LUXURY PURCHASE INTENTIONS

USA

altiant interactive: luxury purchase intent in THE US

release date: JULY 2019

Research covering spend intention on luxury goods & services from affluent communities in United States. It covers the following categories of purchase: watches, jewellery, shoes, flights, overnight hotel stays and cars. The interactive functions enable searches on country, gender, age groups and more.

For any questions related to the data and use of the interactive tool, please contact reports@altiant.com.

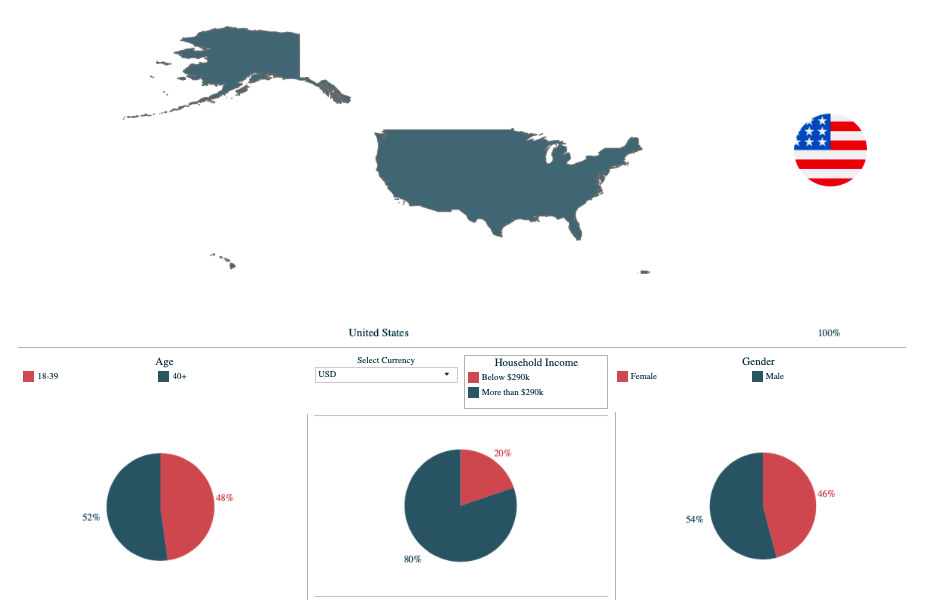

SAMPLE COMPOSITION

The quantitative online survey conducted for this report was carried out in April 2019 and interviewed 207 members from Altiant’s online affluent American community. 54% of this total sample was male, while 46% was female. The age split was 48:52% for under-40s vs over-40s, while the median household income of the sample was $463,000.

Base: 207 American affluent/HNWIs Source: LuxuryOpinions/AltiantBack to Top

PURCHASE INTENTIONS AMONG AFFLUENT/HNWIs

Over half (53%) of our American affluent/HNW respondents to this survey expect to spend more on luxury over the next 12 months than they did in the past 12 months, while only 4% anticipate cutting back. 18-39s are much more positive than the older cohort towards buying ‘many more’ luxury items/services (28% vs 8%).

As seen in Europe and Asia, over-40s are the most likely group to expect to buy about the same over the next 12 months (54% vs 28%). American men are also the most likely to be bullish about their luxury spending for the next year, while women are the more probable gender to anticipate spending about the same amount.

