ALTIANT Global Luxury AND ASSET MANAGEMENT (GLAM) MONITOR

Quarterly GLAM Monitor: Q3 2021

Release date: October 2021

Lars Long - Founder & CEO, Altiant

“Welcome to the newest edition of Altiant’s Global Luxury and Asset Management (GLAM) Monitor. The monitor focuses on the behaviours and sentiments of our panel of validated global affluent/High Net Worth Individuals. We have now collected three years’ worth of data in this luxury tracker, with the data becoming more powerful with each version, especially in light of Covid-19. We hope that the findings continue to assist your business strategies and decisions in the years ahead.

The GLAM monitor contains two main elements for public use. Firstly, there is a quarterly PDF containing the most recent results and key takeaways from this quarter of study. And secondly, all of the data is available within Tableau so that you can reformulate the results according to your own preferences. Age, gender, region and household income filters will enable you to interact with the data and cut it in different ways to identify key variances and trends.

The third quarter of 2021 saw many countries continue to forge ahead with their vaccination programs as they aimed to protect their citizens from the worst effects of Coronavirus. At the time of writing, many countries are cautiously easing restrictions, with categories such as retail and travel immediate beneficiaries. We expect to see further shifts in the data in the coming quarter, with ongoing signs of recovery such as growing readiness to travel again and confidence in financial markets.

This iteration will be the last quarter in which we ask a handful of the questions. Minimal quarterly variance and new Covid-related dynamics mean that we will be instead adding new questions from Q4 which will enhance our tracker even more. We welcome the free and fair use of our data to meet your individual and business objectives, only asking that you clearly link your readers to the source of the data whenever applicable. As we publish additional iterations, trends will continue to strengthen, enabling you to further enhance your understanding of global luxury consumers. If you have any questions about the data, please contact us at glam@altiant.com.”

Altiant Founder and CEO, Lars Long

INTRODUCTION TO THE RESEARCH

All data presented in this GLAM monitor has been sourced from Altiant’s manually validated in-house panel of Affluent and High Net Worth Individuals (HNWIs), Luxury Opinions©. This iteration reports on Q3 2021, but will also include trended data from the trackers’ previous quarters. In order to protect data integrity, all respondents can only answer the survey once a year at most. For any additional questions about this research, please contact glam@altiant.com.

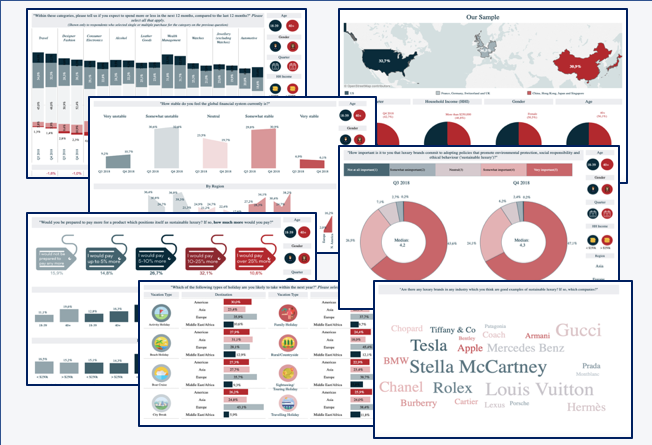

For the methodology, we have continued to survey different members of our global panel whenever possible. 437 affluent/HNWIs were surveyed between July and September 2021, with 142 from Europe, 153 from North America and 142 Asia Pacific. 36% of the sample was aged 18-39, with 64% aged over 40. The sample was split 45:55 in terms of gender (male:female). Across all quarters so far, we have now conducted just under 6,000 interviews, 42% of which were among aged 18-39s (58% over-40) and with a gender split of 49:51 male:female.

Normalised to $US, the median household income in this quarter was $287k (exchange rates as per 30th September 2021). This brought the average across all study quarters so far to $298k.

Note: Percentages in this report indicate survey results combining the last four quarters studied so far unless otherwise stated.

RESEARCH SAMPLE

KEY QUARTERLY CHANGES

· 56% expect to spend more on travel in the year ahead, showing that many affluent travellers are ready and willing to start spending again on luxury holidays.

· Almost half (46%) of investors expect to invest more in the year ahead, indicating returning confidence but also a need to plan financially for unforeseen events such as pandemics.

