HNWIs (eg ’30% of global affluent/HNWIs wear fine jewellery every day’) refer specifically to those surveyed in this report. Comprehensive data broken out and charted by region is available on request.

Key Findings

Usage: Jewellery is a popular category, with 82% of affluent/HNWIs buying fine jewellery within the past year. Rings and earrings are the most popular categories, purchased by 44% and 43% respectively. Around 80% of affluents/HNWIs expect to buy fine jewellery within the next year.

Brand Awareness: Cartier and Tiffany are comfortably the most likely jewellery brands to be mentioned for top-of-mind awareness, cited by 30% and 21% of our respondents.

Sustainability: Sustainable/ethical jewellery is important to more than three quarters of affluent/HNWIs, with 17% prepared to spend more than 15% extra for these types of products. 43% of the sample are interested in man-made diamonds.

UTILISATION & PURCHASE BEHAVIOURS

AMERICANS ARE THE MOST LIKELY TO BE JEWELLERY LOVERS

“Which of the following items of fine jewellery have you purchased within the past 12 months?”

Base: 1,138 global affluent/HNWIs - Source: LuxuryOpinions/Altiant

Jewellery is a popular category, with 82% of affluent/HNWIs buying fine jewellery within the past year. North Americans appear to be the main jewellery enthusiasts, being the most likely to purchase all of the fine jewellery types over the period. Women and under-40s are also significantly more likely than men and over-40s to be active fine jewellery buyers.

Rings and earrings are the most popular categories, purchased by 44% and 43% respectively, falling behind this average among Asians. Necklaces/chokers and bracelets were both purchased by 35% of affluent/HNWIs last year, rising to almost half in North America.

2/3 EXPECT TO PURCHASE FINE JEWELLERY WITHIN THE NEXT 12 MONTHS

“How likely are you to purchase fine jewellery within the next 12 months?”

Base: 1,138 global affluent/HNWIs - Source: LuxuryOpinions/Altiant

Around 80% of affluents/HNWIs expect to be active fine jewellery buyers within the next year. The share of buyers for personal jewellery purchases and for others is broadly equal.

Almost two thirds say that they are either very likely or likely to buy for themselves and/or others (63% and 65% respectively). North Americans are the most likely buyers in both cases, underlining their high degree of enthusiasm and engagement towards fine jewellery.

Under-40s and women are significantly more likely than over-40s and men to say that they will ‘very likely’ purchase fine jewellery within the next 12 months (40% and 43% respectively).

Just under one in five describe their purchase intention as neutral, indicating that they could be converted into active buyers, for example by an eye-catching piece or a special offer.

