LUXURY PURCHASE INTENTIONS

EUROPE

release date: MAY 2019

The quantitative online survey conducted for this report was carried out during January 2019. 200 members from four European countries within Altiant’s online affluent community were interviewed, split as follows: Germany (26%); UK (25%), France (25%), Switzerland (24%). In terms of gender, 51% of this total sample was male, while 49% was female. The age split was 48:52% for under-40s vs over-40s. Normalised to US dollars, the median household income of this sample was $225k.

SAMPLE COMPOSITION

The quantitative online survey conducted for this report was carried out during January 2019. 200 members from four European countries within Altiant’s online affluent community were interviewed, split as follows: Germany (26%); UK (25%), France (25%), Switzerland (24%). In terms of gender, 51% of this total sample was male, while 49% was female. The age split was 48:52% for under-40s vs over-40s. Normalised to US dollars, the median household income of this sample was $225k.

Base: 206 Europen affluent/HNWIs Source: LuxuryOpinions/AltiantBack to Top

PURCHASE INTENTIONS AMONG AFFLUENT/HNWIs

As of January, our European affluent/HNW respondents are often very positive about their projected luxury spending habits for 2019. 45% expect to spend more than they did last year, while only 10% anticipate cutting back. 18-39s are much more likely than the older cohort to expect to expect to buy many more luxury items/services (18% vs 5%), while over-40s are more likely to expect to buy about the same. There are no significant differences by gender for luxury purchase intentions next year.

Base: 206 European affluent/HNWIs Source: LuxuryOpinions/AltiantBack to Top

PURCHASE INTENTIONS BY CATEGORY

We then asked our respondents how likely they were to buy the following luxury items/services within the next year: watches, jewellery, shoes, flights, overnight hotel stays and cars. Leisure-related spending garners a high share of positive responses (either ‘definitely’ or likely’), with 89% and 83% expecting to buy luxury overnight hotel stays and flights respectively. Shoes also proved to be a highly popular category among our affluent European respondents for purchase intention (85%), while cars had the lowest score (48%), a likely reflection on the relatively high cost of purchase.

Base: 206 European affluent/HNWIs Source: LuxuryOpinions/AltiantBack to Top

SPENDING PATTERN PER CATEGORY

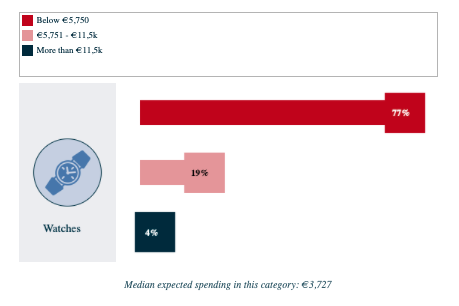

Watches (n=188): A third (33%) of our affluent European respondents would not be prepared to break the €1,150 mark on a new luxury watch, rising to 38% among over-40s. However, almost a quarter (23%) are willing to spend more than €5,750 on a new luxury watch, indicating that the ultra-premium watch segment has a number of willing customers. 18-39s are the most likely age group to be big spenders on a new high-end watch (27%).

Jewellery (n=192): Jewellery is popular with our affluent European respondents, but 42% are not prepared to spend more than the equivalent of €6,250 on a new luxury jewellery piece. Over-40s are the most likely to be price-sensitive, with 48% unwilling to spend over €6,250. A further 21% are prepared to spend €6,250-12,500, with over-40s again more likely than under-30s to be comparatively restrained. 18% are big spenders and prepared to exceed €25,000 per piece, rising to 25% among 18-39s.

Cars (n=166): Encouragingly for luxury car manufacturers, 30% of our affluent European respondents would be prepared to spend more than €50,000 on a new luxury car. 18-39s are more likely than the older cohort to be big spenders within this category (34% vs 26%), while the gender distribution at this top tier is almost equal. Less than a quarter of the sample (24%) would not exceed the equivalent of €20,000 for a new high-end car.

Overnight hotel stay (n=204): More than half (57%) of our survey respondents are prepared to spend over €1,250 per night for a hotel stay, probably being 5 or 6 venues incorporating features such as penthouse suites. Over-40s and men are the most likely to limit their spending on overnight hotel stays to less than €1,250. A further 28% are prepared to spend €1,250-2,500 while 11% appear to be extravagant travellers and are willing to spend upwards of €5,000 per night.

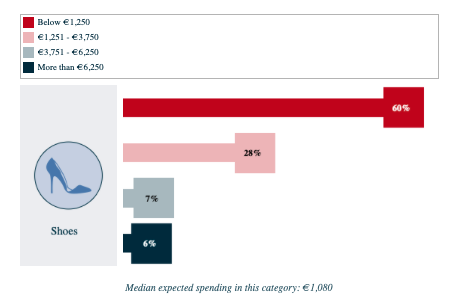

Shoes (n=200): As a relatively affordable category, it is unsurprising that most of our survey respondents (60%) are unwilling to exceed €1,250 for a new pair of luxury shoes. Over-40s (70%) and men (64%) are the most likely to moderate their spending within the category. A further 19% are willing to spend a little more on luxury shoes (€1,251-2,500), while 13% are prepared to exceed €3,750.

Flight (n=201): That only 11% are unprepared to exceed €625 for a luxury flight shows how the majority of our affluent respondents see the value in investing in air travel. €625-1,900 appears to be a sweet spot for luxury air travel, with 40% prepared to spend within this bracket. 19% are willing to spend above €3,750 for a luxury flight (rising to 23% among 18-39s), which would likely incorporate first/business class travel and its associated benefits.

Results were merged and normalised to Euro as per January 2019. The base for this question relates to respondents who coded ‘Definitely’, ‘Likely’, or ‘Unlikely’ in the previous question (‘Definitely not’ respondents were excluded). Base: European affluent/HNWIs who are definitely or likely to buy a new luxury product within the category within the next 12 months

Source: Luxury Opinions/AltiantBack to Top

LUXURY BRAND AWARENESS

A wide variety of brands were mentioned by our panel. Luxury goods industries such as fashion and jewellery fare the best for top-of-mind awareness/preference, with Rolex scoring the highest number of mentions (14%). Chanel, Louis Vuitton and Cartier are the three most cited luxury brands among our survey respondents.

Note: Brand size equates to number of mentionsBase: 206 European affluent/HNWIs Source: LuxuryOpinions/AltiantBack to Top

Publications contained in the Altiant Knowledge Center are free to use, we simply require proper attribution. In no event shall Altiant be liable for any indirect, special or consequential damages in connection with any use of the provided data. Altiant does prohibit the selling of any information contained within or derived from these reports and monitors.