Key Global Luxury Trends

VIEWS From CHINA, UK, US

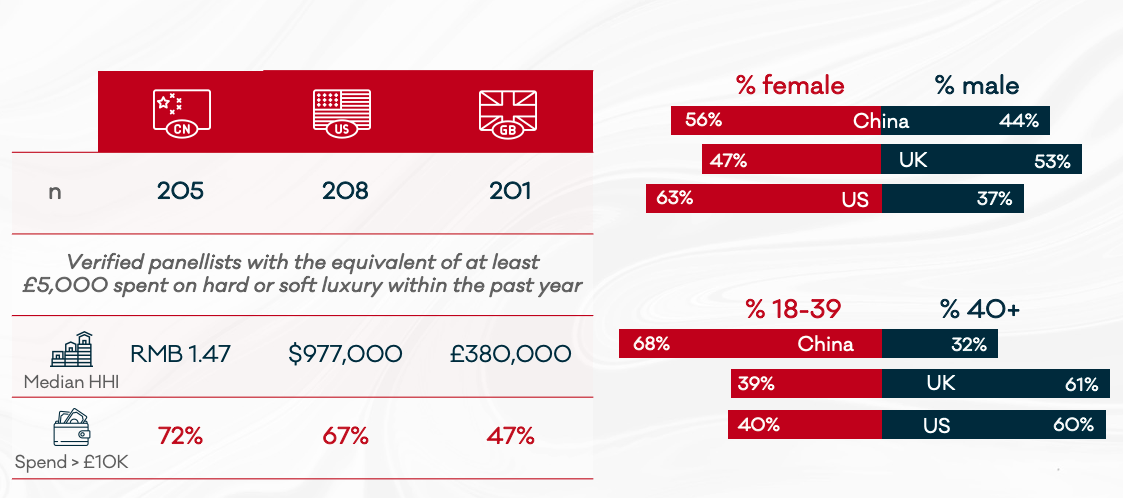

The Surveyed Population

More than 600 affluent & High net worth individuals in the United Kingdom, USA in China

Conducted in Q4-2018

Luxury Shopping: In-store vs. Online

Stores remain popular venues to buy luxury goods

“In which of the following locations have you purchased luxury products within the past year?”

Chinese most likely to see luxury shopping as a social experience

“When buying luxury goods in stores, who do you typically shop with?”

Chinese most likely to see luxury shopping as a social experience

“When buying luxury goods in stores, who do you typically shop with?”

The allure of online

“Which of the following statements about shopping for luxury goods/services online do you agree with?”

Nearer stores would entice many luxury shoppers

“Would you be more likely to visit luxury stores, or visit them more often, if they were located closer to your home?” [any response of ‘definitely’ or ‘probably’]

Creating Luxury Experiences

CREATING EMOTIONAL CONNECTION

Most luxury shoppers have a brand repertoire

“Which one of the following statements is most applicable to you when buying luxury goods or services?”

Luxury fashion brands resonate most often

“We would now like to ask you about how connected you feel to luxury brands. Are there any luxury brands which you feel particularly strongly connected or loyal to?”

Personalisation and exceeding expectations key

“Please tell us about any examples of an especially memorable shopping experience when buying luxury products in stores.”

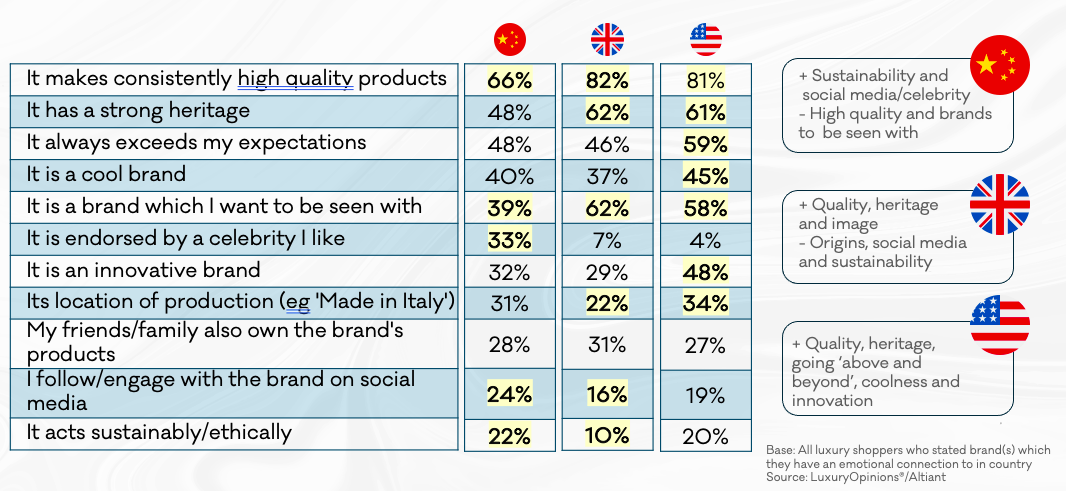

Different factors resonate with different cultures

“Which of the following factors help to explain your connection to this/these luxury brand(s)?”

Sustainability & Ethics in Luxury

Sustainability is important to many)

“How important is it that a brand acts sustainably or ethically when you are buying luxury products/ services (for example, a brand which tackles climate change or makes charitable donations)?”

Chinese RESPONDENTS most likely to be willing to pay more for sustainability

“How much more would you be prepared to pay for the following products if they were made sustainably or ethically?” [average of four categories]

Trust is high in sustainable claims in all three countries

“Which of the following statements do you most agree with in relation to luxury brands’ sustainable and ethical claims?”

Websites and in-store activity are good sustainability platforms

“Finally, how would you like luxury brands and services to inform you about their sustainability commitments and efforts?”

KEY TAKEAWAYS

Despite the popularity of online, physical stores remain important to many luxury shoppers, particularly the Chinese respondents.

Stores could tap into many consumers’ desire for leisure experiences.

9 in 10 luxury shoppers have a repertoire of at least a few luxury brands.

Quality (78%), heritage (58%) and being a brand to be seen with (55%) are the main ways to build emotional connections with luxury consumers.

Almost 1/3 of our sample will pay more than 10% more for sustainable products, but claims must be credibly communicated.

To view the data set in full, or speak to us about any of your luxury research requirements, please email us at contact@altiant.com.

Contributors

Lars Long, Founder & CEO Altiant

Chris Wisson, Knowledge Director

Meryam Schneider, VP Altiant

Plamen Iliev, Senior Project Manager

Contact

reports@altiant.com

ABOUT ALTIANT

Altiant is a specialised fieldwork company which enables large scale, global research among affluent consumers/High Net Worth Individuals (HNWIs) in 15+ countries worldwide.

By servicing dozens of the world’s top luxury and wealth brands, Altiant helps renowned brands and their research agencies to answer critical questions among this very hard-to-reach demographic. We ensure that all of our survey respondents are genuinely affluent by having their identities verified and wealth levels validated.

Altiant is a corporate member of ESOMAR, the World’s leading association for standards & Ethics within market research. Altiant adheres to, and abids by their strict guidelines governing the best practice in the industry.

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.