Client Update: Luxury Consumer Sentiment & Covid-19

May, 24 2021

Introduction

Release date: May, 24 2021

This update in our continuing Covid-19 research reports on data collected among 463 luxury buying, highly affluent individuals from China, USA, France and the UK between April 28 and May 9, 2021. Of the total sample, 53% were aged under-45, while the gender split was 38:62 male:female.

Reflecting the ongoing development made in combating the virus, we have included new questions on vaccines for this update. It is worth noting the considerable uncertainty which still remains about the unprecedented nature and evolution of Covid-19, and different countries’ success in tackling it. As such, it is worth keeping in mind that these results are based on respondents’ perceptions at specific points in time.

Key Takeaways

1. Americans and Brits have caught up with China for thinking that the worst commercial and health effects have passed. France lags some way behind and remain more pessimistic.

2. France has lagged behind other countries for its vaccine rollout and its citizens are also the most reluctant to get vaccinated, a likely result of their misgivings about the vaccines.

3. While 57% of Chinese think that normality has already returned, around half of the respondents in the other three countries think it will take at least six more months for this to happen.

4. Flying on a plane (41%) and attending public events/conferences (43%) concern Wave 4 respondents the most, falling to only 17% for shopping in stores.

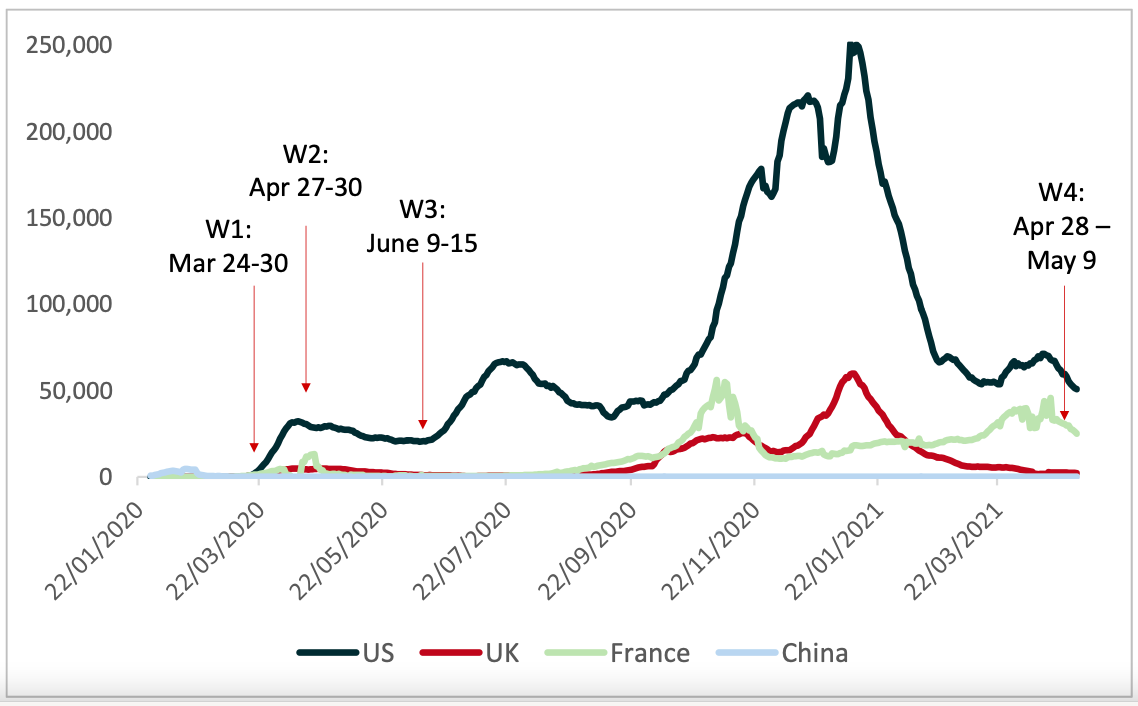

The median HHI for Wave 4 when normalized to USD was $264,000. To provide some context around the timing of our data collection in relation to the outbreak we can illustrate on a country level the field dates in regards to new confirmed cases of Covid-19:

Figure 1 – Daily new confirmed Covid-19 cases (smoothed), January 2020-May 2021

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

Sample Sizes & MARKETS

Wave 1 (March, 24-30): USA (107), UK (101), FRANCE (106), CHINA (reporting on 560)

Wave 2 (April, 27-30): USA (110), UK (117), FRANCE (105), CHINA (134)

Wave 3: (June 9-15): USA (99), UK (115), FRANCE (117), CHINA (98)

Wave 4: (April 28-May 9): USA (142), UK (109), FRANCE (117), CHINA (95)

Clear optimism that the worst has passed

Do you feel that the worst of the health effects of COVID-19 are now behind you and your community?