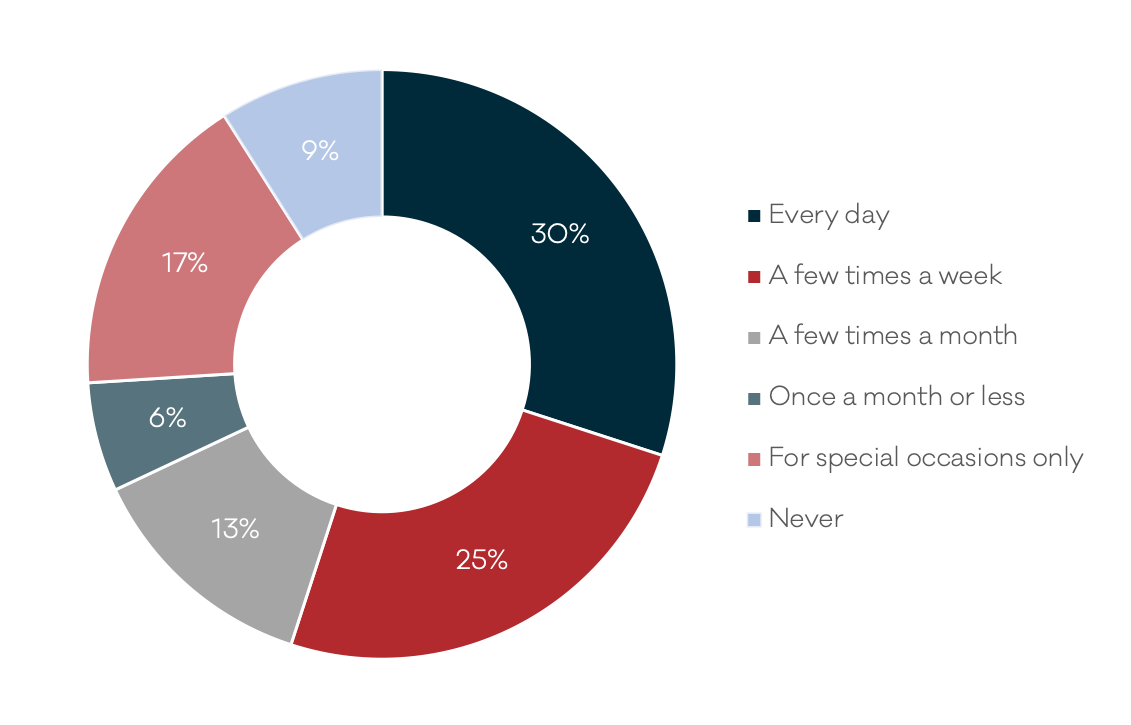

30% OF GLOBAL AFFLUENT/HNWIs WEAR FINE JEWELLERY EVERY DAY

“How often do you wear items of fine jewellery? Select the most appropriate option.”

Jewellery is a central part of many affluent/HNWIs’ lives, with 30% wearing a fine jewellery item such as a ring or earrings every day. This figure rises to 40% among women and North Americans marking these groups out as key for the market. Only 16% of Asians wear fine jewellery every day.

Meanwhile, a quarter of our respondents wear fine jewellery a few times a week, with women and North Americans again the most likely to show this high level of engagement with the category.

Men are more likely to wear fine jewellery sporadically, or even rarely, as well as being much more likely than women to wear it only for special occasions (21% vs 12%). Only 9% say that they never wear items of fine jewellery.

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

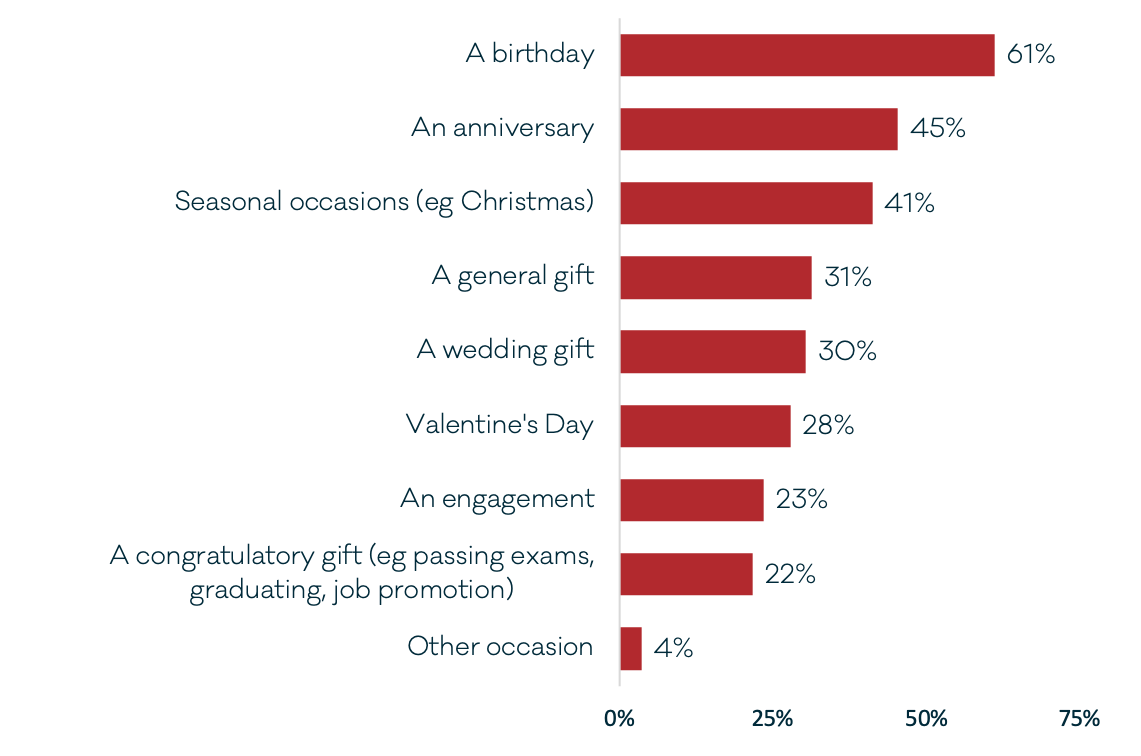

BIRTHDAYS ARE THE MOST POPULAR OCCASION FOR PURCHASING FINE JEWELLERY

“For which of the following occasions have you previously purchased fine jewellery as a gift for someone else? Select all that apply.”