· More than half of the Q3 sample (57%) said that they had liked or recommended a brand to family, friends or colleague, the highest point of the tracker so far.

· Typically hovering around the 20% mark, the share of long-term crypto investors stood at 29% in Q3, the joint highest point of our tracker so far.

Back to Top

THE LUXURY CONSUMER’S MINDSET

DEFINING LUXURY: THE LUXURY CONSUMER’S MINDSET

“Which of the following statements do you think most defines a luxury brand or service?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantDue to minimal quarterly variations over the past three years, this quarter will be the last in which we track this question. The quality of materials/service and exclusivity/rarity continue to remain the most meaningful factors for defining a luxury brand despite the ongoing uncertainties and changes in consumer habits. Both attributes were cited by around two thirds in Q3 (71% and 63% respectively), with all other factors securing around a third or less of respondents’ answers. The next most cited is for luxury brands being status symbols (34%) and for standing out/being iconic (32%).

High prices are still more of a peripheral indicator of luxury, with only 18% associating luxury with an elevated price. Similarly, only 25% cited a designer label as being a luxury indicator in and of itself. Fewer than one in five affluent/HNWIs list only being sold in luxury venues (14%), scope for customisation (13%), packaging (7%) and celebrity endorsements (3%) as links to luxury in Q3. At just 3% for celebrity endorsements, this represents the lowest figure across all three years of study and suggests a weakening celebrity influence.

Looking across all quarters, 18-39s are more likely than over-40s to define luxury brands on grounds of being status symbols, whereas older consumers are more likely to do so based on high quality materials/service. Meanwhile, men remain much more likely to define luxury as being status symbols but are less likely to do on so based on high prices and designer labels.

Results across the three regions also show stark variance. Across all quarters, Americans are the most likely to define luxury by the quality of materials/service, designer labels and standing out/being iconic. Meanwhile, Asians are most likely to identify with status symbols, high prices and celebrity endorsements, and Europeans to do so on grounds of exclusivity/rarity.

THE LUXURY CONSUMER’S MINDSET: SPENDING ATTITUDE 1/2

“Please select the best description of your prevailing spending attitude when shopping specifically for luxury goods and services.”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThis question will also be retired after this iteration of GLAM due to minimal quarterly variance. One in five (20%) of respondents said that money is no object to them as per the Q3 2021 data, with 18-39s and women the most likely to answer here. That Asians are also comfortably the most likely region to adopt this mentality in recent quarters could be due to a quicker return towards normality from Covid-19 in countries such as China, fostering something of a ‘revenge spending’ mentality. Meanwhile, just over half (54%) say that they only occasionally spoil themselves, peaking among Americans at 60%.

As Coronavirus continues to have a global impact, many wealthy individuals are likely to remain a little conservative financially in the coming months. 12% say they are likely to stick to a budget, with Americans the least likely to do so. This figure rises to 18% among Europeans and continues the ongoing shift in sentiment among Europeans in 2021. They also remain the most likely to be bargain hunters at 18% (vs 14% average).

Back to Top

THE LUXURY CONSUMER’S MINDSET: SPENDING ATTITUDE 2/2

“Which of the following statements about luxury products do you agree with?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThis question will also be replaced by a new question next quarter due to the minimal variance seen over the past three years. While the Coronavirus pandemic has reframed many people’s relationship with luxury goods, they remain popular and 81% say that it is worth paying more for better quality goods. Over-40s and Americans continue to be the most likely to concur, although agreement is broadly high across the demographic groups.

Meanwhile, 39% of the Q3 sample say that luxury goods help them to feel confident, with Europeans (28%) lagging well behind the two other regions on this metric. Under-40s and Asians are also the most likely groups to agree. Under-40s are also more likely than average (33%) to be drawn to customisable products such as monogrammed briefcases. On the other hand, a third (32%) prefer discretion and luxury products which do not have clearly branded logos or designs.

Finally, 18% prefer luxury products from their home country, a figure which rises to 35% among Europeans. Only 8% of Asians prefer domestic luxury goods, highlighting the ongoing appeal of international products and services for these consumers.