Figure 2 – Attitudes towards the health effects of Covid-19

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

There continues to be a correlation between the easing of governmental actions, vaccination rates and consumers’ views on the severity of the pandemic. In the current wave of data, increasing numbers of Brits and Americans believed that the worst of the health effects were behind their communities, with around two thirds in both countries now thinking this.

Meanwhile in France, Wave 4 saw an interesting drop on this metric, with only 21% thinking that the worst of the health effects had passed, down from 44% in Wave 4. Much of this appears to have directed contributed to the notable rise in the share of wealthy French individuals who are unsure if the worst has passed. This uncertainty is a likely reflection of ongoing lockdowns and movement restrictions, uneven implementation of regional policies and a relatively slow vaccine rollout in France.

For the second successive quarter, there was a dip in the share of affluent Chinese thinking that the worst had passed. While this still stands at 65%, with only 32% thinking that the worst is yet to come, it does highlight lingering concerns. There could be a few reasons for this, such as relatively low vaccination rates at the time of survey, some caution around vaccine efficacy/new variants and possibly fear in seeing how quickly things can escalate in other large countries such as India and Brazil.

Commercial optimism is returning

Do you feel that the worst of the commercial effects of COVID-19 are now behind you and your community?

Figure 3 – Attitudes towards the commercial effects of Covid-19

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

Data for the US and UK follows a very similar pattern, with Americans showing the more optimistic mindset of the two countries across the study. In Wave 4, 57% of wealthy Americans thought the worst had passed in a commercial sense, falling to 40% of Brits. Nevertheless, there has been a clear shift in optimism in the UK, with a near-threefold increase in those thinking the worst has passed between early-June 2020 (Wave 3) and late-April 2021 (Wave 4). The Chinese response has shown comparatively little variance over the study period, but the share of those thinking the worst has passed moved marginally upwards again in Wave 4, to 61%.

Sentiment among affluent French individuals is considerably more conservative, with only a marginal increase in those thinking the worst has passed between Wave 3 and Wave 4 (up to 21%). Instead, more than half (57%) think that the worst commercial impacts are yet to come (down from 66% in the previous Wave). Like in the chart above, much of this pessimism instead appears to have shifted to uncertainty about how effectively France is coping (up to 22%). This uncertainty permeates, and is probably linked to, related factors such as vaccine rollout and efficacy.

Covid-19 has had a negative financial impact on 35% of affluent/HNWIs

We are seeing a lot more parity emerging within the financial impacts on households due to Covid-19. We did not delineate positive effects due to governmental stimulus but left this more general in nature. The data from the most current wave shows that French respondents are reporting the least negative effect on household finances due to Covid-19.

“What would you say is the likely financial impact on you and your family of this pandemic?”

Figure 4 – Financial impact of Covid-19, Wave 3 vs. Wave 4

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

We are continuing to see quite a high degree of parity within the financial impacts on households due to Covid-19. We did not delineate positive effects due to governmental stimulus but left this more general in nature. The data from Wave 4 shows that Chinese, American and British respondents are reporting similarly negative effects on household finances due to the pandemic, with around a third or less reporting a negative impact. French respondents are now feeling the impact most, with 41% saying that the pandemic has adversely impacted them.

Figure 5 – Comparison of financial impact of Covid-19

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

When comparing the movements between the four countries over time, we are continuing to see significant changes from the previous Wave. After all four countries converged to a very similar point in Wave 3, Wave 4 has seen significant improvements in all markets. The US, UK and China are now almost nudging into positive territory, while the French perception lags slightly behind.

EXPECTED RETURN TO NORMALCY

“All things considered, how much longer do you think it will be until you and your family return to ‘normal’?”

Most of the world is asking the question “When will things get back to normal”. We are also curious about this so we asked our respondents when they thought normalcy would return to their communities. The data below shows a derived calculation to estimate the median time expected by the respondents. Keep in mind that this is not a prediction but rather an estimation which is unfortunately entirely outside of the control of our respondents.

Interestingly, due to the fact that the median respondents from the UK and US fell into the highest range (6 months or longer) this effects our ability to estimate with any precision, so we can only say that the median expected return to normal date for the US & UK is currently longer than 6 months.

