PREMIUM CREDIT CARDS

VIEWS From THE WealthY CONSUMER

Survey Background

This snapshot report is part of Altiant’s Category Surveys, short questionnaires submitted to our in-house panel of validated Affluent and High Net Worth Individuals, LuxuryOpinions®. This version explores the Premium Credit Cards Market. The aim is to assess our panel’s sentiments and interactions with the credit card market and its associated brands.

The quantitative online survey for this report was carried out during February 2019, and interviewed 1,036 members from various countries across our online affluent community (33% in Asia/33% in Europe/34% in North America). 43% of this sample was aged 18-39, while 57% was aged 40+. The gender split was 50:50% male:female. Normalised to $US, the median household income across this total sample was just less than $297,000.

Please note that any overarching references to affluent/HNWIs (eg ’91% of global affluent/HNWIs own at least one credit card’) refer specifically to those surveyed in this report. Comprehensive data broken out and charted by region is available on request.

Key Findings

1. Credit cards are a popular payment method among affluent/HNW respondents. Almost half of the sample (47%) have two or three credit cards, while 34% have four or more. Europeans cardholders are most likely to get their credit cards through a private bank (38% vs 29% average).

2.Credit cards are a daily part of many affluent/HNWI lifestyles, with half (49%) using them daily (31% use them more than once a day). The next 12 months predicted spend shows only 9% expecting to cut back on their credit card usage. The highest share of respondents – over half (55%) – state that they expect to use their credit cards about the same .

3.About 30% of the respondents have spent more than $5,000 on one single transaction with 15% over $10,000 in the past 12 months. Over a third (37%) spent $1,000-$5,000 on their most expensive card purchase last year, rising to 41% among North Americans.

4.American Express presents the strongest brand awareness for premium card brands (62%), with its Platinum card being the most popular card for ownership (31%). Reward programmes are the most popular premium benefit (65%), followed by Hotel offers/discounts (60%).

5.There is a significant increase in interest for universal cards (combining all cards in one wallet) and cryptocurrency among card owners; the former rising from 19% usage last year to a potential 43% next year, and the latter up from 19% to a potential 34%.

OWNERSHIP & UTILISATION

81% OF AFFLUENT/HNWIs HAVE MORE THAN ONE CREDIT CARD

“How many personal credit cards do you have? Please exclude any debit cards.” / “How many of these credit cards are co-branded (eg. airline or retail branded cards)?”

Credit cards are a popular payment method among our affluent/HNW respondents. Just 4% do not own a credit card, while only 15% have just the one. Europeans and Asians are much more likely than North Americans to fall into one of these two categories (33% and 17% respectively).

Almost half of the sample (47%) have two or three credit cards, while 34% have four or more. Over-40s (37%) and North Americans (53%) are significantly the most likely groups to have four or more credit cards.

Co-branded card ownership has reasonable penetration, with 35% of card owners saying that co-branding features on more than one of their cards. That 30% have no co-branded cards shows that this is an area primed for further development

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/Altiant48% OF RESPONDENTS DO NOT PLAN TO GET A NEW CREDIT CARD WITHIN THE NEXT YEAR

“Do you plan to change or acquire a new credit card within the next 12 months?”

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantJust over a quarter (26%) of our respondents to this survey state that they plan to get a new credit card within the next year. Under-40s are the most likely age group to plan in this direction (32%), while Europeans are the least likely of the three regions to do so (18%).

Some 26% also state that they are unsure if they will get a new card within the next year. Targeted benefits and rewards could provide the incentive for these potentially convertible consumers to get new credit cards.

Meanwhile, almost half (48%) do not plan to get a new credit card within the next year, rising to 51% among over-40s and 57% among Europeans. As seen later in this snapshot, satisfaction rates are reasonably high among card owners, perhaps negating many users’ wishes to change credit cards.

HALF OF AFFLUENT/HNWIs USE THEIR CREDIT CARDS DAILY

“How often do you typically use your credit card(s)?”