Base: 207 American affluent/HNWIs Source: LuxuryOpinions/AltiantBack to Top

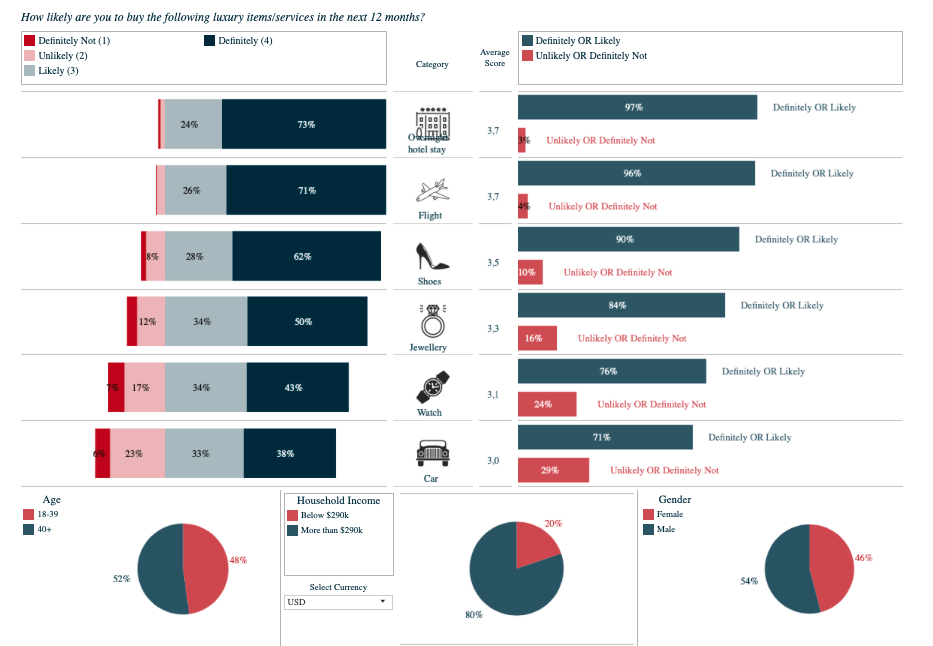

PURCHASE INTENTIONS BY CATEGORY

We asked our respondents how likely they were to buy the following luxury items/services within the next year: watches, jewellery, shoes, flights, overnight hotel stays and cars. Leisure-related spending remains extremely popular among wealthy Americans, with 97%and 96%expecting to buy luxury overnight hotel stays and flights respectively.Shoes and jewellery were also ‘definitely’ or ‘likely’ to be purchased by more than four in five American affluents, falling to 76% for watches.

As seen in Europe and Asia, cars had the lowest score, a likely reflection on the relatively high cost of purchase of luxury vehicles. Nevertheless, 76% of American affluent/HNWIs say they are likely to buy a luxury car within the next year, far ahead of the other two regions (48% and 47% respectively), reflecting the enduring popularity of the automotive category among Americans.

Base: 207 American affluent/HNWIs Source: LuxuryOpinions/AltiantMedian Expected Spending PER CATEGORY

The base for this question relates to respondents who coded ‘Definitely’, ‘Likely’, or ‘Unlikely’ in the previous question (‘Definitely not’ respondents were excluded).

Watches (n=193): 24% of our affluent American respondents would not be prepared to break the $2,000 mark on a new luxury watch, rising to 29% among over-40s. However, one in five (21%) are willing to spend more than $10,000 on a new luxury watch, indicating that the ultra-premium watch segment has a number of willing American customers. 18-39s are the most likely age group to be willing to spend heavily on a new high-end watch (27%).

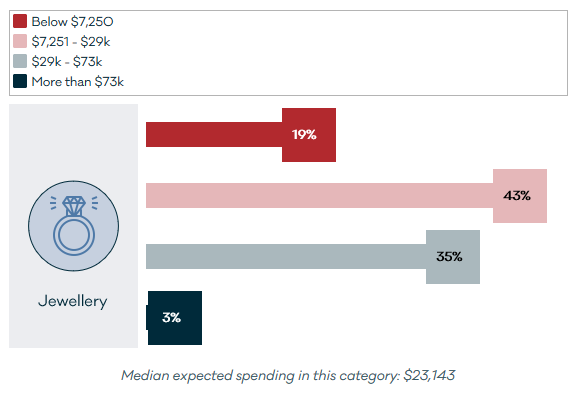

Jewellery (n=198): Jewellery is a highly popular category with our affluent American respondents, but one which is relatively price-sensitive. A third (34%) are not prepared to exceed the equivalent of $10,000 on a new luxury jewellery piece, rising to 42% among over-40s. A further 23% are prepared to spend $10,000-20,000, with over-40s again more likely than under-30s to limit their spending (31% vs 14%). 19% are prepared to spend heavily within the category and exceed the equivalent of $40,000 per piece, rising to 25% among 18-39s.