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

Birthdays represent the key occasion for jewellery purchases, with 61% of our respondents having done so previously. Other celebratory occasions such as anniversaries and seasonal events such as Christmas have also seen over two in five of our respondents buy fine jewellery as a gift.

The association of diamonds with love appears to be reasonably strong still, with 30% buying fine jewellery as a wedding gift and 28% for Valentine’s Day, the latter being particularly popular among under-40s and North Americans.

However, only 23% say they have purchased fine jewellery as an engagement gift previously, suggesting that alternative gift types are popular. That under-40s are also most likely to have done so for this occasion suggests that the new generation of jewellery buyers are in fact rather traditional in this case.

THREE IN FIVE BUY FINE JEWELLERY WITH A PARTNER…

“When purchasing fine jewellery, who do you shop with? Select all that apply.”

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

Affluent/HNWI shoppers are most likely to buy fine jewellery with their partner (61%) or alone (44%). While all regions are equally likely to shop for jewellery with a partner, there are clear regional differences when shopping alone; peaking among North Americans 55% and falling to just 36% among Asians.

A family member and friends are cited by 22% and 21% respectively of our affluent sample, with Europeans the least likely region to do so in both cases.

Creating comfortable relaxing spaces and refreshments are important for jewellery stores to make the shopping visit pleasurable for the shopper, but also those shopping with them.

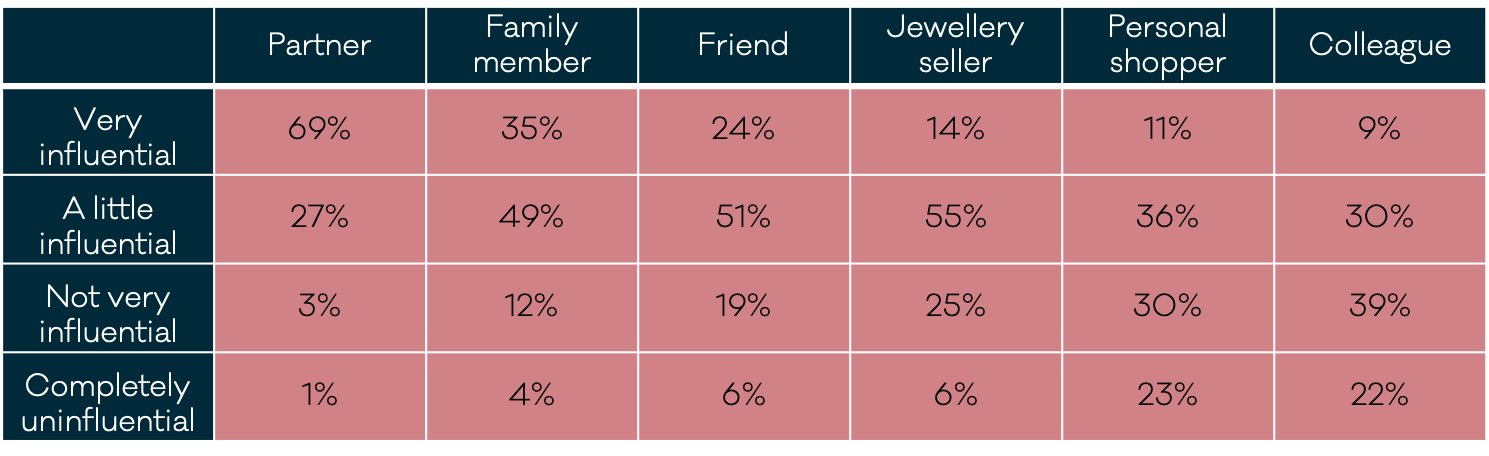

…AND PARTNERS ARE THE MOST INFLUENTIAL PEOPLE OVER PURCHASES

“Thinking about the sum total of your credit limits across all cards, what would estimate it to be?” / “Do you typically tend to pay off your credit balance in full each month? Please select the most appropriate option.”