Credit cards are a daily part of many affluent/HNWI lifestyles, with half (49%) using them daily. Among the 31% who use credit cards more than once a day, under-40s (37%) and North Americans (42%) are the most likely multiple users.

A further third use credit cards every few days, with over-40s, and Europeans and Asians the most likely groups to cite this frequency. The stark difference in usage frequency by region indicates that North Americans are the most likely to purchase items regularly and therefore make more card transactions.

Only 7% use their credit cards less frequently than about once a week, indicating how central they are to most affluent/HNWIs’ spending habits.

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantNET CREDIT CARD USE COULD RISE SIGNIFICANTLY OVER THE NEXT YEAR

“Do you expect to use credit cards more, less or about the same in the next 12 months compared to the last 12 months?”

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantThe highest share of respondents to our survey – over half (55%) – state that they expect to use their credit cards about the same next year when compared to last year.

Interestingly, there is a net positive difference of a quarter (+23%) between respondents expecting to increase and reduce their credit card usage within the next year. 32% expect to use credit cards much/a bit more often, with men and Europeans the most likely groups to expect to use them much more.

Meanwhile, only 9% expect to cut back on their credit card usage, with only 2% anticipating a drastic cut back. This suggests that credit card usage could rise significantly among affluent/HNWIs within the next year.

30% SPENT MORE THAN $5,000 ON THEIR MOST EXPENSIVE CREDIT CARD TRANSACTION

“What is the most expensive item which you have bought on a credit card within the past 12 months? Please specify the item if you can remember.”

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantUnsurprisingly given their wealth, many of our affluent/ HNWI respondents are big spenders. Flight tickets, luxury goods such as watches, tuition fees and holidays are among the most popular items purchased on credit cards.

Some 30% of the respondents spent more than $5,000 on their most expensive single transaction in the past months, with 15% spending over $10,000. Over a third (37%) spent $1,000-$5,000 on their most expensive card purchase last year, rising to 41% among North Americans.

North Americans are likely to be the biggest spenders on their cards, with 25% spending the equivalent of over $10,000, compared to only 14% of Asians and 11% of Europeans (17% overall).

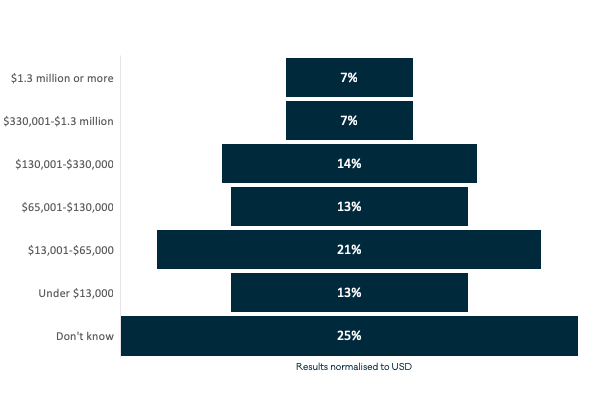

CREDIT LIMITS VARY WIDELY ACROSS OUR RESPONDENTS

“Thinking about the sum total of your credit limits across all cards, what would estimate it to be?” / “Do you typically tend to pay off your credit balance in full each month? Please select the most appropriate option.”

Our respondents to this survey cite a wide variety of amounts in terms of their total credit limits. Only 13% have a total credit limit of under $13,000, while 21% have a limit between $13,000-$65,000.

Meanwhile, 14% of credit card owners have considerable spending freedom and claim to have a total credit limit in excess of $330,000. That a quarter don’t know what their limit is might also point towards a relaxed relationship with their total credit limit.

The significant majority of our respondents (89%) typically pay off their credit balance in full each month, with 63% saying they always do so (peaking among Asian respondents at 68%). Only 10% claim that they rarely or never pay off their balance in full each month, with women more likely than men to make this assertion.

