Luxury Consumer Sentiment & Covid-19

Quick Links:

Introduction to the research

Are the worst of the health effects behind your community

Are the worst of the commercial effects behind your community

EFFECT ON HOUSEHOLD FINANCES

EXPECTED RETURN TO NORMALCY

BRANDS THAT ARE RESONATING

Previous: Access to Webinar: ‘Luxury Consumer Sentiment in the Age of Covid19’

Luxury Consumer Sentiment & COVID-19

Release date: May 11, 2020

This update in our continuing Covid-19 research reports on data collected among 469 luxury buying, highly affluent individuals from China, USA, France and the UK between April 27-30. The median HHI when normalized to USD was $227,000. To provide some context around the timing of our data collection in relation to the outbreak we can illustrate on a country level the field dates in regards to new confirmed cases of Covid-19:

Source: ourworldindata.org

Sample Sizes & GEO

CN Tracking: n=560 during March focused on Tier 1 Cities

Wave 1 (March, 24-30) : USA (107), UK (101), FR (106), CN (reporting on 560) - March, 24-30

Wave 2 (April, 27-30) : USA (110), UK (117), FR (105), CN (134)

Pessimism dropping but still high among US, UK, FR respondents

Do you feel that the worst of the health effects of COVID-19 are now behind you and your community?

Even as governments begin easing restrictions, still skepticism remains high within the affluent communities. Only about 1 out of 3 (33%) Americans surveyed felt that the worst of the health effects were behind their community. This drops further to about 1 out 5 in both France (18%) and UK (21%). Another interesting yet sobering observation is that the level of uncertainty around this metric in the UK rose to 31%.

Encouragingly, Chinese sentiment saw significant improvement between the two waves, 78% of those interviewed in wave 2 believe that the worst of the health effect is behind them. We need to be very cautious of trying to draw direct comparisons between countries here as each nation has reacted and been effected differently so naturally their rebound curves will differ as well.

AFFLUENTS BRACING FOR CHALLENGING COMMERCIAL TIMES AHEAD

Do you feel that the worst of the commercial effects of COVID-19 are now behind you and your community?

The vast majority of our respondents outside of China believe that the worst of the commercial effects are yet to come, this is especially highlighted in the UK where only 1 in 20 (5%) think the worst is behind their community. Again as China has begun the rebounding process, their commercial sentiment figures have continued to rise.

FRANCE AND UK PROJECT THE MOST NEGATIVE EFFECTS TO HOUSEHOLD FINANCES

Interestingly the data from Wave 2 shows that about half (48%) of Americans do not anticipate being negatively effected by the viral outbreak. Also of note, China who in theory, should have more clarity on the projected impact of the crisis (as it nears the end to the outbreak before the others), has the highest percentage of respondents (26%) answering that this will have a significantly negative impact. There were zero people in France and the UK who stated that this will net a positive effect to their household’s financial situation.

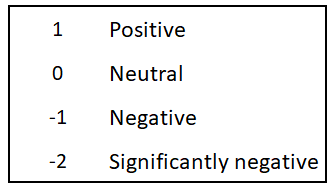

What would you say is the likely financial impact on you and your family of this pandemic?

When comparing the movements from wave to wave between the four countries, it appears that the USA has been the only country to experience a significant uptick in sentiment regarding the effect on household finances.

EXPECTED RETURN TO NORMALCY

Most of the world is asking the question “When will things get back to normal”. We are also curious about this so we asked our respondents when they thought normalcy would return to their communities. The data below shows a derived calculation to estimate the median time expected by the respondents. Keep in mind that this is not a prediction but rather an estimation which is unfortunately entirely outside of the control of our respondents. Interestingly, due to the fact that a majority of respondents from the UK selected the highest range (6 months or longer) this broke our method of estimation, so we can only say that the median expected return to normal date for the UK is currently longer than 6 months.

Brands that are resonating with luxury consumers

In France, UK and USA we also asked consumers which brands or companies they thought were standing out as doing a particularly good job during the pandemic. Interesting to note that luxury consumers are placing a significant amount of positive sentiment around the delivery services, supermarkets, technology and entertainment providers

We hope that you found this data to be of interest. We are planning to perform another round of analysis at the end of the May and will be publishing comparative data to help show respondents’ evolving views over the month. The page will be accessible in our Knowledge Center.

If you feel the need to stay connected to affluent consumers and collect bespoke information for your brand during this period of uncertainty, Altiant can help you to do this reliably and tactfully.

You can also stay up-to-date on key issues surrounding purchase intent, travel and consumer/investor sentiment with our free, interactive Global Luxury and Asset Monitor (GLAM).

To speak to us about any of your luxury research requirements, please email us at contact@altiant.com

Contributors

Lars Long, Founder & CEO

Meryam Schneider, VP Marketing

Ivan Murtov, SR PM

Contact

reports@altiant.com

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.