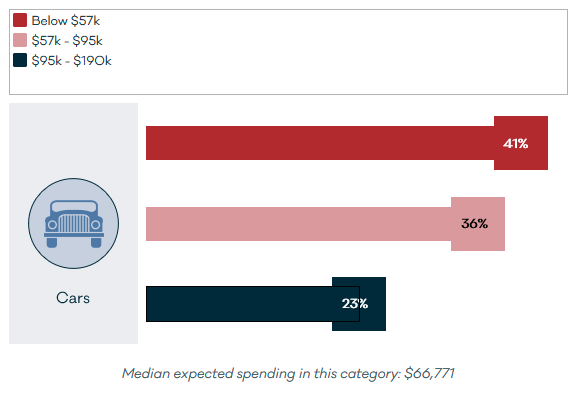

Cars (n=194): Cars remain highly popular among Americans, with many households owning more than one (see Altiant’s Luxury Automotive snapshot). 38% of our affluent American sample would be prepared to spend more than $100,000on a new luxury car, rising to 50% among 18-39s. There is only a relatively small gender skew in intended spending at this top tier, rising from 35% among women to 41% among men. Only 18% of the sample would not exceed the equivalent of $50,000 for a new high-end car.

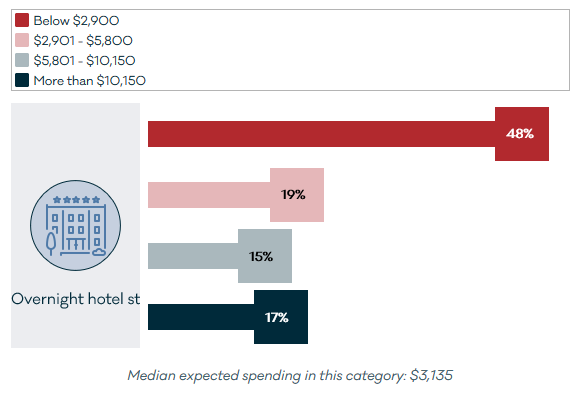

Overnight hotel stay (n=205): 27% of our survey respondents, and rising to 33% among over-40s, are prepared to spend up to $1,000 per night for a hotel stay. However, that this is relatively low shows how heavily American affluents are prepared to spend for luxury hotel stays and facilities. A further 18% are prepared to spend $1,000-2,000,while a third appear to be extravagant travellers and say they are willing to spend upwards of $5,000per night.

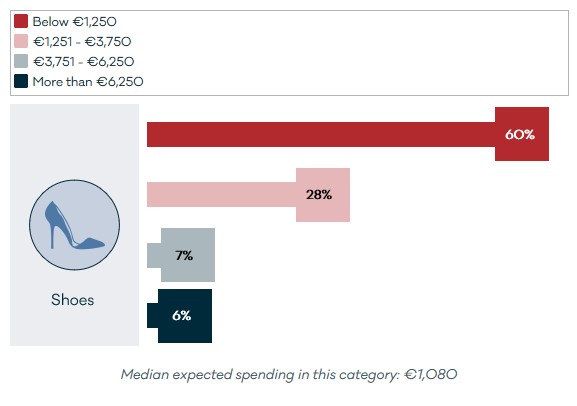

Shoes (n=202): Luxury shoes are generally relatively affordable in relation to other categories such as cars and watches. It is therefore unsurprising that half of our survey respondents (51%) are unwilling to exceed $2,000for a new pair of luxury shoes, a figure which is broadly equal for both genders and rises to 61% among over-40s. A further 24% are willing to spend $2,000-5,000on luxury shoes, while a quarter are prepared to exceed the $5,000 mark.

Flight (n=206): That only 21% are unprepared to exceed $1,000for a luxury flight shows how the majority of our affluent American respondents are willing to invest in premium air travel. $500-2,000appears to be a sweet spot for luxury air travel, with 39% prepared to spend within this price range. Meanwhile, 23% are willing to exceed$5,000for a luxury flight (rising to 29% among 18-39s), a price which would indicate first/business class travel and associated perks.

Results were merged and normalised to US Dollar as per January 2019. The base for this question relates to respondents who coded ‘Definitely’, ‘Likely’, or ‘Unlikely’ in the previous question (‘Definitely not’ respondents were excluded). Base: American affluent/HNWIs who are definitely or likely to buy a new luxury product within the category within the next 12 months

Source: Luxury Opinions/AltiantBack to Top

LUXURY BRAND AWARENESS

Many brands were mentioned by our panel for this question. Luxury goods such as fashion and jewellery are particularly popular, with Rolex scoring the highest number of mentions (19%of the sample). Gucci, Cartier, Louis Vuitton and Chanel all achieved a response rate of 8-14%. Luxury car brands such as Mercedes-Benz and BMW also fared well, reflecting the particularly high popularity of this market among Americans.

Note: Brand size equates to number of mentions

Base: 207 American affluent/HNWIs Source: LuxuryOpinions/AltiantPublications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.