Global Luxury AND ASSET MANAGEMENT (GLAM) MONITOR

sentiments and behavioUrs of the world’s affluent and high net worth populations

LUXURY & SUSTAINABILITY

q3 2020 edition

Luxury & Sustainability: The Importance of Sustainability

While Covid-19 has shifted some individuals’ immediate focus away from the ongoing climate crisis, there remain regular reminders of this issue, such as the wildfires in California. Improved air quality and thriving wildlife have been two of the few upsides of the recent lockdowns and are positives which many consumers are keen to retain into the future. As such, there are more demands being made of brands to acknowledge and act with them in alleviating climate concerns, for example via recyclable materials or carbon offsetting.

On a scale of 1-5, 56% rated sustainability at an importance of 4 or 5 in Q3, a figure which has remained above 50% across the whole study period. 64% of Europeans and Asians rank sustainability as important, though this falls to just 39% of Americans. In Q3, 31% rank sustainability as an importance of 3-4 while only 13% rate it at an importance of 1-3. This indicates that many consumers do recognise the ongoing need for an environmental focus, and that it remains an important matter to them despite other concerns and priorities.

Unfiltered Base: 4,120 global affluent/HNWIs | Source: LuxuryOpinions/AltiantLuxury & Sustainability: Trading up for Sustainability

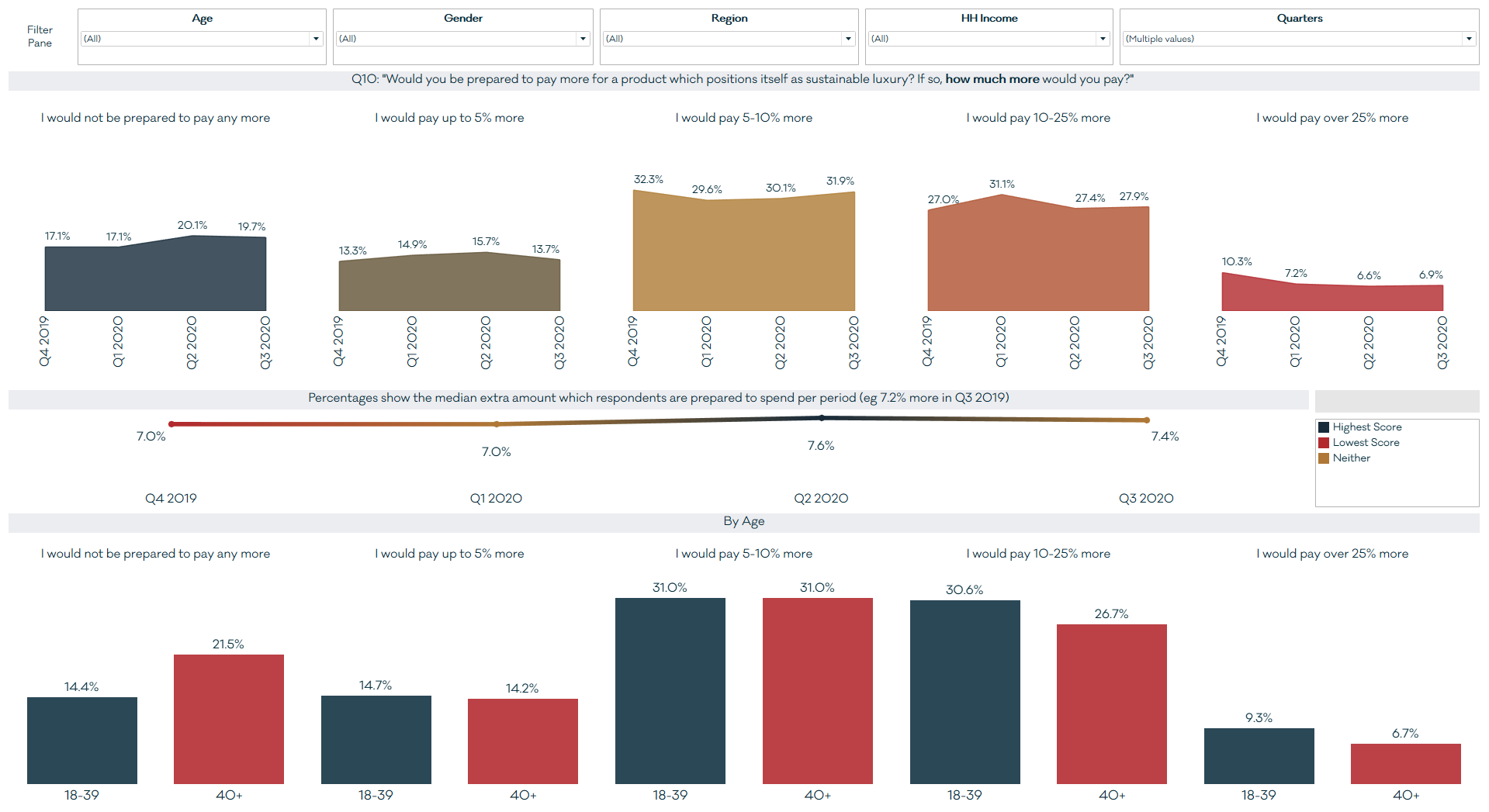

Many affluent consumers are seemingly prepared to back up their views on environmental protection and sustainability with their money. Only 20% of our Q3 sample are entirely unprepared to spend any more for sustainable/ethical luxury products. While this figure continues to be broadly flat across all study quarters so far, this is the joint highest result on this metric to date, possibly indicating that more consumers are expecting brands to automatically act with a sustainable ethos.

Some 45% of the Q3 sample are prepared to spend up to 10% more, which could be a sweet spot for brands to justify a small price premium. The remaining 35% are prepared to spend more than 10% extra, 7% saying they are even prepared to spend more than 25% extra for sustainable/ethical luxury products. Trading up for sustainable goods resonates with both genders and age groups.

Despite being the least likely to rank sustainability as important, 38% of Americans are willing to spend 10% or more extra for sustainability, the same share as Asians and ahead of Europeans (29%) For Europeans in particular, sustainability appears to be seen as a given in a luxury product’s price, or something which should only carry a small premium.

Unfiltered Base: 4,120 global affluent/HNWIs | Source: LuxuryOpinions/AltiantLuxury & Sustainability: Sustainable Luxury Champions

Over each of the past five quarters, a handful of luxury brands stand apart for being the most likely to be cited as sustainable luxury operators by our respondents: Louis Vuitton, Stella McCartney, Gucci, Chanel and Tesla. The same brands also emerge as being among the most cited within the last quarter specifically. Hermés, Rolex, Dior, Mercedes-Benz and Cartier follow a short distance behind in terms of mentions in Q3.

Unfiltered Base: 4,120 global affluent/HNWIs | Source: LuxuryOpinions/AltiantPublications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.