Figure 6 – Expected return to normality, Wave 4

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

* Note: ‘Already has’ is a new code included for Wave 4

China is easily the most likely country to believe that life has already returned to normal, with 57% citing this compared to less than 10% in UK, US and France. While some Chinese cities have switched between lockdown and openings, the regulations have been broadly more relaxed than Western economies. Only 7% of the wealthy Chinese think that it will take longer than six months for normality to return.

Americans are marginally the most confident among the other three countries, with half (48%) thinking that normality will return in six months or less (while 8% think it has already). By comparison, 47% of Brits believe normality will return in under six months, falling to just 30% in France. A significant share of respondents in the US (41%), UK (48%) and France (57%) are still sceptical and think that normality will not return until winter 2021/22 at the earliest.

“Are there any companies or brands which you have discovered, or have changed how much you use, since the start of the pandemic? Why?”

This question was adapted from previous Waves to reflect the ongoing evolution of the pandemic. Online retailers such as Amazon, food delivery services such as Blue Apron and Hello Fresh, and home streaming services were the most cited brands, reflecting the fact that many consumers have spent lots of time at home since the start of the pandemic. A selection of quotes from respondents to this question are shown below.

“Dine at home companies like Pasta Evangelists. Really good for a change and a treat.”

“I’ve discovered the wonders of Amazon Fresh (grocery delivery). I’ve started using a lot more meal delivery kits like HelloFresh, Everyplate, Blue Apron because dinners were getting very boring.”

“I’ve discovered the wonders of Amazon Fresh (grocery delivery). I’ve started using a lot more meal delivery kits like HelloFresh, Everyplate, Blue Apron because dinners were getting very boring.”

“Homeware and kitchenware purchases have increased. Loungewear shopping has increased. I’ve not made any purchases for party wear, shoes or handbags.”

“I used second-hand clothing sales platforms (Vide dressing, Vestiaire Collective) because I had more time to sort out, put my items online, rather than drop them in consignment stores, which are regularly closed.”

“I am using Amazon much more simply because it has delivered on time every time throughout the pandemic. It has also been extremely flexible on its return policy.”

“I am using local brands, particularly those that have adapted to the pandemic and helped the community. ”

“I have reduced my spending on luxury goods and increased the purchase of skin care products, such as Clinique; their products are quite efficient.”

“Companies such as BYD and SAIC-GM-Wuling set up mask production that meet people’s needs.”

Vaccines and Public Interactions

Data in this section is new for Wave 4. These questions were not asked to respondents in Waves 1-3, meaning that trending over time is not possible for the remaining charts.

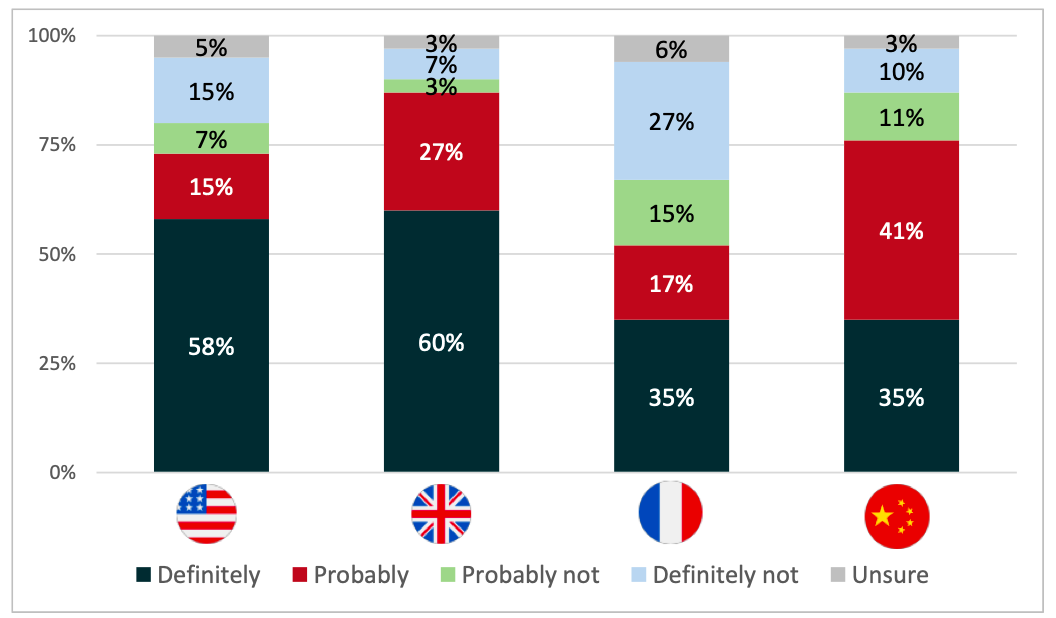

France lags a long way behind for vaccinations

“Which of the following statements is most applicable to you regarding approved Coronavirus vaccines?”