THE LUXURY CONSUMER’S MINDSET: Luxury purchases (Past 12 Months)

“In which of the following categories have you purchased a luxury brand or service within the past year?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantPrior to 2020, travel numbers previously saw little quarterly variation in our tracking study, reflecting the all-year-round appeal and/or necessity of luxury travel. Despite progress with vaccinations, travel is only now starting to restart in earnest, although international holidays to popular locations such as Japan and Australian remaining prohibited. While some countries have sporadically reopened their borders to holiday-goers in recent quarters, many wealthy individuals have remained cautious about taking holidays, especially those further afield. The potential imposition of costly quarantine periods on returning home has also deterred many travellers.

Almost two thirds (64%) of our Q3 2021 sample said that they had taken a luxury holiday within the past year, and 36% had done so multiple times. The number of travellers within the past year is continuing to climb towards normality again as affluent individuals start to take holidays again. Of the three regions, Europeans remain the least prolific travellers: only 31% took more than one holiday over the past year, rising to 35% of Asians and 41% of Americans.

Pre-2020, designer fashion trailed a short distance behind tourism for purchasing penetration. However, fashion has since moved comfortably ahead of tourism and 80% said that they had bought a high-end fashion item within the past year, with 59% making multiple purchases, as per the Q3 data. High-end electronics (79%), leather goods (75%) and alcohol (74%) have also remained widely purchased and not seen any sustained significant falls in popularity over the past year. Under-40s are the most likely to make multiple purchases in all three of these categories, with Americans and Asians also the most likely buyers.

Leather goods and alcohol see a clear skew in purchases towards women, while men are more likely to buy watches and invest in wealth management services. Wealth management investment continues to hold up, with 73% doing so in Q3. Watches also remain widely popular, with two thirds (66%) buying a luxury watch within the past year.

THE LUXURY CONSUMER’S MINDSET: Luxury Purchase Intent (Next 12 Months)

“Do you think you will make purchases in any of these categories within the next year?” - Active buyers, past 12m

Total filtered Base (active buyers) of 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantLuxury automotive is comfortably the least likely category to have been purchased within the past year (41%), a probable reflection on the higher cost and infrequent necessity of buying new cars. Many affluent travellers may continue to reassess their driving habits as Coronavirus comes under control. Furthermore, 32% of category buyers expect to cut back on spending on cars in 2021, the highest result among all categories, although 25% expect to spend more on luxury cars.

Elsewhere, planned purchasing trends for 2021 look a little more positive as many affluent consumers are poised to spend again as Covid-19 gradually comes under control from vaccinations. Travel remains the main beneficiary, with many consumers having already slashed their travel spend in 2020/early 2021. Only 14% expect to spend less on travel over the next year, while 56% expect to spend more on travel, showing that many affluent travellers are ready and willing to start spending again on luxury holidays.

Wealth management also appears to be well placed. Almost half (46%) of investors expect to invest more in the year ahead, indicating returning confidence but also a need to plan financially for unforeseen events such as pandemics. Many of the other categories are now showing a comfortably higher share of buyers expecting to spend more in the coming year than they did in 2020. This suggests that many wealthy consumers are now feeling a little more bullish about a return to normality and that this could correspond to a loosening of purse strings. Designer fashion, alcohol, watches and high-end electronics are well-set to see strong rises in spending over the coming year.

***

Automotive is also the most likely category to not entice new customers over the next year; 40% of non-users do not expect to buy a car in 2021, although 19% did expect to do so. Watches and jewellery may also struggle to bring new customers into the category, with around a quarter of current non-users not anticipating becoming active buyers. Travel may see further benefits from new or returning customers, with 16% of last year’s non-travellers likely to do so in the year ahead.

THE LUXURY CONSUMER’S MINDSET: Purchase Channels

“Within the past 12 months, how have you purchased luxury brands or services?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantCovid-19 will continue to fundamentally influence how shoppers buy products and services, both in 2021 and beyond. Stores in many countries are now open again, albeit often with regulations attempting to stop potential transmission. Social distancing and face masks may remain compulsory for a time, with many affluent consumers likely to remain wary of face-to-face interactions and favour online shopping instead.

Prior to the pandemic, the share of consumers buying luxury goods/services in a physical store typically hovered around the 85% mark. As the pandemic hit, there was a clear drop in in-store shoppers to around 65%. However, this is now rebounding and we can see that many affluent individuals are returning to stores; 77% said they had done so within the past year which is up by ten percentage points over Q2. Under-40s (83%) and Asians (87%) are the most likely to do so.