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

Partners are the most influential people for jewellery buyers when buying fine jewellery with others, 69% saying that their partners are very influential. This rises to 76% among male buyers, indicating that many women often have some input into what their partners buy.

Family members and friends are also influential over jewellery purchases, albeit to a slightly lesser degree than partners (84% and 75% respectively). Jewellery sellers are also influential for 69% of jewellery buyers, underlining the importance of in-store service and care.

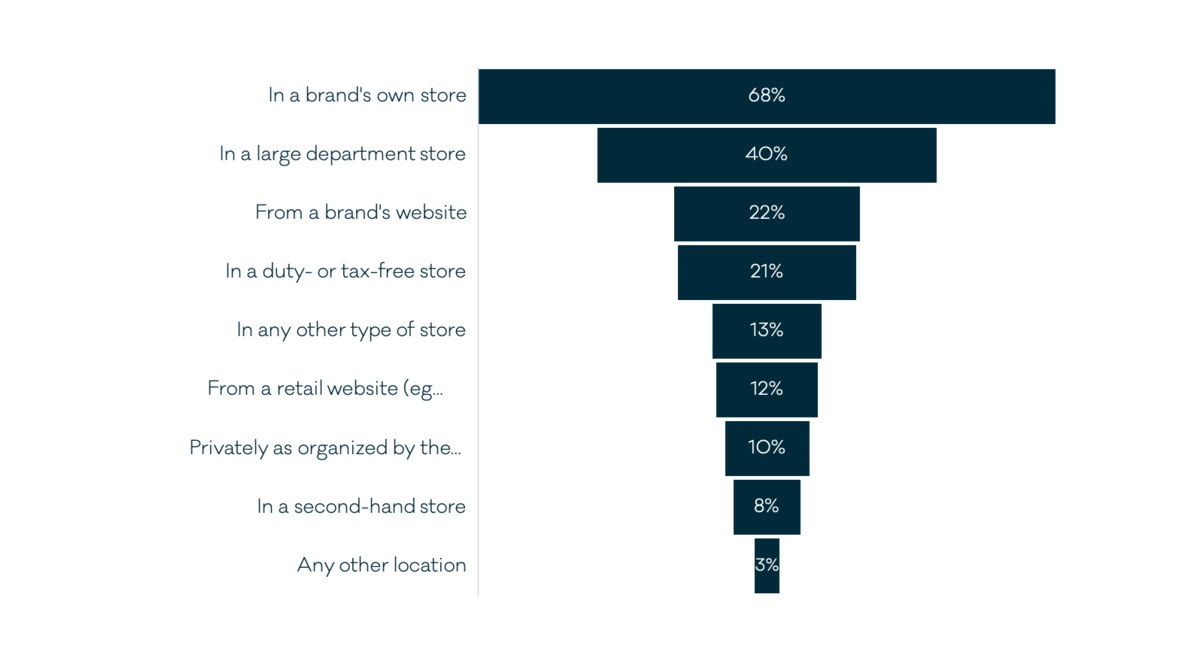

STORES REMAIN KEY FOR JEWELLERY BRANDS

“In which of the following locations have you purchased fine jewellery within the past 12 months? Select all that apply.”

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

Branded stores are the most popular place to purchase fine jewellery, with 68% of category buyers having done so within the past 12 months, rising to 78% among North Americans.

Large department stores are the next most popular location (40%), with 21% having purchased from duty/tax-free stores. With many affluent/HNWIs travelling regularly, duty-free stores represent a lucrative route to market.

Online sales are also important for the luxury jewellery market, with 22% of fine jewellery buyers buying from a brand’s website. 18-39s (28%) and North Americans (33%) are the most likely to buy via branded websites. 12% buy from retail websites such as Amazon.

BRAND AWARENESS & PERCEPTION

CARTIER AND TIFFANY DOMINATE TOP-OF-MIND AWARENESS AMONG JEWELLERY BRANDS

“When thinking about fine or luxury jewellery, which is the first brand that comes to mind?”