Figure 7 – Status and attitudes towards Coronavirus vaccines

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

By the end of April 2021, just over half of the UK’s population had received at least one vaccine, falling to around 43% for the USA, a third in China and just under a quarter in France. Within the UK, US and China, vaccination rates are comfortably higher among our respondents than for the general population. This is a likely reflection of the higher average age of our sample which means that they are more likely to have been offered vaccinations than the general population.

Across the whole sample, 56% have been either partially or fully vaccinated, rising to 67% for men and 71% for over-45s. The UK and US have been particularly proactive in their vaccine rollouts which is likely to have elevated the confidence levels as seen above. Three quarters (76%) of our British sample and two thirds of Americans (67%) have had at least one vaccine, with a further 17% and 9% respectively ready willingly for their first jab. Interestingly, 23% of unvaccinated Americans are either hesitant or unwilling to get a vaccine, a figure which falls to just 6% of Brits (also see Figure 8 below).

Chinese confidence is also broadly high, but the rollout has been a little slower than in the US and UK. 55% of our wealthy Chinese sample have had at least one jab, while a further 34% are ready and waiting for their first. Like Brits, only a minority (11%) are either unsure or unwilling to get a Covid-19 vaccine.

The picture in France is markedly different. The comparatively slow vaccine rollout is reflected in our sample as only a quarter have had one/both jabs, while a further 27% are waiting willingly for their first. Conflicting reports about the safety and efficacy of different vaccines appears to have had an impact on our wealthy French respondents, with 20% unsure about getting a vaccine, while a quarter (24%) say that they are currently not planning to get one. Evidently much needs to be done to improve confidence levels in the different vaccines for the French.

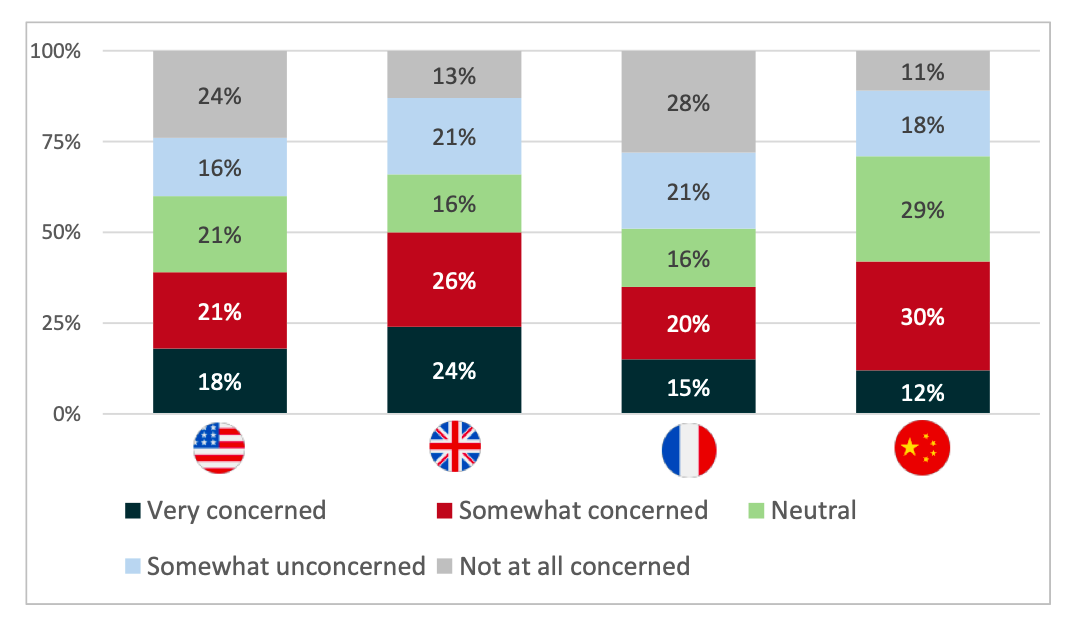

Around a third have a level of vaccine uncertainty

“On a scale of 1-5, how confident are you in the safety and efficacy of the Coronavirus vaccines?”