Online luxury shopping has seen a big upturn since the start of 2020 and remains popular even as restrictions are lifted. In Q3 2021, 65% reported to buying luxury goods online via a computer or laptop within the past year, while 42% did so via their mobile phone/tablet. Americans are the most likely to prefer online shopping via both types of devices. While there is little age difference between shopping via computers, under-40s are more likely to do so via smaller devices (50% vs 37%). It will remain important for brands to continue delivering reliable and user-friendly online platforms, particularly for smaller screen devices, in the coming years.

THE LUXURY CONSUMER’S MINDSET: Social Media Interactions

“Have you participated in any of the following activities in relation to luxury brands and services on social media in the past 3 months?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantAs online retailing has prospered, social media has also become more important for many luxury brands. Engaging and sharable content proved to be a lucrative sales channel for brands while individuals were in lockdown. Social media engagement and interactions have showed minimal quarterly variations across the tracker apart from a small blip in Q2. More than half of the Q3 sample (57%) said that they had liked or recommended a brand to family, friends or colleague, which actually marks the highest point of the tracker so far. The share of respondents following a brand also bounced back in Q3 to reach 47%.

Elsewhere, the share sending a private message to a brand on social media remained broadly flat against the previous quarter (20%), as did those making purchases via social media (20%). Under-40s are still much more likely than over-40s to buy luxury goods via social media (30% vs 15%), with Europeans lagging behind the other two regions on this metric (14%). Only a quarter (26%) reported making none of these social media interactions.

Back to Top

LUXURY & SUSTAINABILITY

Luxury & Sustainability: The Importance of Sustainability

“How important is it to you that luxury brands commit to adopting policies that promote environmental protection, social responsibility and ethical behaviour (sustainable luxury)?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantWhile Covid-19 has shifted some individuals’ immediate focus away from the ongoing climate crisis, this remains one of the most pressing issues internationally. Many people are becoming increasingly demanding of brands to acknowledge and act with them in alleviating climate concerns, for example via recyclable materials or carbon offsetting. They are also becoming more discerning about brands which make sustainable claims.

On a scale of 1-5, 49% rated sustainability at an importance of 4 or 5 in Q3. Under-40s and women remain the most likely to rank sustainability as important, but it is striking how much less importance Americans attach to it (33%). In Q3, 34% rank sustainability as important (3-4), while only 17% rate it at an importance of 1-3. This indicates that many consumers do recognise the ongoing need for an environmental focus, and that it remains important to them despite other concerns and priorities.

Luxury & Sustainability: Trading up for Sustainability

“Would you be prepared to pay more for a product which positions itself as sustainable luxury?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantMany affluent consumers are seemingly prepared to back up their views on environmental protection and sustainability with their money. Only 18% of the Q2 sample are entirely unprepared to spend any more for sustainable/ethical luxury products, a figure which falls to just 11% of under-40s and 13% of Asian respondents. Overall, 44% are prepared to spend up to 10% more, which could be a sweet spot for brands to justify a small price premium.

The remaining 38% are prepared to spend more than 10% extra, with 8% saying they are even prepared to spend more than 25% extra for sustainable/ethical luxury products. These figures are broadly on a par with the previous quarter. Trading up for sustainable goods resonates with under-40s a little more than over-40s, especially for the 10-25% extra bracket. Despite being the least likely to rank sustainability as important, 38% of Americans are willing to spend 10% or more extra for sustainability, broadly in line with both the European (35%) and Asian (40%) response.

Luxury & Sustainability: Sustainable Luxury Champions

“Are there any luxury brands in any industry which you think are good examples of sustainable luxury? If so, which companies?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantOver each of the past study quarters, a handful of luxury brands have stood out as the most likely to be cited as sustainable luxury operators by our respondents. The likes of Louis Vuitton, Stella McCartney, Gucci, Louis Vuitton and Tesla consistently garner a high share of the response, with these brands also being among the most cited within Q3. Other brands that secured a notable number of mentions in the last quarter were Chanel, Rolex, Hermès and Prada. Hermès’ recent launch of a new mushroom-based ‘leather’ bag could see it rise even higher in the coming quarters, while Prada announced it was stopping using fur completely last year and Louis Vuitton plans to do so by the end of 2022.