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

A wide variety of jewellery brands were mentioned for top-of-mind awareness among our panellists, reflecting the high number of operators in the market. This fragmentation is also shown in the fact that 22% of respondents mentioned a brand which garnered fewer than 10 responses overall.

However, two brands comfortably stand out for being the most likely to be mentioned: Cartier (30%), and Tiffany (21%). That the next most likely to be mentioned is Bulgari at only 5% shows the dominant brand awareness which Cartier and Tiffany have been able to forge.

CARTIER IS SEEN AS THE BEST QUALITY JEWELLERY BRAND OF THE FIVE SELECTED

“Which of the following characteristics describes how you view the following brands? Select all applicable characteristics for each brand.”

Brand awareness is reasonably high across the five brands, almost reaching 100% for Cartier and Tiffany. Graff appears to have work to do to boost its name among this potential client base, known by only 58%.

It is unsurprising that the brands with the highest awareness scores (see previous slide) also fare well for brand perceptions. Cartier and Tiffany significantly lead the way when it comes to being timeless, iconic and worth paying more for. Tiffany also stands out for being perceived as particularly cool.

As expected, all five brands secure their highest scores for quality, with Cartier again leading the way (63%). However, all brands could be doing more ethically, with all five scoring less than 10% on this metric.

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

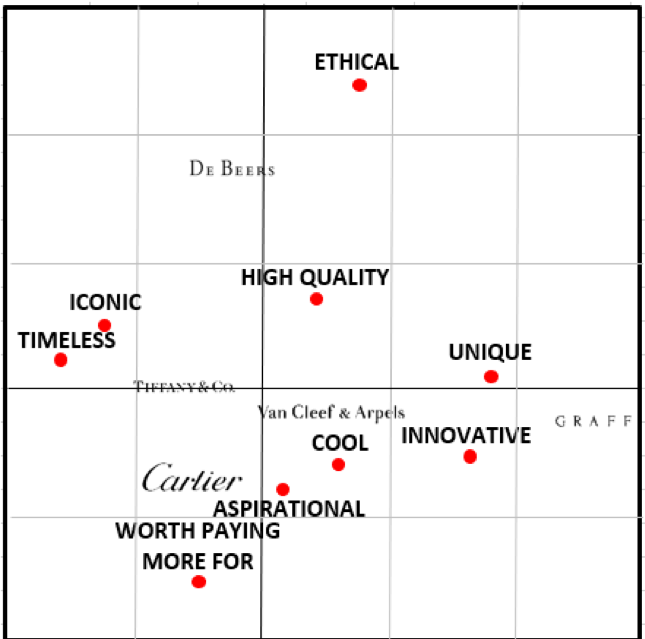

TIFFANY STANDS APART FROM THE OTHER SELECTED JEWELLERY BRANDS

“Which of the following characteristics describes how you view the following brands? Select all applicable characteristics for each brand.”

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

When this data is transferred into a correspondence map, Tiffany holds the desirable position of standing out from other direct competitors. The brand’s focus on personlisation and bespoke items appear to resonate with our panel, helping Tiffany to forge and iconic and cool image which is particularly popular among our North American respondents.

Cartier is also perceived particularly favourably among North Americans, with over-40s also most likely to see the brand as high quality. Indeed, Americans are significantly more likely than European and Asian respondents to view jewellery brands favourably on various metrics.

Graff’s position as relatively independent of the Cartier-De Beers-Van Cleef cluster owes largely to its comparatively low awareness score, which drives fewer strong brand associations.

SIGNIFICANT REGIONAL VARIATIONS EMERGE IN TERMS OF BRAND PERCEPTIONS

“Which of the following characteristics describes how you view the following brands? Select all applicable characteristics for each brand.”