Figure 8 – Confidence in the safety and efficacy of Coronavirus vaccines

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

The rapid development of various Covid-19 vaccines has been a scientific success, but also led to a degree of uncertainty as some individuals believe it has been insufficiently tested. Only 60% of our total affluent sample are ‘confident’ or ‘very confident’ in the safety and efficacy of the vaccines, with 10% ‘not at all confident’. Men (72%) and over-45s (64%) are more likely than women (53%) and under-45s (57%) to be confident in the vaccines.

French respondents are the most sceptical by some distance, a direct explanation for their caution in receiving vaccines (see above). Only 27% of wealthy French individuals are secure in the safety and efficacy of the vaccines, while 35% are not very confident/very unconfident. That 38% are neutral suggests that many French citizens are waiting for further information or testing before adopting a more definitive position.

British (79%) and Chinese (77%) respondents are the most confident in the vaccines, again reflected in the data for their propensity to be vaccinated (see above). Confidence is a little lower in the US, with only 62% positive towards the vaccines’ safety/efficacy, while 20% are not confident in them. Many American cities are even reporting unused booking slots and vaccine surpluses as concern about the vaccines proliferates among a notable minority.

Almost three quarters of the wealthy willing to carry a Covid ‘passport’

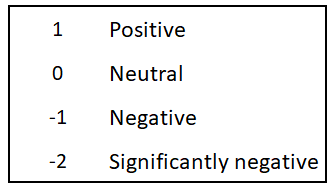

“Would you be prepared to carry some form of ‘Covid passport’ (digital or physical copy) which proves you have been vaccinated in order to do enter some venues/carry out certain activities?”

Figure 9 – Attitudes towards Covid passports/certification

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

A prominent, and often divisive, talking point has been the potential use of some form of Covid passport or certification to enable people to safely re-enter public spaces. Each of the four countries have moved at different speeds on this subject as summarised below:

· US – The White House has ruled out mandatory federal Covid passports, saying citizens' privacy and rights should be protected.

· UK – From May 17th its NHS app (or a paper copy) could be used as vaccine passport for those who had already received both jabs.

· France – The government recently launched a Covid health pass to allow travel to and from its overseas territories and eventually, other EU countries. It will be located within the TousAntiCOVID app which was launched in summer 2020.

· China – China’s citizens have been using Covid passports since March 2021, which can be paper copies or downloaded via WeChat.

While there have some been concerns about restrictions of freedom, almost half of affluent/HNWIs say that they would ‘definitely’ carry one of these (48%), while 24% would ‘probably’ do so. Over-45s are particularly receptive to carrying them, with 60% saying they definitely would compared to 38% of under-45s.

Brits are the most receptive of the four countries overall, with 87% saying they definitely/probably would be willing to have one and only 10% in opposition. The situation among wealthy Americans is similar, albeit a little less positive, as 73% say they would definitely/probably carry one, while 22% would not. Similarly, there appears to be some reservations in China where only 35% say they would definitely carry one, while a higher share (41%) say they would probably do so. Like Americans, just over one in five (21%) wealthy Chinese are currently reticent to carry one of these types of status documents.

The French response is the most sceptical, with just over half (52%) being willing to carry a Covid passport, only a little higher than the share unwilling to do so (42%). The French govern Our previous research has also shown that many French individuals are cautious about privacy, for example in relation to Covid tracking apps (see our Post-Covid-19 report). Aligning with their reticence to have a vaccine (see above), 27% of wealthy French say they would definitely not carry one, by far the highest response of the four countries for this metric.

Public interactions still carry a level of concern for many

“How concerned are you now about being in the following public spaces?”

Tourism

Figure 10 – Attitudes towards staying in hotels

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

“How concerned are you now about being in the following public spaces?”

Tourism

Figure 11 – Attitudes towards flying on a plane

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

As tourism cautiously reopens, there is a clear need for hotels and airlines to cater for safe and distanced holidays where possible. There are various ways for these companies to alleviate customer concerns, such as strict cleaning protocols and distances between seats, as seen in our Post-Covid-19 report.

Nevertheless, we can see a slowly growing confidence to travel. Americans, Brits and the French have broadly similar concerns when it comes to staying in hotels, with just under a quarter somewhat/very concerned about doing so. Concerns about flying rises to just over a third among the American and French respondents, but reaches half of Brits. This may lead to more domestic or regional trips in the short-term wherein air travel is not necessary. It is interesting to note the relative lack of concern among the French to fly (49%) and stay in hotels (58%) despite their widespread reluctance to be vaccinated or carry Covid passports.

