THE POST-COVID19 LUXURY CONSUMER

VIEWS From CHINA, UK, US AND FRANCE

The Survey Population

More than 580 affluent & High net worth individuals in the United Kingdom, USA, france and in China

The interviewed population.

THE CONTEXT IN WHICH THIS RESEARCH WAS CONDUCTED

Altiant surveys conducted throughout this worldwide pandemic (number of cases).

ourworldindata.org

THE NEW LUXURY CONSUMER: CONSCIENCIOUS & GREEN?

Introspection - Wealth Management - Charitable Donations - Green Growing Attitude & Circular Economy - Loyalty - Privacy

INTROSPECTION

More than a third of the wealthy consumers interviewed have questioned their level of luxury consumption.

Do you agree with the following statement: ‘This pandemic made me question my consumption of luxury goods’?

Wealth management

Around 30% have modified their investment portfolio.

Only 14% of French luxury consumers have changed their investment portfolio vs. 47% in the US and 30% in the UK.

However, in France 31% will take a more active role in managing their family's investments in the future.

CHARITABLE DONATIONS

40% of the global wealthy have or will contribute to a charitable cause in relation to Covid-19.

I will make (or have already made) a charitable donation in relation to Covid-19 and its consequences.

GROWING GREEN ATITUDE

Globally, 35% will put more stress on sustainability & 35% on locally produced luxury goods.

@stellamccartney

38% of French and US luxury consumers have questioned their consumption of luxury and 37% for the Brits.

Although sustainable consumption is much stronger within Millennials, Women and the 40+ year old were more likely to question their consumption of luxury goods.

All groups are showing strong intentions to consume luxury in a more sustainable fashion led by the Chinese segment (57%) and followed by the US (33%), France (32%) and UK (30%).

In China, only 25% will put more emphasis on locally produced, a low proportion compared to the british respondents (40%) and followed by the US (37%) and France (34%).

IN THEIR OWN WORDS 1/2

“In which way(s), if any, you think the Covid19 crisis will be affecting your luxury consumption habits in the future?”

“I will consider my purchases more carefully and try to support UK and local shops much more now.”

“Much more likely to stay local.”

“I will decrease consumption of unsustainable luxury goods.”

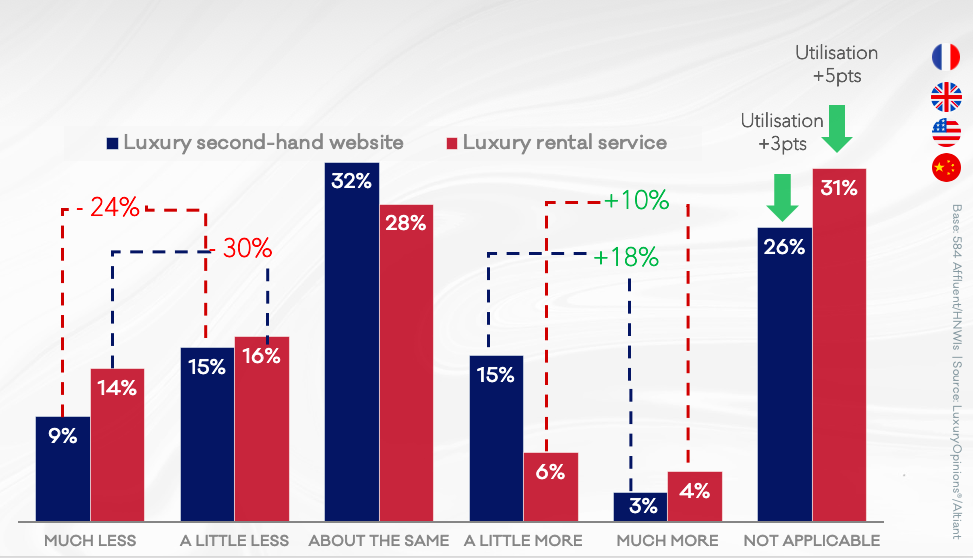

CIRCULAR ECONOMY IN LUXURY

Alternative models gaining more users but intentions for second hand show a net drop of 14 points.

“How much do you think you will spend in the following channels after Covid-19 compared to before?”

POST COVID LOYALTY

Globally, 16% have discovered new luxury brands and more than 50% will remain loyal with disparity between markets.

Do you agree with the following statements?

Only 8% of french HNWI would (or have already) subscribed to a Covid tracking application.

ABOUT PRIVACY

Strong disparity among countries.

I will (or have already) download(ed) a tracking application to help scientists monitor the spread of Covid-19 and other pandemics.

The Future of Brick & Mortar Luxury Stores

Purchase Intentions in Luxury Retail Stores - The Case for Duty Free - In Person Luxury Shopping post-Covid

@Getty Images

LUXURY RETAIL STORES (Intentions after lockdown)

“How much do you think you will spend in luxury retail stores after Covid-19 compared to before?”

THE CASE FOR DUTY FREE (FRANCE/CHINA)

“Assuming the option is available, how much do you think you will spend in Duty Free stores after Covid-19 compared to before?”