Back to Top

FOCUS ON FINANCE

Global Financial System Stability

“How stable do you feel the global financial system currently is?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantCovid-19 has had a major impact upon consumer confidence in global finances, adding to existing uncertainties such as Brexit and the climate crisis. From 37% in Q1 2020, the share of respondents who felt that the financial system was either very or somewhat stable plummeted to just 20% in Q2, a new low point across all quarters of study. The past three quarters have seen this share recover gradually towards pre-pandemic levels and it has hovered around a third since (33% in Q3 2021). This is possibly indicative of many wealthy individuals thinking that the worst financial impacts of the pandemic may be passing. Around a third in each of the three regions perceive this stability.

Only 21% of respondents now adopt a neutral or uncertain position, while 45% think that the financial system is very or somewhat unstable, down from 67% in Q2 2020. At 11%, the share of people answering ‘very unstable’ remains comfortably higher than pre-Covid levels but is now significantly lower than the Q2 2020 level (31%). Despite encouraging signs, the financial impacts of Covid-19 will be felt by many consumers globally well beyond 2021.

Stock Market Knowledge

“How knowledgeable do you think you are about topics related to the stock market?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantSelf-claimed stock market knowledge has historically shown little quarterly variation in our study, hovering around the 75% mark. After reaching a new high of 82% in Q1, this has fallen back slightly in the past two quarters (77% in Q3), perhaps driven by new dynamics and uncertainty. Men (85%), under-40s (86%) and Americans (88%) are the most likely groups to state that they are knowledgeable. Only 23% claim to be very knowledgeable, 16% feel that they only have a little stock market knowledge, while only 4% say they have no knowledge at all. Women are more likely than men to profess having little or no understanding of the stock market (24% vs 15%).

Regional Stock Market Confidence

“How do you think the stock markets in your region will perform during the next 12 months when compared to the past 12 months?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantCoronavirus continues to have a significant, albeit weakening, impact upon the data for stock market confidence. The first two quarters of 2020 saw an immediate shift towards a negative performance, but there are ongoing signs of returning confidence. From 33% in Q2 2020, the share of respondents expecting an improvement in performance rose to 40% in Q3 last year and has remained around 50% since, standing at 50% in Q3 2021. After the losses in 2020, many affluent respondents appear to be much more bullish about their prospects for the year ahead.

This increase is again strongly driven by the European response which has recovered strongly to stand at 53% in Q3. While the Asian response remained broadly flat at 51%, the share of Americans expecting an improvement rebounded from 40% to 47% this quarter. This is perhaps indicative that after a particularly fraught year, investor confidence is returning. After rising in previous quarters, the share of respondents who believe that their stock market performance will remain broadly even levelled off at 27%.

Those expecting a downturn in performance jumped to 53% in Q2 2020, by far the highpoint for the study so far. This figure was driven by a notable rise in responses for a ‘much worse’ performance, which rose to 23%. Q3 and Q4 last year saw the share of those expecting a downturn fall to 42% and then 28%. After the challenges of 2020, only 22% of the Q3 sample expect their stocks to perform worse in the year ahead, a flat figure against the two prior quarters in 2021.

As a full year of Covid-19’s impact is reached, many wealthy respondents appear to view 2021 a little more positively with hopes that the worst has passed. Europeans and Asians are now the least sceptical (both 20%), while 27% of Americans are downbeat about their financial expectations.

Investing in Cryptocurrencies

“Please select one of the following options in relation to your interest in virtual cryptocurrencies like Bitcoin and Ethereum.”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantCryptocurrency investment has garnered a particularly high level of media interest this year. Buoyed by Elon Musk’s car firm Tesla investing $1.5 billion and announcing plans to accept Bitcoin as a payment option, there was growth in various currencies and the rise of non-fungible tokens (NFTs). Tesla backtracked from accepting Bitcoin and cited the energy inefficiency of the coin, with the value of the currency declining steadily thereafter. The raised profile means that only 7% are now entirely unfamiliar with cryptocurrencies.