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantPREMIUM BRAND AWARENESS, BENEFITS & SATISFACTION LEVELS

AMERICAN EXPRESS DOMINATES UNPROMPTED TOP OF MIND BRAND MENTIONS

“When thinking about premium credit cards, which is the first brand which comes to mind?”

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantAmerican Express is by far the most likely premium card brand to be gain unprompted mentions by our panelists. 62% who could name a card cited American Express – or some of its cards such as Centurion – when asked which was the first credit card brand which came to mind.

Visa was the next most cited brand, albeit only by a comparatively small 13%, and falling to just 5% for Mastercard. All other brands secured no more than 2% of the total response, with Chase, Diners Club and Citibank the most likely among the ‘other’ brands listed.

AMERICAN EXPRESS PLATINUM IS COMFORTABLY THE MOST POPULAR PREMIUM CREDIT CARD

Do you own any of the following cards? Please select all that apply.”

Note: results reported as individual cards per issuer (e.g. Visa Infinite from different issuers are not combined together)

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantSATISFACTION IS HIGH AMONG CARD USERS

“How satisfied are you with the following cards you use?”

Satisfaction rates with the different card suppliers are generally strong and comparable across the brands. American Express cards perform generally strongly, with 10% or fewer of users unsatisfied. Centurion is the weakest performer, with only 73% of its users satisfied, pointing towards scope for improvement.

Visa’s cards are generally rated as good performers, with broadly high satisfaction levels, while Mastercard sees a slightly higher share fall into the neutral camp rather than being satisfied.

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantREWARDS & BENEFITS KEY FOR GARNERING PREFERENCE OVER COMPETING CARD

“Which of the following make you choose one credit card brand over another? Please select all that apply.”

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantRewards and benefits are important features which many affluent/HNWIs look for in credit card brands. Two thirds (65%) cite rewards such as airmiles as a reason to choose a specific credit card brand, although this falls to just 47% among European respondents.

In a similar vein, half (49%) identify unique tailored benefits as a draw, with European respondents again the least likely to respond at 44%. North Americans are the most likely region to be attracted by benefits and rewards, as well as for exclusive/invite-only products or services (42% vs 36% average).

Other key features for credit card brands include enabling users to save money and spend with almost no limit (both 27%), being a status symbol (23%) and making the user feel successful (18%), all of which could be used in marketing activity.

TWO THIRDS CITE REWARD PROGRAMMES AS APPEALING TO THEM

“When looking at the benefits linked to your preferred card(s), what are the most relevant ones to you? Please select up to 5 and rank in order of importance.”

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantWhen looking specifically at benefits, a number of schemes resonate with our respondents. A reward programme was cited by 65%, peaking among North American respondents at 70%. A quarter of the overall sample identify this as the most important factor.

Travel benefits such as hotel offers (60%), airport lounge access (57%) and airline offers (56%) all resonate with around three in five of our respondents. Women and North Americans are the most likely to be interested in hotel offers, while it is interesting to note that Europeans are the least likely respondents in each of these three cases.

Lifestyle benefits and insurances (travel and medical) are all more likely to be cited as appealing credit card benefits by under-40s than by over-40s.

INFLUENCERS & BARRIERS

ONLINE IS THE MOST LIKELY INFLUENCER OVER CREDIT CARD CHOICE

“Who influences your choice of credit cards? Please select all that apply.”

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantA wide variety of sources influence our respondents’ choice of credit cards. 32% claim that the choice is theirs alone, with over-40s much more likely than the younger cohort to be uninfluenced (39% vs 23%).

Online research is an important tool for many affluent/HNWIs for their credit cards, with 36% using this method to inform their choice (rising to 41% among men). On the other hand, women are significantly more likely than men to be influenced by their partner and family members.

Bankers/wealth advisers are particularly influential among our European respondents (30% vs 21% average), although they are the least likely region to be influenced by a favourite brand (16% vs 22% average).