Overall about 40% are planning to spend the same amount as before the crisis in Duty Free and 15% would spend more than before. The wealthy Chinese are showing much greater intention with an intended increase of 44% when the option will be available.

IN-PERSON LUXURY SHOPPING

Welcoming the clients back in store.

‘ Which of the following measures would make you feel comfortable about going back to a luxury store?’

On-Line Channel: Today and Tomorrow's champion

Online Luxury - The sites that are Selling (During & After Lockdown) - The Winning Categories - Online Expectations - The Preferred Luxury Websites

ON-LINE LUXURY

45% shifted more budget online during the confinement.

Do you agree with the following statement: ‘I have shifted more of my luxury spending on-line’?

IN THEIR OWN WORDS 2/2

“In which way(s), if any, you think the Covid19 crisis will be affecting your luxury consumption habits in the future?”

“I hardly ever ordered on the internet but I ordered on the Dior and Hermès site during confinement. The delivery was very efficient and the product similar to the photos; I will therefore order more on the Internet in the future. It is practical, easy and efficient.”

“I used to order a lot online and now I’m going to exclusively order online.”

“I will focus on more online experiences more than in-store/in person experiences”

WhiCH SITES ARE SELLING (during Lockdown)

Brand sites showing a net increase of 18 points and the multi-brand sites +5 points.

Overall during the lockdown/restricted movements period, how would you qualify your spend in the following distribution channels?

WhiCH SITES ARE SELLING (AFTER Lockdown)

In the wake of Covid-19, there could be a notable shift towards brand sites led by US and Chinese wealthy consumers.

Assuming all options are available to you, how much do you think you will spend in the following channels after Covid-19 compared to before ?

THE WINNING CATEGORIES

Lockdowns and restrictions have changed affluent and HNW consumers budget distribution.

How much more or less would you spend in these categories compared to last year?

ON-LINE EXPECTATIONS from AFFLUENT AND HNWIs

Prices and Return policies ranking first.

What would improve your luxury online shopping experience?

28% increased their spend on Social Media platforms during the confinement. This number is largely driven by the Chinese wealthy consumers (50% have increased their SPEND).

The Preferred Luxury Websites of the Wealthy

Mono and multi brand websites are shinning as well as pre-loved luxury ones.

Which luxury website do you most enjoy shopping on?

MOVEMENTS & LUXURY TRAVEL

Budget Adjustments - About Flying - Welcoming the Luxury Traveler back onboard - Welcoming the Luxury Traveler back in Hotels & Resorts

@airasia

LUXURY TRAVEL & HOSPITALITY

Travel Budget Adjustments are visible with overall decline in spend intentions, private transportation and hotel categories remain the least affected.

Assuming all options are available to you, how much do you think you will spend in the following categories after Covid-19 compared to before ?

HOTELS & RESORTS

63% will spend the same amount or more. 34% say they will spend less money.

CRUISES

52% will spend less money in cruises than they did before the crisis.

CHAUFFEUR SERVICE

51% of wealthy respondents will spend the same amount or more in private chauffeur service.

PEER TO PEER RENTALS

39% will spend less money than before the crisis, 31% will spend the same amount and 14% will spend more.

PRIVATE JET/HELICOPTER/YACHT

42% will spend the same amount or more than before the Covid-19 crisis. 24% will spend less.

RENTAL CARS

34% will spend less money than before the crisis, 38% will spend the same amount and 19% will spend more.

Contact us to receive detailed data per category: reports@altiant.com

ABOUT FLYING

A drop in purchase intentions with long-hauls being more affected.

Assuming all options are available to you, how much do you think you will spend in the following categories after Covid-19 compared to before ?

45% of HNWI globally claim that they will book less long-haul flights for leisure than before the crisis vs. 38% for short-haul flights.

More than 1/3 of HNWI’s budget will remain the same: 39% for short leisure flights and 32% for short business flights.

30% of wealthy Chinese respondents tell us that they will book a wellness retreat stay as soon as possible.

IN-PERSON: AIRPLANES

Welcoming the luxury traveller back on plane.

Which of the following measures would make you feel comfortable about resuming your flying habits?’

43% will feel more comfortable with hotel staff observing a strict cleaning protocol during their stay.

IN-PERSON: HOTELS & RESORTS

Which of the following measures would make you feel comfortable about going back to a luxury hotel or resort?’

To view the data set in full, or speak to us about any of your luxury research requirements, please email us at contact@altiant.com.

Contributors

Lars Long, Founder & CEO Altiant

Meryam Schneider, VP Marketing Altiant

Plamen Iliev, Senior Project Manager

Contact

reports@altiant.com

ABOUT ALTIANT

Altiant is a specialised fieldwork company which enables large scale, global research among affluent consumers/High Net Worth Individuals (HNWIs) in 15+ countries worldwide.

By servicing dozens of the world’s top luxury and wealth brands, Altiant helps renowned brands and their research agencies to answer critical questions among this very hard-to-reach demographic. We ensure that all of our survey respondents are genuinely affluent by having their identities verified and wealth levels validated.

Altiant is a corporate member of ESOMAR, the World’s leading association for standards & Ethics within market research. Altiant adheres to, and abids by their strict guidelines governing the best practice in the industry.

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.