Concern in China appears to be a little lower, possibly reflecting the pandemic being a little more controlled here. Rates of concern are broadly in line with the other three countries, and they are the least likely to be very concerned about flying (12%). Meanwhile, the Chinese are the most likely to be neutral about flying and staying in hotels, suggesting that they are likely to remain cautious despite their improving domestic situation.

“How concerned are you now about being in the following public spaces?”

Retail

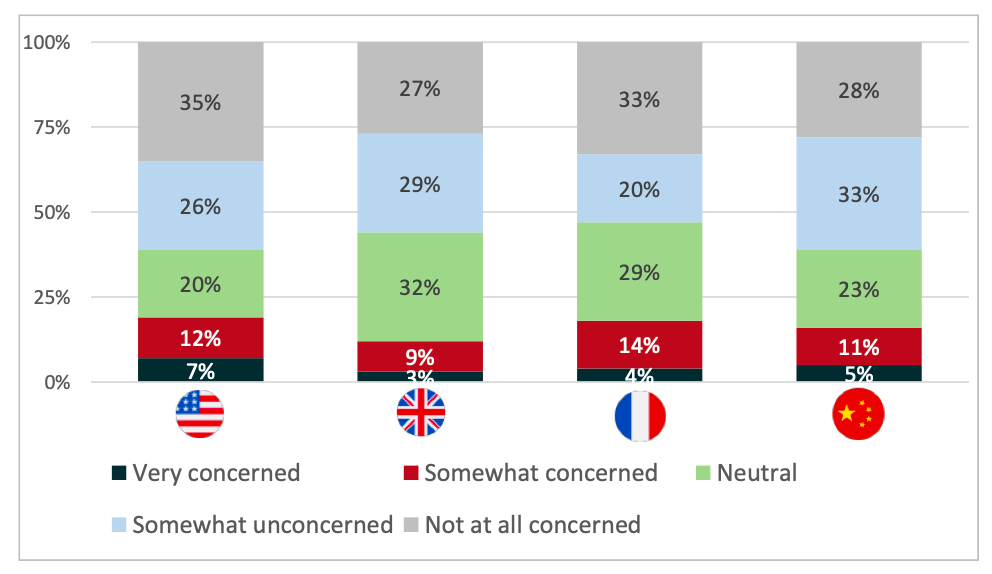

Figure 12 – Attitudes towards shopping in stores

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

Our previous research shows that 45% of wealthy individuals switched more, or all, of their shopping online as stores closed due to the pandemic. There have been sporadic patterns of store openings/closures and rules such as mask-wearing over the past year, with considerable variation by country.

Nevertheless, responses for shopping in store are now broadly similar across the four countries, with fewer than one in five concerned in doing so, and around three in five being unconcerned. Brits are the least likely to be concerned despite the lack of mask enforcement, with only 12% concerned about shopping in person. Stores will evidently continue to have to focus on cleanliness and distancing in order to give customers confidence to shop in person.

“How concerned are you now about being in the following public spaces?”

dining

Figure 13 – Attitudes towards dining/drinking in restaurants/bars

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

Meanwhile, willingness to dine or drink in public currently shows a generally higher level of concern. Many Chinese cities have had venues open for several months now, a likely reason why only 20% are concerned about dining/drinking out of home. This figure rises to 26% among Brits, 31% in the US, and peaks in France at 35%. Nevertheless, just under half in all four countries are unconcerned about dining or drinking publically which may be cause for some optimism for the hospitality industry for the summer months.

events

“How concerned are you now about being in the following public spaces?”

Figure 14 – Attitudes towards going to public events/conferences/festivals

Base: 463 affluent/HNWIs Source: LuxuryOpinions®/Altiant

There is a similar pattern when it comes to attending public events such as conferences and festivals. The Chinese are the least likely to be concerned overall (29%), rising significantly among the French (39%) and Americans (46%), and with a peak among Brits (53%).

To speak to us about any of your luxury research requirements, please email us at contact@altiant.com.

To speak to us about any of your luxury research requirements, please email us at contact@altiant.com

Contributors

Lars Long, Founder & CEO

Chris Wisson, Knowledge Director

Meryam Schneider, VP

Contact

reports@altiant.com

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.