LATE PAYMENT AND MEMBERSHIP FEES ACCEPTED BY MANY AFFLUENT/HNWIs

“Do you think fees are acceptable on any of the following transactions relating to credit cards? Please select all occasions that you think are acceptable for accruing a small change from using your card.”

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantOur respondents to this survey are generally accepting of some fees accruing which relate to certain credit card activities. Only 21% of credit card owners are entirely opposed to any fees, with over-40s a little more resistant than under-40s (23% vs 18%).

Late payment fees are the most acceptable form of fees accrued, with 46% thinking that this is a reasonable charge for credit card companies to make. This rises to 52% among North Americans, with this region also the most likely to accept cash withdrawal fees (27% vs 22% average).

Membership fees are accepted by 37% of our respondents (rising again to 47% among North Americans), although there is clearly greater reticence to pay to joining fees for a specific card scheme at just 16% overall. Interestingly, Europeans are the most likely region to accept joining fees (23%) but just a third accept ongoing membership fees.

40% ARE PREPARED TO PAY $200+ ANNUALLY FOR THEIR FAVOURITE CREDIT CARD SCHEME

“How much would you be willing to pay annually for your favourite credit card scheme?”

Three in five (30%) card owners from our sample for this survey are not prepared to spend anything annually for their favourite credit card scheme. This rises to 36% among women and 39% among Asian respondents.

Many card owners are receptive to paying a relatively small amount for their favourite scheme, with 41% prepared to spend up to $500 annually. Europeans are the most prepared to spend up to $200, whereas North Americans are the most likely to be spend up to $500 (and beyond).

Only 11% are willing to spend more than $1,000 annually, rising to 18% among our Asian respondents. Credit card brands will need to offer lucrative or unique benefits to encourage many card owners to spend more than $500 annually to participate in their schemes.

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantWHAT'S NEXT: THE FUTURE OF PREMIUM PAYMENT CARDS

UNIVERSAL CARDS AND CRYPTOCURRENCIES COULD BE SET FOR A SPIKE IN USAGE

“Which of the following have you used within the past 12 months, and would be interested in using within the next 12 months? Please select all that apply.”

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantMobile wallets (51%), Near-Field Communication (NFC) technology (48%) and cash-sharing apps (39%) were the most popular of the listed payment methods used last year. Under-40s are the most likely to use all three types, and while Europeans are most likely to use NFC (61%), they are the least likely to use the other two.

It is worth noting the significant increase in interest for universal cards and cryptocurrency next year; the former rising from 19% usage last year to a potential 45% of new users next year, and the latter up from 19% to a potential 33%. Under-40s are the most likely converts, with interest remaining strong across all three regions.

Only around a quarter of card owners in this survey appear to be entirely disinterested/disengaged with this new technology, with women and North Americans the most likely groups to be unmoved.

MANY AFFLUENT/HNWIs OPEN TO EMBRACING NEW PAYMENT TECHNOLOGIES

“Finally, which of the following would you be interested in for future card payments? Please select all that apply.”

Many of the card-owning respondents in this survey are receptive to new technologies and ways of paying. 48% are interested in using their smartphone for payments instead of the credit card, peaking among under-40s and North Americans at 52%.

Under-40s are also significantly more likely than over-40s to be interested in universal cards (50% vs 39%) and crypto-linked cards (26% vs 18%). As seen previously, 34% of our respondents have four or more credit cards, and bringing these under one overarching card could be a lucrative new development in the market.

Interest in paying with iris/finger print technology is constant across age, gender, and region, averaging at a robust 44%. This could be a promising avenue for card brands to explore further given these interest levels.

Base: 1,036 global affluent/HNWIs / 993 who have credit card(s) Source: LuxuryOpinions/AltiantTo view the data set in full, or speak to us about any of your luxury research requirements, please email us at contact@altiant.com

Contributors

Chris Wisson, Knowledge Director

Meryam Schneider, VP of Marketing

Lars Long, Founder & CEO

Contact

reports@altiant.com

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.