Typically hovering around the 20% mark, the share of long-term crypto investors stood at 29% in Q3, the joint highest point of our tracker so far. This peaked among under-40s (38%) and Americans (39%). A further 15% said that they were short-term crypto investors in Q3. As more companies and even local authorities start accepting cryptocurrencies for payments, the market could also still attract new investors. 30% of the Q3 sample are current non-investors but are interested in doing so, while only 19% say that they do not currently invest in them and do not think they will do so in the future.

FOCUS ON TRAVEL

Luxury Travel Experiences

“Which of the following have you done while on holiday within the past three years?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThis question focuses on luxury holiday activities within the past three years and as such, the data still only shows minor quarterly variations which reflect Covid-19. Americans are the most likely to have treated themselves on their luxury holidays in various ways, particularly for travelling by business/first class, staying in a penthouse/suite or using room service.

Luxury remains important right from the start of our respondents’ holidays, including at the airport: 51% travelled by business or first-class and 48% used a VIP waiting lounge as per the Q3 data. 5* or more hotels are still highly popular with affluent travellers, used by 69% of the Q3 sample. Meanwhile, 51% stayed in a suite/penthouse room and 32% rented a beachfront villa; the former being the joint highest point of the tracker so far. Room services/concierges also appeal to many and were used by 51% as per Q3.

Spas had been used by 64% of our sample, with these facilities appealing to both genders and age cohorts (albeit to under-40s and women the most). Wellness tourism continues to flourish as more luxury hotels acknowledge the attraction of relaxation facilities such as spas. These venues are likely to be particularly attractive when the immediate threat of the pandemic passes, with many travellers focusing on both their physical and mental health.

Fine dining also plays an important role in luxury holidays (71%), although these venues will have to evolve as some degree of social distancing may remain in the immediate future. Just over a quarter (28%) have had a private transport experience such as a helicopter ride within the past three years. These are likely to remain popular in the coming quarters as the wealthy look for holidays which continue to provide isolation and a degree of distance from infection risks.

Holiday Purchase Intentions

“Which of the following types of holiday are you likely to take within the next year?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThe majority of our affluent/HNWI respondents have travelled regularly over the past quarters of our study. Covid-19 will obviously continue to have a significant impact here, reducing the frequency and variation of luxury holidays in the year ahead. As expected, 2020 showed this drop in travel plans despite some countries cautiously reopening their borders to tourists in the summer months.

Travelling within their own regions rather than going further afield remains the most popular among our sample. Indeed, this has been exacerbated by the impact of the virus, with fewer wealthy travellers willing to take longer-haul journeys. The risks of potential quarantines and self-isolation periods mean that many wealthy travellers are instead opting for more domestic trips or going to countries close to their residence. This is also likely to continue in the coming quarters, even as vaccine programs are rolled out.

Different holiday types see wide variance in popularity across the regions, but all types have seen a downturn in interest since the outbreak of Covid-19. City breaks in Europe and the US have been hit particularly badly, a likely reflection of travellers’ ongoing concerns about being in overcrowded places where their exposure to Coronavirus may be elevated. Sightseeing/tourist holidays and family holidays within Europe continue to see a considerable drop in interest against pre-Covid levels. Rural/countryside breaks (e.g. Glamping) and family breaks look likely to be among the most resilient holiday types in the coming year, reflecting the probable desire for many travellers to remain close to family and distanced from crowds and strangers.

Luxury Leisure Travel Spending

“Please think about the most expensive holiday lasting at least five days which you took within the last year. Approximately how much did you spend on the holiday, considering only the cost of travel, accommodation and entertainment (eg food/drink/activities)?”

Total Unfiltered Base: 5,954 global affluent/HNWIs | Source: LuxuryOpinions®/AltiantThis question is the final one which we will be replaced after this quarter due to minimal quarterly variation. Many affluent travellers continue to be willing to invest significant amounts in luxurious holiday experiences. When all currencies are normalised to US Dollars, only 3% of the Q3 sample said that they spent less than $1,000, while 9% spent $1,000-$3,500. A further 26% spent between $3,500 and $7,000, while another 35% spent $7,000- $14,000.

At the top end, Americans represent a particularly lucrative pool of affluent travellers for brands to target and are the most likely to have invested heavily on a luxury holiday: against the total quarterly figure of 17% who spent over the equivalent of $14,000, this rose to 22% among Americans.

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.