EUROPE

ASIA

NORTH AMERICA

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

Sustainability & FINE JEWELLERY

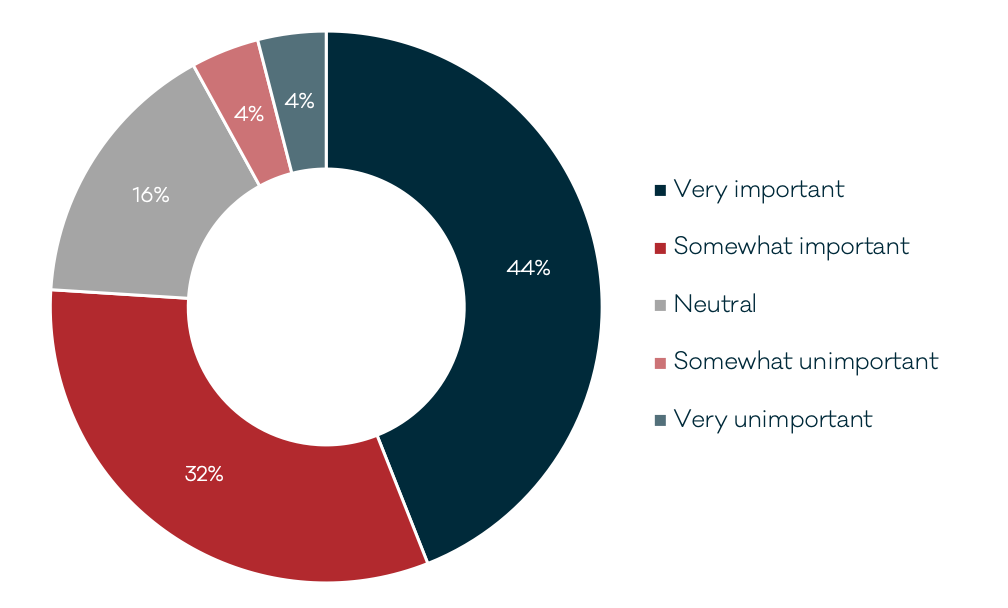

SUSTAINABILITY IS IMPORTANT TO MORE THAN THREE QUARTERS OF AFFLUENT/HNWIs

“How important is to you that a fine jewellery brand acts ethically or sustainably (eg does not use conflict diamonds)?”

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

As seen on the previous sections, all five of the selected brands score poorly for perceived ethics. Along with sustainability, these represent key areas for improvement, particularly as 44% of our respondents describe these features as very important, and a further 32% as important.

18-39s and North Americans are the most likely groups to identify a brand’s ethical and/or sustainable positioning as very important to them. Adopting this strategy could be a significant point of difference for jewellery brands in this highly competitive market.

OVER HALF ARE POSITIVE TOWARDS SECOND-HAND/USED FINE JEWELLERY

“How do you feel about the following types of fine jewellery products? Select the most appropriate option.”

Over half of our respondents are positive towards owning second-hand/used fine jewellery, peaking among North Americans at 64%. Just 19% are opposed to these types of products, suggesting that this could be a buoyant market in the coming years.

In a similar vein, Millennials are driving the wider luxury goods trend for ‘experiences over goods’, and are looking to rent luxury items rather than owning them outright. 42% of our respondents, rising to half of under-40s, are interested in renting fine jewellery items, for example for special events. This could also be a lucrative market for some brands to focus upon more in the coming years.

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

The ethics of mining diamond has received widespread industry coverage, with the onus on operators to source responsibly. The man-made diamond industry remains in its infancy, but the fact that 43% of our respondents are positive towards them – with a further 29% potential converts – bodes well for growth in this segment of the market.

ALMOST 1 IN 5 ARE PREPARED TO SPEND MORE THAN 15% EXTRA FOR SUSTAINABLE/ETHICAL JEWELLERY

“How much more would you be prepared to pay for fine jewellery products if they were made sustainably or ethically?”

Base: 1,138 global affluent/HNWIs Source: LuxuryOpinions/Altiant

Only 26% of our respondents say that they would not be prepared to pay any more for ethical/sustainable jewellery. Over-40s are significantly more likely than their younger counterparts to adopt this view (31% vs 19%).

While 18-39s are broadly more willing to pay more for ethical and sustainable jewellery, 5% of over-40s – driven by North Americans – are willing to spend more than 25% extra for jewellery made in this way.

Some 42% are prepared to spend between 1% and 10% more for jewellery made in this way, suggesting that adding a few extra percent to a price could be a compelling purchase driver. Clearly conveying the reasons behind the additional costs – for example, a donation to a charity – would convince many jewellery buyers of the brand’s credibility and honesty.

To view the data set in full, or speak to us about any of your luxury research requirements, please email us at contact@altiant.com

Contributors

Chris Wisson, Knowledge Director

Plamen Iliev, Senior Project Manager

Contact

reports@altiant.com

media@altiant.com

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.